Nate Budde is a contributor for BuiltWorlds. His startup, zlien, just won our March Madness contest after 150 executives voted for their pitch at the BuiltWorlds Summit.

Nate Budde is a contributor for BuiltWorlds. His startup, zlien, just won our March Madness contest after 150 executives voted for their pitch at the BuiltWorlds Summit.

We invite experts and thought leaders to share their knowledge on topics related to innovation in the built environment. Information on each contributor can be found at the bottom of each article. Learn more about our contributor program here.

Let’s clear up something right off the bat: Although this article is about construction companies decreasing their risk through increased visibility, it’s not about High-Visibility Clothing or any other form of PPE — that’s a different visibility. (Interesting side note: High-Visibility (HV) Clothing was first used in the construction industry back in 1964 by track workers during the construction of the Scottish region of the electrified British Railway system.)

The visibility we want to talk about here is project stakeholder visibility, or the degree to which each participant on a construction project knows the name and the role (at the very least), or name, role, contact information, and applicable payment and security status (as a goal) for all the other interested parties on that project. No matter the stakeholder’s role on a project, having access to this information has many benefits. But, despite all the obvious and non-obvious benefits to visibility and collaboration between interested parties, this is not how the industry currently works. The construction industry is so intently focused on protection and leverage — especially when it comes to payments — that processes to make things go more smoothly are overlooked or specifically passed over.

The Bird’s Eye View

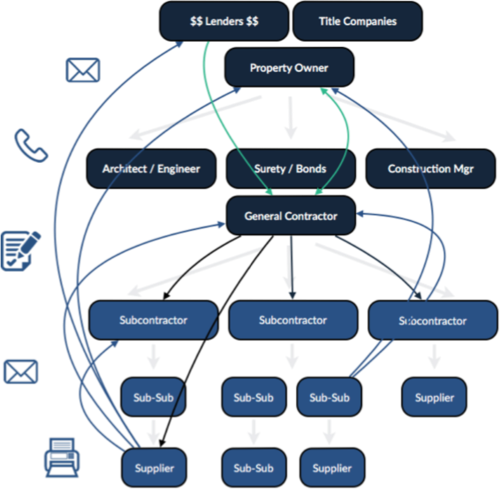

Every year, $1 trillion of construction industry payments makes its way through the convoluted mess (see graphic). We call it the “payment chain,” and it’s the way projects have been run, and project participants have been paid, for a long, long time. But as complicated as this example looks, it represents a very “clean” project that is no doubt familiar to anyone in the industry. In the real world, the system of payments is further complicated by the inability for each stakeholder to know the other participants. In other words, imagine the above chart with all the same required payments, but with the identify of multiple parties hidden or erased, and you have a more accurate picture of the typical project.

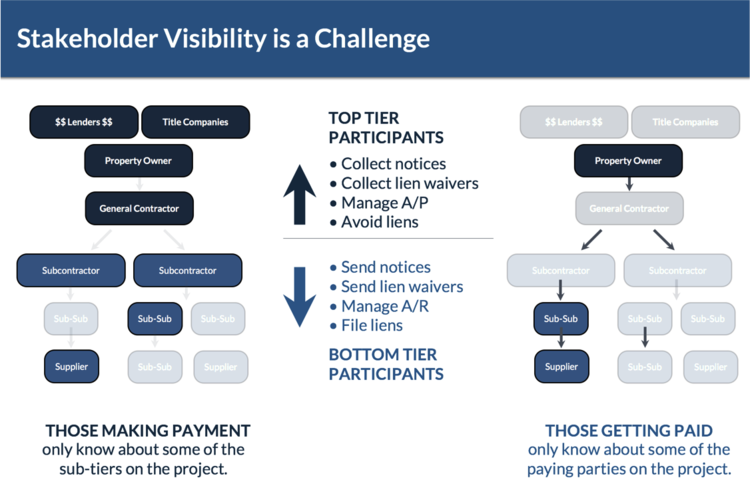

Generally speaking, you can split all of the participants on almost any construction project into 2 groups: the Top Tier (which includes all of the project stakeholders from the general contractor on up), and the Bottom Tier (which includes all of the project stakeholders below the general contractor). While the top and bottom tiers have different concerns and are managing different kinds of risk, the common problem of low project stakeholder visibility affects each group. In the next section, we’ll discuss how low visibility is a challenge for each group of stakeholders as money flows down through the payment chain.

Looking from the Top and Bottom Tiers

How often do the top tier stakeholders know all the subcontractors, sub-subs, and suppliers on a construction project? How about the bottom tier stakeholders knowing who all the top tier participants are?

No surprises here – the answer is almost never. Since the GC needs to collect lien waivers from all parties down-the-chain to keep the project lien-free and on-schedule, it’s imperative that all lower-tiered parties are known. However, GCs and owners are often caught off-guard when they receive a Notice of Intent to Lien (NOI) from a sub-subcontractor or supplier that they didn’t even know was working on their project. And on the other side, sub-subcontractors and suppliers, who want to remain in a secured position relative to their lien rights to protect against slow or non-payment, often don’t know the identity of the top tier parties to whom they must provide notice.

That’s Just the Way It Is

The historic practice of protection first, namely, relying on legal and financial leverage as protection against project financial risk, is not only an unfair solution, but it can cause more problems than it solves. And, given the industry’s problems with visibility up and down the chain, this unfair “solution” doesn’t even work. A GC can’t use its financial muscle and contracting power to out-leverage sub-subs or suppliers that it doesn’t know exist. Similarly, those sub-subs and suppliers can’t protect themselves through lien rights, if they are unable to send notice to owners and GCs whose identity they don’t know. This just compounds the problems of attempting to rely on a leverage and fear-based solution.

A Collaboration-First Mindset

The only way to change this destructive practice is to change the paradigm — and the entire mindset — of the industry from a protection first stance to collaboration first. Collaboration first means that project stakeholders will have a roadmap of where to go to manage payment problems before those problems impact not only their own bottom line, but the overall project. And since any collaboration must begin by knowing with whom you’re supposed to be collaborating, this makes project stakeholder visibility an essential component of any collaboration first initiative. Simply put, it’s impossible to collaborate with someone if you don’t know who they are.

Accordingly, true collaboration throughout an entire project as a solution to financial risk (in a similar manner to the collaboration by stakeholders to eliminate physical injuries and job site risk), requires total project visibility. While a comprehensive data-graph of all construction projects, participants, and stakeholders may seem like a pipe-dream given the current state of construction (non)-collaboration – it’s a change than needs to, and will, happen. Change here can come from the bottom up, and must begin with the overlooked parties (sub-subs, suppliers, and similarly-tiered parties) providing notice that they are on the project. This incremental step toward enabling collaboration by providing visibility, also allows the lower-tiered parties to remain in secured positions while the rest of the industry comes around to the collaboration mindset. Similarly, top-tiered parties should welcome notices as a good faith effort to increase the visibility for all the project stakeholders.

Providing stakeholder visibility, remaining secured, and the ability exchange automatic hassle-free conditional waivers with pay-apps or invoices that automatically turn to unconditional waivers when payment is received is the future of fair and collaborative construction payment.

About the Author

Nate Budde is the Chief Legal Officer and General Counsel at zlien, a vertical SaaS platform designed to help construction industry participants reduce their financial risk and default receivables by promoting a fair construction payment process and optimizing financial and credit risk management. Nate is a licensed attorney in Louisiana and a graduate of Stanford University (B.A.) and Tulane Law School (J.D.).

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.