Total US construction spending ticked marginally higher in March (0.3% MoM & 3.8% YoY), beating economists' expectations of 0% growth, and bucking the broader economic downtrend that's resulted in capital retraction.

Residential construction, which has historically accounted for >50% of US construction spending during up-cycles, has now declined for 10 straight months, yet foundational economic investments being made in the government-incentivized built world continue to accelerate (offsetting the 12.5% decline in single-family construction).

The repatriation of global operations and the commencement of Industry 4.0 drove monthly investments into next-generation manufacturing to fresh highs – up 62.3% YoY and more than doubling pre-pandemic levels – which coupled with nonoffice commercial (data centers, warehouses, EV charging stations, etc.) now accounts for 27.4% of nonresidential spending.

Annualized US construction spending is now being led by the build-out of cutting-edge semiconductor fabricating plants (reducing our reliance on Taiwan for the production of our most advanced chips), hyperscaling data centers (accelerating with recent breakthroughs in AI), last-mile warehouses (closing the e-commerce demand gap), and of course, the new roads & highways promised by the latest infrastructure investment bill -- IIJA increased the federal transportation budget by $283.8B, and is providing over $200B in additional critical infrastructure investments (improvements in digital connectivity, power distribution, water management, sustainable utilities, etc.).

Despite the apparent industry-specific tailwinds, broader economic restructuring has shaken the capital markets and given pause to many ancillary corporate innovation programs, as execs tighten their belts on new investments to effectively navigate the near-term economic uncertainty.

Now the question is whether or not this macro & microeconomic dichotomy will continue to propel the budding tech adoption in the AEC space or if FUD (fear, uncertainty, and doubt) will take the wheel, creating another near-term hurdle to this paper-trailing industry's digitalization.

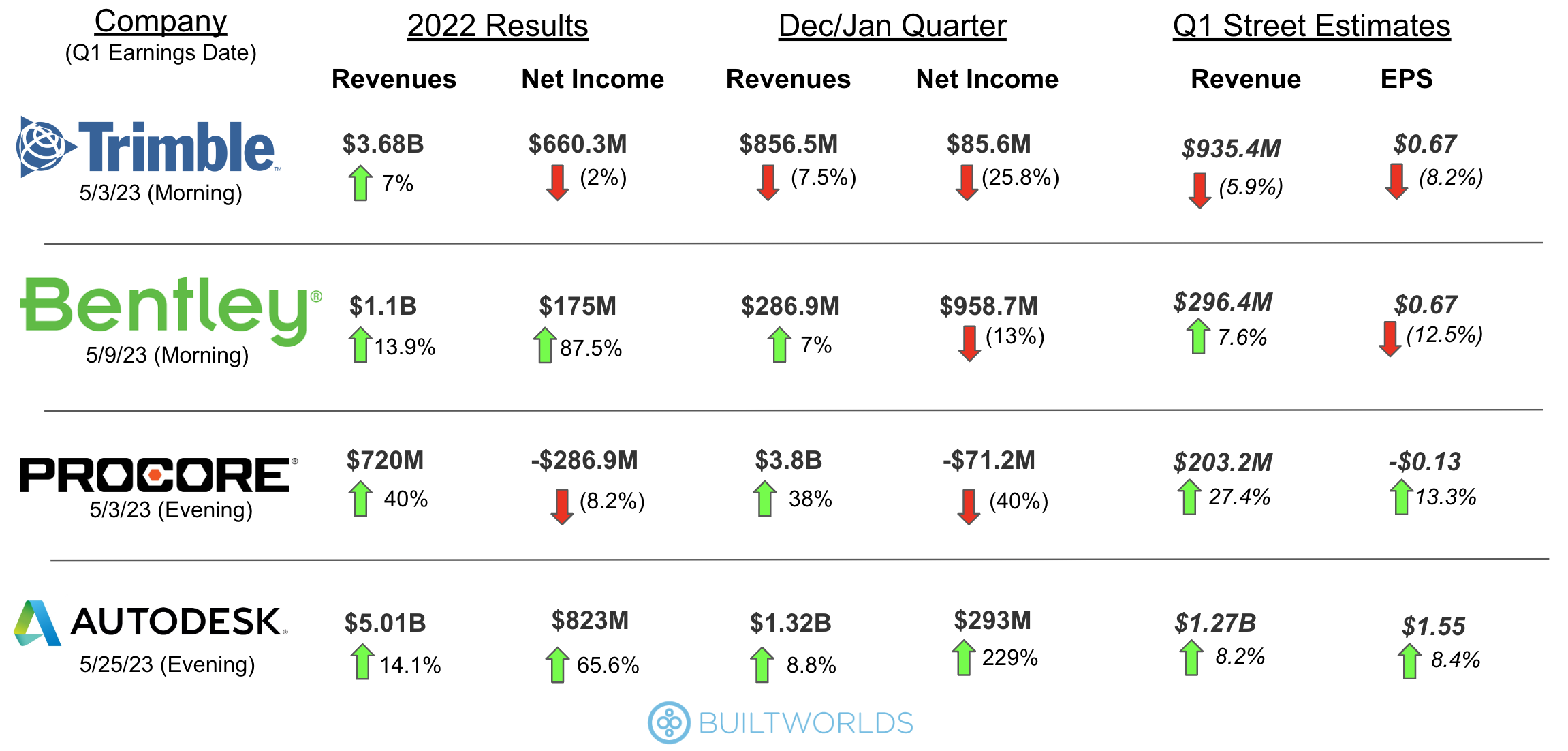

Q1 earnings from the handful of publicly traded AEC-tech players this week and later this month should provide us with clues into how the built world is responding to this precarious economic situation.

The Built World's Q1 Earnings Line Up

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.