No one ever said construction was the easiest industry for scoring an easy profit. Labor issues and rising material prices periodically conspire to make business conditions among U.S. construction contractors volatile at best, to the detriment of margins. This year’s second quarter saw material prices jump 4.4% in year-over-year comparisons, according to real estate expert JLL.

If that weren’t enough, labor — or a shortage of it — continues to dog contractors. Such conditions can erode profits, depending on a contractor’s geographic location, specialty and other variables.

Tough times call for innovative measures that allow contractors to squeeze as much as possible from their capital. One result is that many firms are turning to startups that develop new cloud-based software technologies to achieve greater savings.

Fintech in the built world

Among some of these solutions are BuildingConnected, a San Francisco-based digital bid management enterprise, BuildPay, a cloud-based project payment platform in Troy, NY, and Bento for Business, a San Francisco startup focusing on employee expense management.

BuildingConnected

BuildingConnected, who recently secured a Series B round of funding, assists contractors in saving time and money during preconstruction by linking them to a secure network of thousands of general contractors for purposes of achieving quick and accurate construction bids.

BuildingConnected, who recently secured a Series B round of funding, assists contractors in saving time and money during preconstruction by linking them to a secure network of thousands of general contractors for purposes of achieving quick and accurate construction bids.

BuildPay

On the other hand, BuildPay has developed an electronic platform that allows all project members in the construction chain to promptly transfer funds from an escrow account right into their bank accounts as work is completed.

On the other hand, BuildPay has developed an electronic platform that allows all project members in the construction chain to promptly transfer funds from an escrow account right into their bank accounts as work is completed.

Bento for Business

Bento for Business decided to tackle the common, yet elusive problem of misappropriated employee expenditures.

Bento for Business decided to tackle the common, yet elusive problem of misappropriated employee expenditures.

“Companies don’t realize the magnitude to which they may be leaking money due to employee misspending,” Bento for Business CEO and co-founder Farhan Ahmad said. This oversight undermines the secure management of cash flow, which is vital to construction firms.

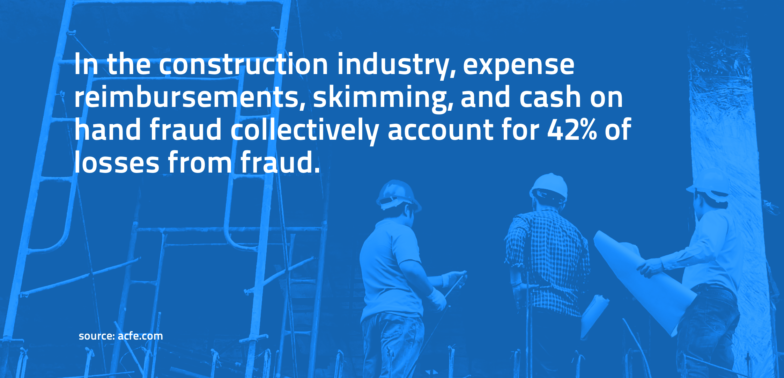

In fact, some 33% of all businesses declare bankruptcy due to fraud and employee theft, according to the U.S. Chamber of Commerce. Additionally, the Association Certified Fraud Examiners reports that fraud and employee theft account for 42% in lost revenue in the construction industry.

To address the issue, Bento for Business developed a solution for small businesses using smart software and pre-paid cards. The two combined better controls expenses, according to Bento, adding increased transparency to employee-related transactions and cutting down the time required to track and process receipts and expense reports.

“When it comes to making a profit, improving the bottom line is just as important as growing the top line,” said Ahmad.

How Bento works

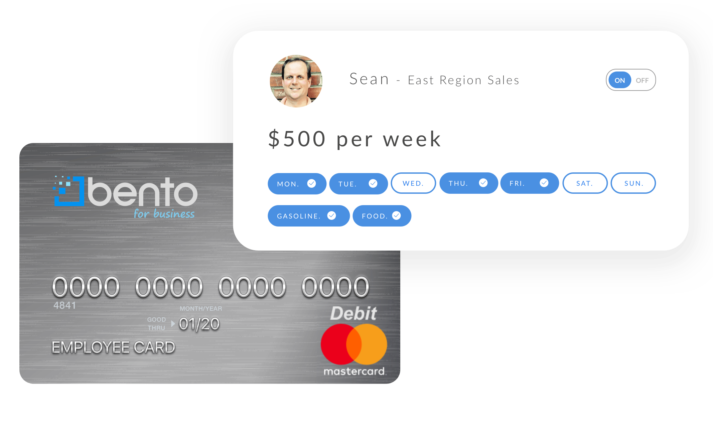

The solution provides users a commercial prepaid debit MasterCard linked to Bento’s online expense management system. After signing with Bento, contractors connect their bank account and safely transfer money into their Bento bank account. Then, they can order as many Bento cards as they need and expect them to be mailed out immediately.

Simple implementation

Bento allows management to easily issue Bento cards to employees and program detailed spending limits for each card by amount, category, and time period. The card can be turned on or off by company administrators immediately, at any time.

Management can easily monitor expenses

Cloud-based software oversees transactions in real time to prevent any potential misuse of the card, according to Ahmad. Any unauthorized spending will be declined at the cashier. Company money for fuel, for example, could not be misallocated for an employee’s personal uses.

“Construction contractors currently account for 22% of our customer base,” Ahmad said. Among the reasons: Construction calls for use of a seasonal workforce, and lack of familiarity with their team can mean that company and project managers, who are also always on the go, are looking for ways to mitigate the risk of misused funds. Further, prices vary from project to project and unexpected expenses often arrive.

Bento allows construction administrators to adjust cash allocations at any time on cards to reflect those differences or even issue a card for each project. The cloud-based software also leads to greater oversight for contractors engaged in multiple projects to not only monitor purchases, but also quickly produce expense reports.

Additional features

Easier expense reports and accounting

AEC accounting departments can spend 20+ hours a week tracking employee spending and sorting through expense reports because employees don’t always submit their expenses on time, leading to extra processing time and labor. Bento’s solution for the problem is to allow employees to upload receipts for their transactions via the mobile app, which accountants can access in real time. Plus, all transactions can be viewed in real time by card, category, and customized tags and can be exported in various formats and automatically synced to QuickBooks Online.

Increased security

Bento uses a 256-bit secure socket layer encryption to protect personal data, with the information stored in highly secure data centers that incorporate electronic surveillance and multi-factor access control systems. According to Ahmad, all funds held within Bento are FDIC insured up to a balance of $250,000.

“With less time required to reconcile receipts and expense reports with other facts and figures, you don’t have the issue of frustrated employees working long hours and pulling their hair out,” Ahmad said. “They and other members of the enterprise can have peace of mind about the bottom line and go home a little earlier at the end of the day.”

This article was sponsored by Bento for Business.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.