More than most of us, economists loathe uncertainty. So imagine their sudden consternation two months ago when the wildest of political wild cards was played on the 313th day of 2016.

Yes, the unexpected election of Donald J. Trump as 45th President of the United States not only disrupted global markets, at least for a bit. It also upended many months of meticulous mathematical planning that had already informed the annual crop of industry forecasts that so many of us have come to rely on for short- and long-term decisions re hiring, equipment rentals, materials purchasing, etc.

“President-elect Trump continues to shape his cabinet and policies, thus making it difficult to forecast potential outcomes at this point,” said Ed Sullivan, chief economist for the Portland Cement Association (PCA), speaking last month. “The impact of uncertainty is expected to be compounded by increased inflationary expectations which will impact long-term bonds and loans, such as mortgages — to the detriment of cement consumption.”

With all that in mind, PCA announced before the holidays that it was revising its U.S. cement consumption forecast for 2017 to 3.1% growth, down from its initial prediction of 4.2%. Sullivan will likely update his forecast again later this month at the annual World of Concrete show in Las Vegas.

“Without many details of the policies proposed, it’s still too early to tell the likely impact of the programs of the new administration,” said Kermit Baker, chief economist for the American Institute of Architects (AIA). “However, architects will be among the first to see what new construction projects materialize and what current ones get delayed or canceled,” he added. “So the coming months should tell us a lot about the future direction of the construction market.”

“Most contractors expect to remain busy in 2017… although there will be a shift in the types of projects most active ”

“What remains to be seen is the extent to which Congress will respond to the proposals by the incoming Trump Administration for greater infrastructure spending and less regulation of the banking sector,” added Robert A. Murray, chief economist for Dodge Data & Analytics, which had released its initial 2017 forecast in October. At that time, Murray had predicted a 5% boost in new U.S. construction starts this year. “Going forward, the construction industry should still benefit from several positive factors,” he said Dec. 22. Specifically, such factors include state funding support for school construction, led by the passage of California’s recent $9-billion bond measure, Proposition 51.

“Public works support (also) is coming from recent bond measures passed at the state level, although the continuing resolution just passed by Congress for fiscal 2017 federal appropriations did not provide an increase for highway funding,” said Murray, who like most of us, is now waiting for more solid data.

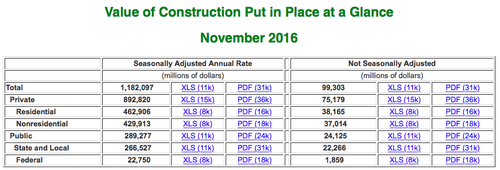

Some encouraging data arrived this week, with the release yesterday of the U.S. Census Bureau’s latest monthly report for 2016 Construction Spending through November. According to the report, the Value of U.S. Construction Put-in-Place for the first 11 months of last year reached the seasonally adjusted annual rate of $1.182 trillion, the highest total recorded since 2006.

“These numbers confirm what contractors have been reporting—that there was no let-up in demand last year,” said Ken Simonson, chief economist for the Associated General Contractors of America (AGC). “Most contractors expect to remain busy in 2017, as well, although there will be a shift in the types of projects that are most active. Office construction is especially hot, while manufacturing and apartment construction are slowing sharply, and public investment is a major question mark.”

Indeed, that question mark hovers over much as our industry now embarks on a new year. But so many signs remain positive that most economists remain bullish despite the uncertainty.

“With a new presidential administration coming to Washington, there is a presumption that the economic dynamics of the near-term future will be markedly different than they have been,” said Anirban Basu, chief economist for both Associated Builders & Contractors (ABC) and Procore Technologies. “If the last few weeks are any indication, the 2017 economy will be associated with tax cuts, more government spending, less financial regulation, faster economic growth, a stronger U.S. dollar, robust stock market performance, and greater overall CEO confidence,” he added. “That should translate into improved construction spending moving forward.”

Just today, in fact, ABC released its own new monthly report on U.S. Construction Employment, finding that the latest industry unemployment rates are down in 38 states compared to a year ago. “The continued decline on a year-over-year basis in the unemployment rate nationally. and in the majority of state rates, is an indication of the health of the construction job market and its recovery from the deep recession it experienced,” explained economist Bernard M. Markstein, who conducted the analysis for ABC. “The demand for skilled construction workers remains especially strong leading into 2017.”

So, the twists and turns of 2017 are just beginning. But so far, we’re still on an upward climb.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.