Built world VCs are carefully studying the latest annual reports from the handful of publicly traded AEC-tech companies, looking for indicators of adoption breadth and speed, as well as gaps/inadequacies in these industry-leading tech stacks where startup opportunities may be ripe.

Construction tech behemoths like Trimble (TRMB) & Procore (PCOR) released their December quarter results over the past 2 weeks, along with a number of other leading industry players, unveiling some enlightening truths about the future built world.

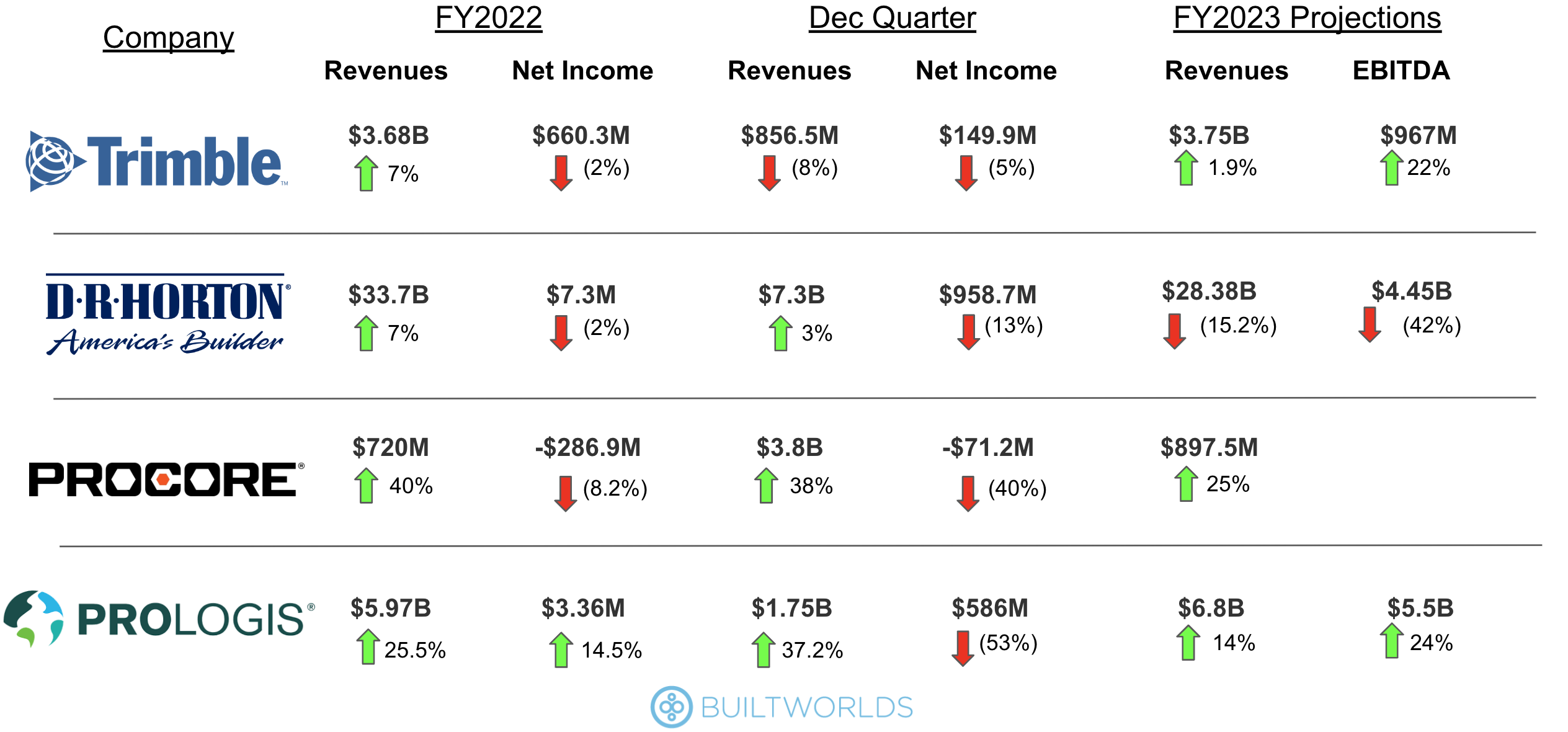

The results depicted below should year-over-year changes, along with projected 2023 performance.

The Results

Trimble (TRMB)

Trimble missed on both top and bottom-line estimates, but still managed to illustrate profitable growth and anticipates margin expansion in 2023. TRMB, nevertheless, experienced downward pricing pressures with investors still nervous about its transition to a subscription platform model (ARR now accounting for 45% of revenue).

Trimble’s inorganic growth strategy remains intact with its nearly $2B acquisition of Transporeon, a leading supply chain management solution, in December broadening the scope of potential clients across the AEC value chain. Trimble picked up stakeholder aligning integration platform, Ryvit, in the first week of 2023 for an undisclosed amount. With just $3.5M in total funding and revenues around $5M, the acquisition of Ryvit was not a capitally meaningful purchase, however, it has much greater implications on Trimble’s ARR-driven platform play – integrated digital tech stack that aligns building stakeholders, similar to Autodesk’s Construction Cloud, Oracle’s Smart Construction Platform, or The Procore Platform.

The push to integrate siloed point solutions into one cohesive platform is not only mission-critical but now a ubiquitous offering. Now it's a matter of adjusting incentives to create a common objective across the building value chain, which appears to only be possible at the owner/developer level where stakeholder visibility is most comprehensive.

The AEC platform approach if executed correctly across the aforementioned tech stack integrators will create an environment where point solution startups can go deeper into the development of their core competencies instead of wasting efforts to make a comprehensive project management platform.

"A jack of all trades is a master of none, but oftentimes better than a master of one"

Procore (PCOR)

Procore, the leading project management software provider, topped Street estimates with notable revenue growth of 40% in FY2022 but continues to issue more shares each quarter to support its operations with a seemingly perpetual bottom-line deficit (diluting current shareholders). PCOR jumped over 7% higher within the first 5 minutes of Friday trading, but the bullish uptick was lacking conviction, opening up on thin volumes, and inevitably reverting to a mere +2% post-earning price action.

Procore has ballooned its outstanding share count by >50% since the end of 2021. With 2 more years of projected losses ahead, Procore is poised to continue unloading large quantities of new shares to support its growth-at-all-costs business strategy, as it fights toe to toe with Autodesk’s Construction Cloud for control of the booming AEC-tech adoption sprawl.

An unfortunate by-product of this strategy is the value deteriorating dilution that secondary equity issuances have on current shareholders' ownership – similar to Uber’s aggressive market controlling strategy to dominate the ride-sharing duopoly. PCOR shares remain below that 10x price-to-forward sales multiple (aka market cap to 2023 revenue), a valuation ceiling that investors are holding for ARR-driven SaaS businesses across the board.

The growth-at-all-costs model is one that’s falling out of favor in both public and private markets, with VCs’ increasingly conservative cash deployment focusing on ventures with a defined path to profitable growth (or at the very least realistically attainable positive cash-flow levers in the subsequent 24 months).

Procore’s report unveiled a still massive hole in the value-rich SME (small & medium-sized enterprises) side of the industry, which accounted for just 15% of ARR. SMEs in construction represent a significantly longer-term growth opportunity.

Procore's earnings call last week also illuminated an evident lack of international traction as the notorious regionality of the construction industry remains a hurdle on the digital front -- Procore's international business represented 28% of total sales & marketing costs in 2022 but only accounted for 15% of total ARR. The international markets are another area where venture capital dollars might be employed in startups with a little less US competition.

Up to Bat

Autodesk’s end-of-year earnings hit the wire Thursday after the closing bell (2/23) followed by Bentley Systems' results next Tuesday (2/28).

Want To Learn More About Venture West

See Conference Agenda & Signup To Attend

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.