New home sales declined for the 10th consecutive month in November (the longest sequential decline since 1999), while seemingly economically-agnostic commercial & institutional demand for the future built world continues to drive construction backlogs to multi-year highs.

November 2022 home sales fell 35.4% year-over-year, in line with the price-moderating function of the Fed’s ripping rate hikes, with the average 30-year mortgage soaring north of 7% in November (an over 20-year high) from 3.1% just 1 year prior (an all-time low).

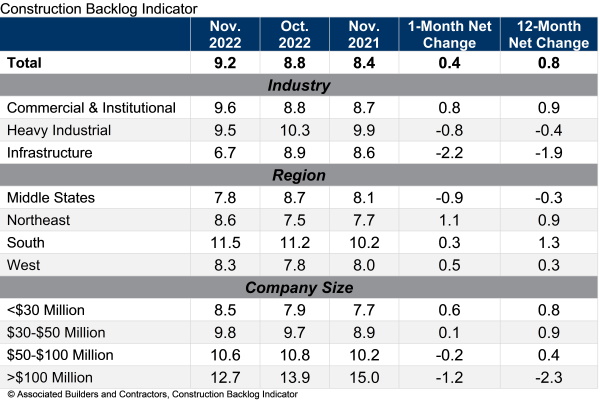

At the same time, capital-flushed US businesses continue to pour cash into next-generation commercial building projects. According to Associated Builders and Contractors (ABC) survey data, the total US construction backlog jumped to an over 3-year high of 9.2 months in November, with small/specialty contractors (<$30M annual revenue) being the most significant contributors (shown below).

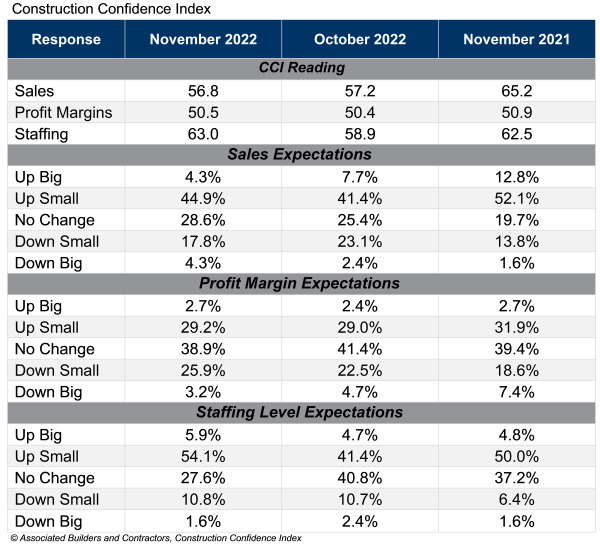

The Construction Confidence Index (CCI) assessing contractors' 6-month outlook came in buoyantly above 50 (the threshold for expected growth) as backlogs continue to defy the Fed’s pervasive demand-curbing monetary policies and construction staffing concerns ease (for now, though a societal shift away from skilled labor positions continues to be a long-run concern).

ABC’s survey revealed that 77.9% of contractors expect sales to remain buoyant over the next 2 quarters (flat to up), while 70.1% indicated stable to growing profit margins. These healthy construction metrics all seem counterintuitive to the most aggressive rate hike cycle in over 4-decades, highlighting this as an economic black swan event.

The argument that the economically lagging nature of the construction industry is yet to feel the impact of soaring rates is weakening fast with many contractors boasting of a rapid jump in project backlogs in just the past 3 months.

At the same time, the proof that this is a period of economic restructuring, as opposed to an economic fallout, seems to strengthen as B2B development continues to look toward the future of our rapidly digitalizing world. The economic restructuring into Industry 4.0 is providing a strong agnostic tailwind for the AEC space and the innovations that are poised to power the future of the building industry.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.