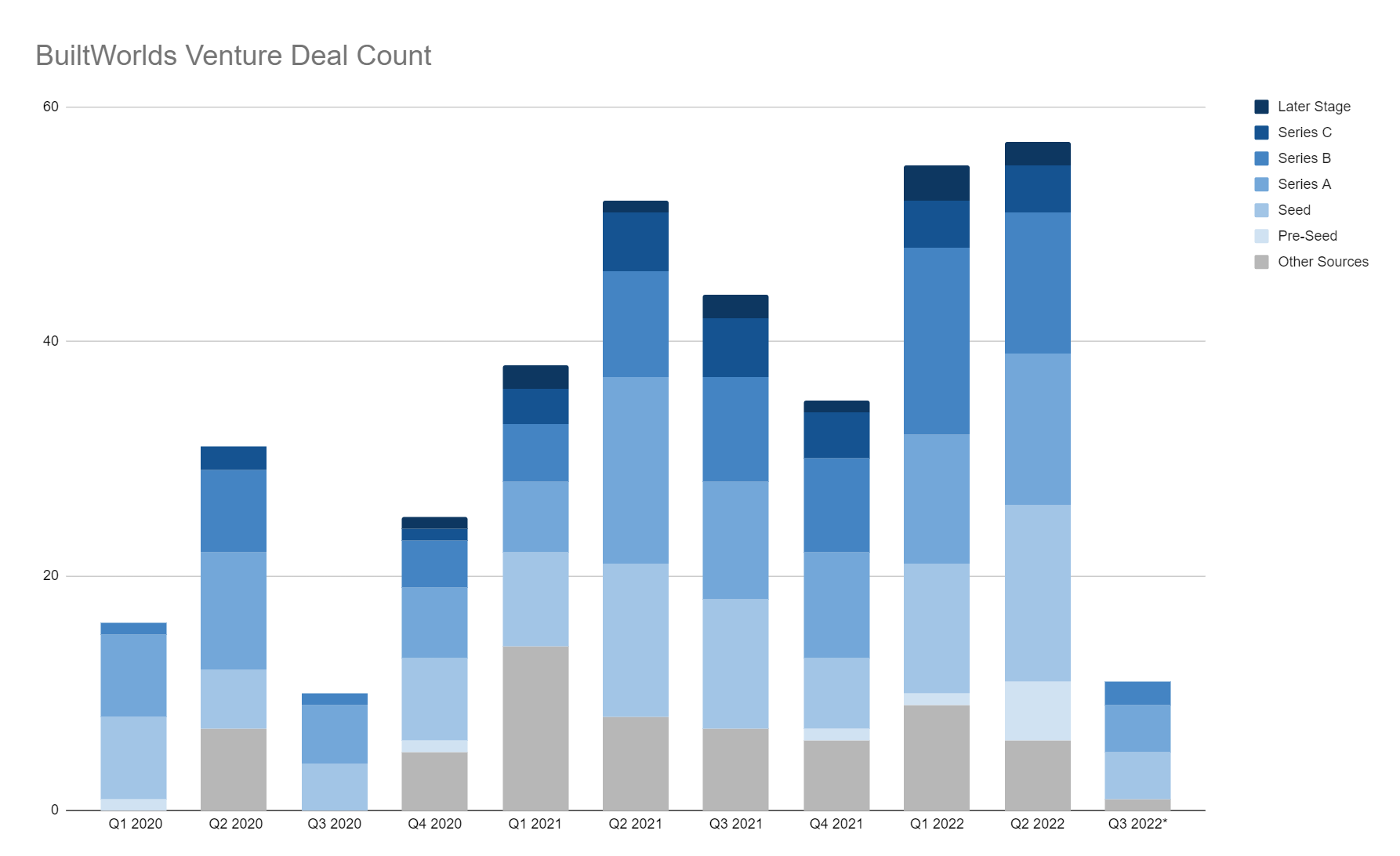

With the broader markets in turmoil, and asset volatility well above average, investors more than ever are seeking clarity into current and potential future endeavors. The BuiltWorlds 2022 2nd Quarter Venture Report, published in early July, takes a deeper look at the current state of global markets and how the construction industry has been, and will continue to be, affected by global events. Author Dan Laboe, BuiltWorlds Director of Venture Research, details how, while near-term cash flow may be in flux, private investors, CVC’s, and VC’s looking at opportunities across the built world continue to seek opportunities with a budding focus on longer-term prospects (earlier-stage investment ventures). As opportunities for lucrative growth across the industry continue to grow, a spotlight will remain on the venture side of the built world to provide some clarity into the market.

In the continued effort to provide clarity to the venture side of the industry, Laboe will be joined by Mike Mahan, Managing Director and founding member of Stanley Ventures, an investment group within Stanley Black & Decker, to discuss what we have seen in the first half of the year, and what might be in store for the back half on next week’s BuiltWorlds Analyst Call.

The call will begin with a review of some of the key takeaways detailed in the BuiltWorlds 2022 Q2 2022 Venture Report. Laboe will provide color around key data points, and additional BW insights, leading into a broader conversation about how this may influence investor outlook for the remainder of the year. We will then hear from Mike about how he and the team at Stanley Ventures, industry-leaders in the AEC space, view that data and how they interpret some of the trends outlined in Laboe’s report.

Stanley Ventures is one of the CVC groups under the Stanley Black & Decker business, alongside Stanley X. Stanley Ventures focuses on slightly later stage technologies and solutions with the potential to grow, while the Stanley X group focuses on the early stage, truly innovative technology with the ability to disrupt the future of the industry.

Mike has been with Stanley Ventures since its inception back in 2016, where he launched the group as part of Stanley’s CVC initiatives. Mike’s primary focus within the group is leading investments specifically related to the tools business, including power tools, hand tools, tool accessories, and construction technology. Recently, Stanley Ventures has led investments in companies such as Tulip, Bartesian, NExkey, RailPod, and Soloinsight.

The call will take place July 27th at 10:00AM CDT through zoom. The link to register for this call can be found here.

For additional venture insights provided this year, take a look at previously published BuiltWorlds venture reports including AI-Enabled Robotics Constructing the Future and the Q1 2022 - Investment Activity Report.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.