If you’re like a lot of construction executives, you’re concerned about the big picture: projects getting done on time, to spec, and within the budget, all while hitting quarterly numbers and tightening operations to improve margins.

You may not think to examine internal fraud, but the Association of Certified Fraud Examiners (ACFE) estimates that the average company loses five percent of its revenue to fraud each year. In the construction industry, about a fifth of that – one percent overall – is lost to employee expense fraud.

Here’s the thing: because that’s a relatively small slice of overall revenue, most construction leaders don’t notice it. They don’t even think to check. Meanwhile, money keeps leaking. Consider these numbers:

- 23 percent of expense reports fail audits.

- One in five business travelers with an expense card submits non-compliant expenses.

- Only 17 percent of those who commit expense fraud are caught.

The good news: this is a solvable problem. Here’s what employee fraud looks like in most construction companies and how you can fix it to boost your bottom line.

The 5 types of business expense fraud in construction firms

Experts have identified six major forms of expense fraud:

- Mischaracterized expenses: The single most common type, according to a 2016 study, this involves claiming personal purchases for business reimbursement (the classic trip to the lumber yard where your superintendent grabs a few things for his deck renovation in addition to the project you’re paying him to oversee). As much as 44.8 percent of fraudulent purchases fall into this category.

- Inflated expense claims: While some employees might physically alter receipts, others buy too much of something – a hundred hardhats instead of a dozen, for example – and return the extras. They then submit the original receipt for reimbursement and pocket the difference.

- Falsified claims: This might involve manufacturing receipts with a computer program or asking family members for their receipts to submit.

- Multiple claims: This involves submitting the same receipt multiple times (maybe to different supervisors) for multiple reimbursements of a single (legitimate) purchase.

- Claiming extra mileage: A subset of the “inflated expense” claim, this type of fraud involves claiming personal miles as a business expense. It accounts for more than a third of all fraudulent claims.

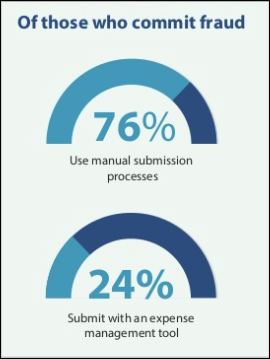

But maybe the most interesting facet of fraudulent expense claims is that they’re submitted by hand a whopping 76 percent of the time. That’s right: fewer than a quarter of fraudulent expense claims come in through automated reporting tools. Hence, that brings us to:

4 ways to reduce your business expense fraud losses

Again, expense fraud is very solvable. Any one of these four strategies can help reduce the amount of money you lose to fraud each year; adopting two or more can lead to significant improvements.

- Switch to an automated expense management system: As aforementioned, fewer than a quarter of fraudulent business expense claims come through automated systems. That’s because these systems make fraud much harder to get away with. In fact, research shows that an automated system can reduce fraud by as much as 68 percent. If you’re not sure where to start, check out G2Crowd’s reviews of popular systems, which are sortable by business size, system feature, and market presence.

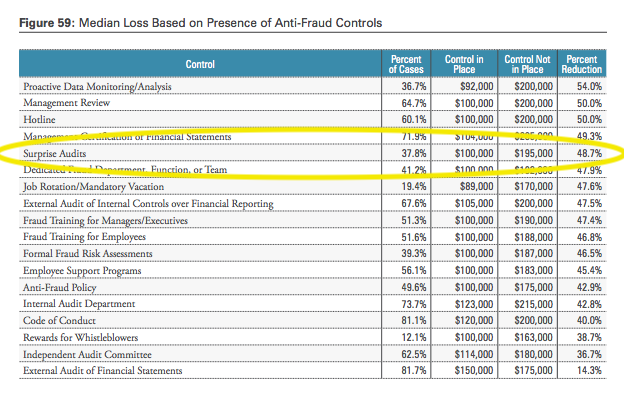

- Perform surprise expense audits: The unpleasant truth is that your employees are behind expense fraud. In some cases, they work together: a project accountant, for instance, might agree to approve questionable gas receipts for a cut of the gain. That’s why it’s smart to have a third party do surprise expense audits. It’s also wise to let your accounting team know that you’re planning such an audit (but not when it’s scheduled). The ACFE found that companies that conducted surprise audits saw median losses 47.9 percent lower than those that didn’t.

- Introduce a whistleblower program and reward: Setting up a whistleblower program can be tricky, but it can offer a one-two punch for reducing fraud: first, it sends a message that fraud won’t be tolerated. Second, it offers an immediate financial incentive for employees to act in the best financial interest of the business.

- Switch to debit-based employee cards: Debit cards offer all the convenience of credit cards (a big upfront win over petty cash and gift cards), plus they can offer proactive limitations by restricting the funds an employee has access to. Employees who are switched from credit to debit cards may test the limits initially, but once their cards are denied for purchases over their expense limit, they likely modify their behavior.

The takeaway: expense fraud happens, but it doesn’t have to

When expense fraud happens, nobody wins. The business loses money, employees can lose their jobs, and entire teams can suffer morale losses when fraud is discovered. The best way to eliminate this revenue drain is to take proactive measures to prevent it.

BuiltWorlds partnered with Brink’s Travel + Expense to bring you this article.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.