The post-pandemic return to office recovery hit a ceiling after occupancy topped 50% in January (crossing this milestone for the first time since the global lockdowns began 3 years ago). The ubiquitous remote & hybrid working environment that COVID forced on the corporate world has become entrenched in the "new normal" leaving commercial landlords heavily exposed to downside risk.

Remote & hybrid employment has become the status quo for the next generation of economic participants. With the US unemployment rate holding at an over 50-year low, and worker satisfaction near all-time highs, while employers look to cut overhead wherever they can (office space appearing to be one of the more obvious places to cut back), the long-term impact of the work-from-home movement is beginning to be seen by commercial real estate players.

The number of companies requiring their employees to be in the office full-time continues to drop, going from 49% to 42% in the past 3 months alone (according to Scoop Technologies).

Commercial building owners & operators are rushing to augment their spaces to incentivize tenants back into the office as commercial leases begin to come up for renewal. Despite these return-to-office efforts, commercial landlords are undoubtedly in for some pain as the built world resets for the future.

Commercial real estate giants like JLL (JLL), Cushman & Wakefield (CWK), and Newmark (NMRK), have seen their public market valuations cut to less than 50% of the peak they touched in early-2022 (before investors began understanding the long-term implications of the global lockdowns' economic shift), falling below pre-pandemic levels, as pessimistic short-sellers start piling on.

At the same time, US building & construction stocks climb back toward all-time highs as contractor backlogs tick higher.

Signs of renewed optimism are returning to the AEC space as longer-term secular tailwinds begin to shine through the near-term cloud of uncertainty.

As inflation cools and the rising interest rate environment concludes, investors & developers are beginning to look past near-term economic turbulence and toward the digitally-empowered future with growing optimism.

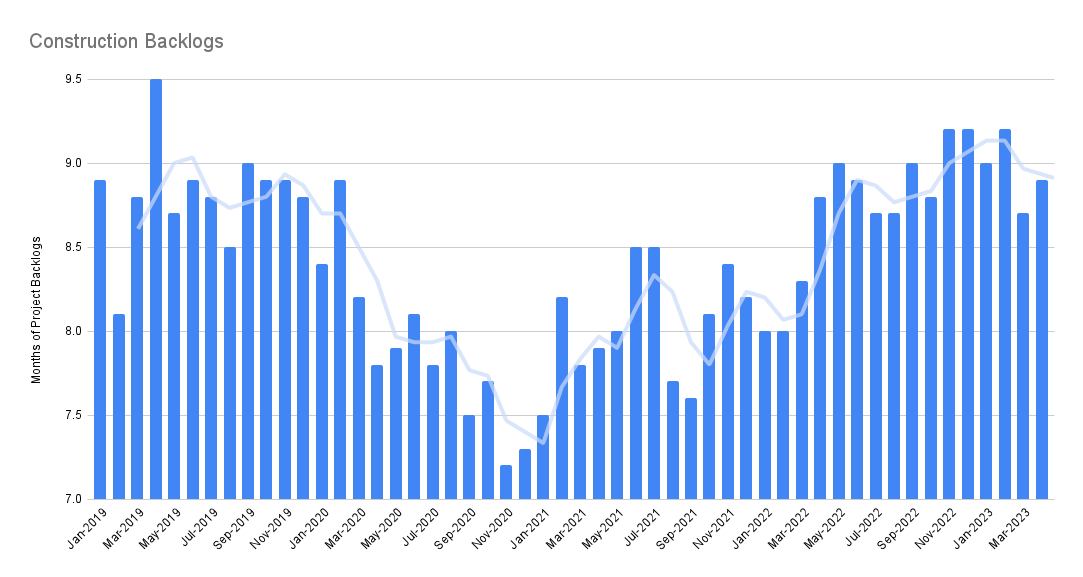

Later-stage built-world investors are finally coming out of the woodwork after months of hibernation with over $675M in capital being deployed across 13 deals in the past week. At the same time, Associated Builders and Contractors’ data showed that construction backlogs for April ticked up from the 7-month low it touched in March.

Construction backlogs have historically been seen as a lagging economic indicator due to the months of budgeting & planning that precede there. However, as you can see from the rapid backlog drop-off in 2020, these backlogs quickly respond to capital recalls. The nearly 9 months of average project backlogs imply that the capital markets in construction remain buoyant above average pre-pandemic levels.

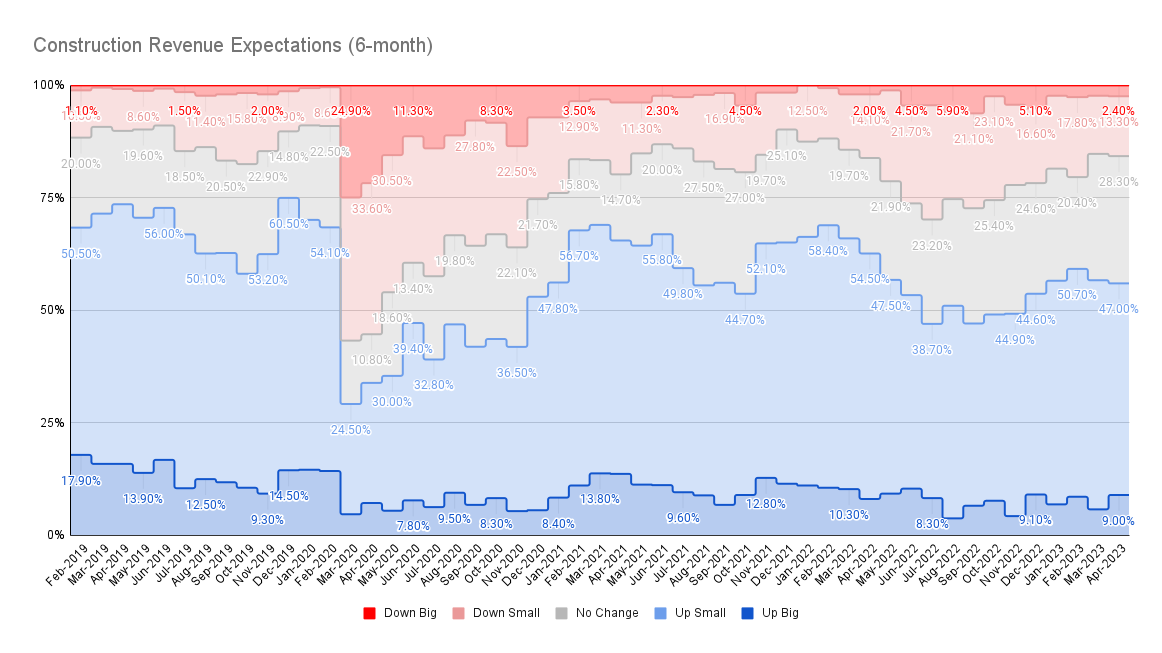

6-month construction revenue, profit margin, and staffing outlooks bounce back to their highest levels in 12 months.

56% of contractors surveyed indicated that they expected sales over the next 6 months to improve with only 15.7% of contractors expecting an operational decline compared to 20.4% in February and 25.5% 6 months ago.

A healthy amount of cautious optimism continues to propel tech adoption - supported by the latest set of quarterly reports from the handful of publicly traded AEC-tech companies (keep an eye out for Autodesk's Q1 earnings release Thursday after the closing bell).

Built-world venture investors are beginning to deploy capital with a renewed focus on later-stage rounds. This past week has seen more than $775M in VC inflows across 16 deals, the most active week all year.

Top 3 Deals of The Week

$50M | Venture | 5/19/2023

Investors: Fika Ventures and 01 Advisors

BuildOps is a leading all-in-one management software built specifically for the modern commercial specialty contractor. Focusing on trade contractors, BuildOps combines service, project management, and more into a single SaaS platform.

BuildOps enables subcontractors to run their entire business on one software solution that manages their invoicing & billing, scheduling, estimates, proposals, payments, workflows, custom forms, financial reporting, and more. The company's industry-leading cloud-based solution allows commercial service contractors to increase cash flow, boost profit margins, and impress their customers.

Founded in 2018, privately held, and veteran-owned, BuildOps is backed by prominent institutional firms including Founders Fund, Next47 (Siemens), Global Founders Capital, and other world-class institutional investors.

$225M | Series D | 5/17/2023

Investors: BoltRock Holdings and Centaurus Capital

Gradiant is a different kind of water company, deploying a full technology stack of creative solutions to help the world’s leading industries achieve sustainable operations through responsible water use. The company offers the design, build, and operation of end-to-end water and digital solutions across industries, including microelectronics, pharmaceuticals, food & beverage, lithium and critical minerals, and renewable energy.

Gradiant’s innovative solutions reduce water used and wastewater generated, reclaim valuable resources, and renew wastewater into freshwater. The Boston-headquartered company was founded at MIT and has over 900 employees worldwide.

50M | Series B | 5/16/2023

Investors: Walden Catalyst and NGP Capital with participation from Bessemer Venture Partners, Aramco Ventures, Swisscom Ventures, Swisscanto Private Equity

ANYbotics is a Swiss robotics company pioneering the development of autonomous mobile robotics. The company's walking robots move beyond conventional, purpose-built environments and solve customer problems in challenging infrastructure so far is only accessible to humans. Founded in 2016 as a spin-off of the world-leading robotics labs at ETH Zurich.

ANYbotics' customers include leading international energy, industrial processing, and construction companies. In 2020, ANYbotics raised CHF 20 m in a Series A financing round and won several prizes, including the Swiss Economic Forum 2020 award.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.