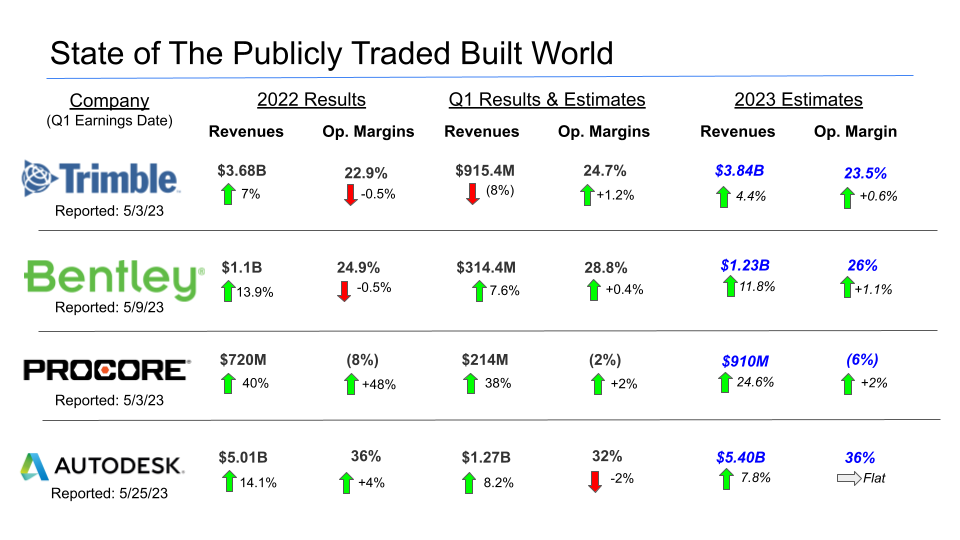

Publicly traded built world innovators have shown their hands in this market rallying Q1 earnings season, with Autodesk’s quarterly report last Thursday evening (5/25) rounding out Q1 results & full-year guidance revisions for the 4 musketeers of AEC-tech (shown below) on a rather precarious note.

Autodesk’s (ADSK) Q1 results were in line with Wall Street estimates, while management maintained its full-year sales & margin guidance from its year-end earnings call 3 months prior. ADSK’s post-earnings price action was lackluster, as asset managers start putting capital back to work in next-generation tech winners (with the Fed’s rate hike cycle ostensibly coming to an end), and investors are seeking out those companies with upward momentum in full-year guidance (a signal of economic resilience).

Unfortunately, Autodesk’s management team remained conservative on 2023 (FY24) growth projections, as the company’s transition to annual billing cycles (as opposed to the up-front multi-year contracts) elevates near-term cash-flow uncertainties, with a significant volume of 3-year contracts set for renewal in the back half of this fiscal year.

Autodesk’s year-over-year revenue growth dropped into the single digits for the first time since it transitioned to an ARR-driving subscription-based SaaS business model nearly 6 years ago. Despite the decelerating topline, Autodesk’s “Make” business segment (aka its construction solutions) continues to be a bright spot for this AEC-tech giant, with a reported 20% YoY jump (on a constant currency basis) as industry adoption continues to snowball.

Autodesk’s $1.15B acquisitions of PlanGrid and BuildingConnected at the end of 2018 enabled its end-to-end AEC-focused Construction Cloud platform. Autodesk is connecting this industry's disparate stakeholders starting from its core design & engineering customer base and fighting upstream to digitalizing builders.

Autodesk’s recently launched Construction Cloud (November 2019) remains in its infancy like the rest of the built world tech environment. There are still plenty of economic inefficiencies in the traditionally unsustainable, antiquated, & highly-fragmented structure of the built world, leaving an enormous blue ocean opportunity for well-positioned innovators.

Industry Adoption

Autodesk estimates that the AEC-tech space will grow to become a $46B market opportunity by 2026 (~$30B “Design” TAM + ~$15B “Make” TAM), giving Autodesk a ~5% market penetration today – ~$2.4B in annual “Design & Make” revenue (AEC accounting for ~48% of the company's total sales).

The lion's share of Autodesk’s AEC sales continue to be generated by its market-leading building design & engineering software, but it’s making its way through the built world value chain with a growing number of builders leveraging Autodesk’s new Construction Cloud including 15 of the top 20 ENR 400 players.

Procore, which is quickly becoming US contractors’ go-to project management software provider with over 15,000 enterprise customers, has penetrated less than 2% of the paper-trailing US construction market.

The AEC-tech inflection point (25%+ industry adoption) is close at hand as capital-juiced legacy corporations begin to lead both the development and financing of the burgeoning built-world startup ecosystem.

Check out more industry adoption metrics and some of the leading solution providers in the link below.

BuiltWorlds 2023 Project Software 50

Check out BuiltWorlds 2023 Project Software Top 50 List for a look at leading and emerging solutions across 4 project management categories: Collaboration & Doc Management, Accounting & Payment, Business Intelligence & Data Analytics, and Enterprise Resource Planning (ERP)

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.