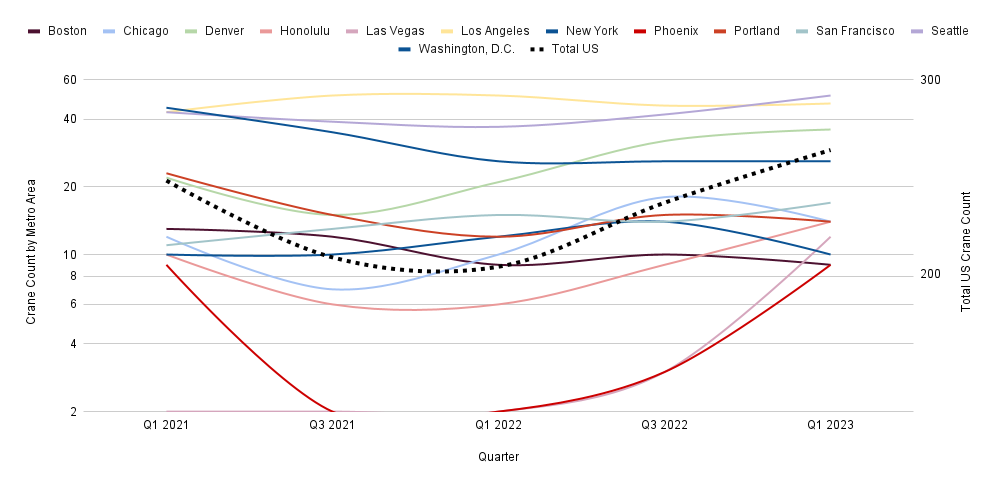

The Q1 RLB (Rider Levett Bucknall) Crane Index was released last week, showing a shift in building investments but generally depicting economic buoyancy in the built world. This newly adopted North American crane counting report (which began in 2020) paints an incredibly straightforward picture of construction activity across 14 key markets, measuring the evolving number & use of construction cranes on the skyline.

The total crane count remained elevated in Q1 with a rise of just over 7% (+34 cranes). Industrial & civil builds, multi-family residential, and mixed-use construction projects (with an elevated focus on those COVID transplant cities) more than offset the -20% decline in total US commercial crane count.

For context, the three top sectors across all cities are Residential (51%), Mixed-Use (22%), and Commercial (12%).

All in all, investments into the built world have been incredibly resilient to this increasingly capitally restrictive environment with Denver, Honolulu, Las Vegas, Los Angeles, Phoenix, San Francisco, Seattle, and Toronto all seeing elevated Q1 crane activity. Boston, Calgary, Portland, and Washington DC all saw their cran count hold steady, while Chicago and New York were the only cities to see a decline (both larger driven by the dip in commercial projects).

The Crane Index continues to strengthen the secular growth narrative painted in BuiltWorlds' Q1 Venture report which you can access below.

3 Highlighted Weekly Deals

Undisclosed | Strategic Round | 4/13/2023

Investor: Citi SPRINT

Citi SPRINT (“Spread Products Investment Technologies”), the strategic investing arm of Citi’s Global Spread Products division, is part of Citi Institutional Strategic Investments. Citi SPRINT focuses on incubating innovative fintech companies that provide strategic relevance and next-generation solutions to the financial markets.

Built plans to use the investment to accelerate its growth in commercial real estate asset management and enable further operational and technological enhancements. Through the utilization of Built’s platform, Citi will have the opportunity to introduce digitization solutions to other lenders, developers, and borrowers in the ecosystem.

$90M | Series B | 4/13/2023

Investors: Original Capital, SoftBank Vision Fund 2, Northzone, TVC, JLL Spark, Committed Capital, and Pictet

Infogrid is an AI-powered sustainability-focused smart building platform that automates and optimizes facilities and building management, actively preventing carbon emissions, water, and chemical waste while making buildings safe. It does this while generating significant financial ROIs for its facility manager and landlord clients. Infogrid provides building owners, facility, and workplace managers with a holistic and real-time view of building data that can help them meet sustainability targets, reduce costs and improve employee productivity and well-being. Over 200 global blue-chip customers are already using Infogrid to improve their facilities' internal environment and overall sustainability.

The new financing will fuel the next phase in Infogrid’s global growth, including expanding Infogrid’s vast dataset (Infogrid already collects billions of unique data points monthly, and this is growing exponentially) and the deep and broad functionality of its proprietary AI-powered building intelligence platform. It will also help Infogrid serve its global blue-chip customer base with an expanded sales and customer success organization.

$16.3M | Series B | 4/14/2023

Investors: led by Bosch Ventures and MIG Capital with participation from new investors Hannover Digital Investments (corporate venture capital investor of HDI Group) and Prospect Mining Studio / newlab Ventures, High-Tech Gründerfonds (HTGF), Gründerfonds Ruhr, NRW.BANK, RAG-Stiftung and F-LOG Ventures

Talpa provides predictive analytics applications for fixed and mobile assets, covering equipment in various industries including mining, construction, and logistics. By integrating disparate, real-time, and historical data onto a scalable and fast-analysis platform our service generates valuable insights by connecting to the machine’s ECU Data.

The funding will enable the company to enhance its industrial intelligence platform and expand from mining into construction, logistics, and other heavy industries.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.