Already a Venture Forum Member?

Click Below For The Interactive Index & Q2 Earnings Report

Technology is no longer a singular sector as its margin-expanding benefits seep into every corner of our rapidly advancing economy.

The world of building tech is still in its infancy but the pandemic’s digital accelerant provided the AEC space with a willingness to adopt these digital tools of the future. Now, building innovators are making a name for themselves in the public markets with tech behemoths like Procore (PCOR) & Bentley (BSY) fetching valuations of $11B & $5.7B in their recent IPOs’, respectively – Bentley went public in September 2020 and Procore IPO’ed May of 2021.

Other (unprofitable) built world tech powerhouses like Matterport (MTTR) & Samsara (IOT) opted to debut their shares via a special-purpose acquisition company or SPAC, a back-door route into the public markets – merging with a publicly traded shell company, aka a SPAC, formed for the sole purpose of publicly listing typically earlier stage growth ventures without undergoing the grueling painstaking IPO process.

An unprecedented 613 “SPAC IPOs” hit the exchanges in 2021, more than doubling the record set the year prior, as enterprises raced to raise capital in the public markets, providing pre-profit and even pre-revenue idea-stage companies a platform to do so.

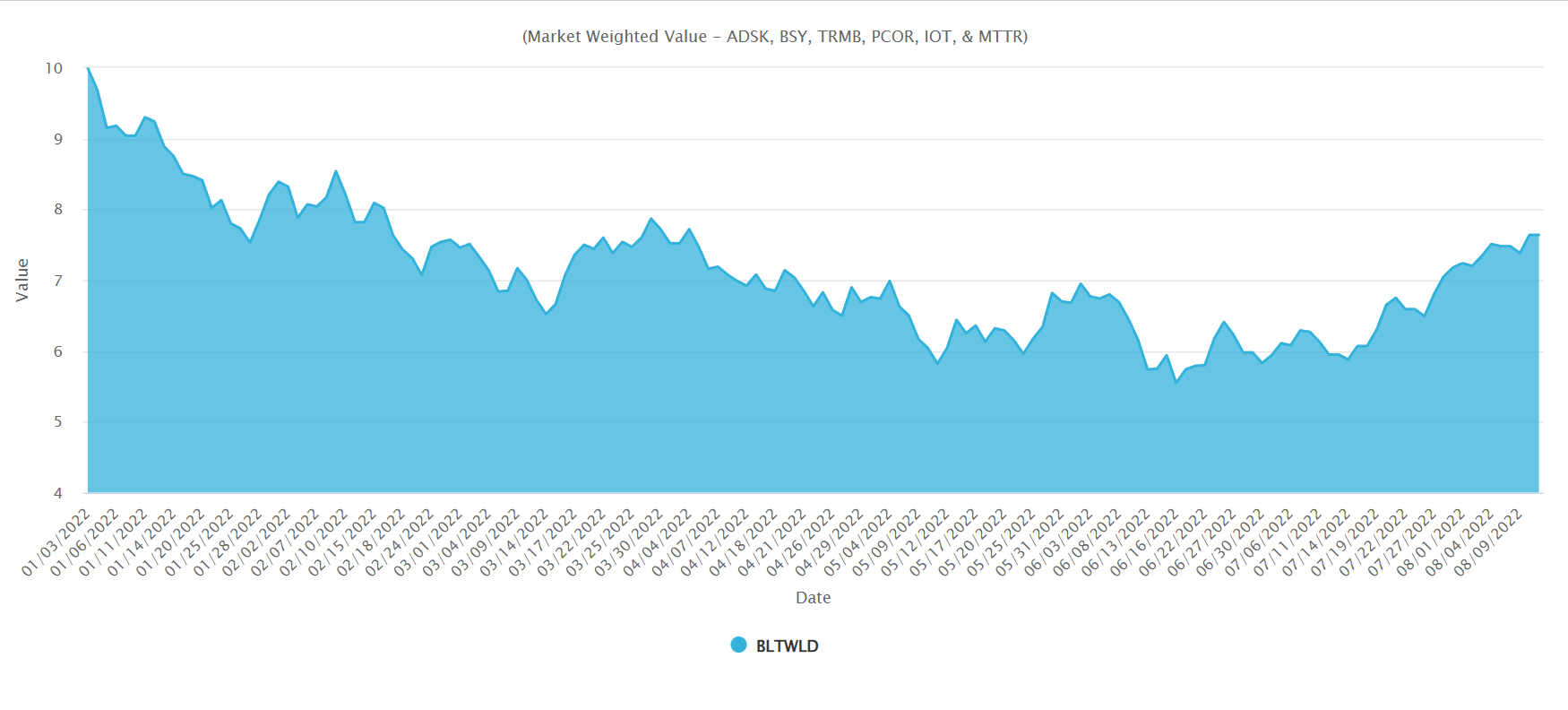

We have identified 6 publicly traded US companies that nicely encompass the BuiltWorlds technology ecosystem: Autodesk (ADSK), Trimble (TRMB), Bentley (BSY), Procore (PCOR), Samsara (IOT), and Matterport (MTTR).

These 6 building tech pioneers comprise the BuiltWorlds Index, which has been tracking the market-weighted performance of these stocks since 2022 began. Below provides a sneak peek of this interactive market benchmark.

The public equity market provides built world VCs & CVCs a real-time investment performance look along with a valuation check – provided by the BuiltWorlds Index Forward P/S ratio (using leading revenue estimates for the next 12 months, aka F12M), which has dropped from nearly 15x into single-digit territory.

We use P/S instead of P/E or any other earnings multiplier due to the unprofitable growth of PCOR, MTTR, & IOT.

To get full access to the BuiltWorlds Index and its forward P/S ratio (both charts interactive and updated daily), along with the related Q2 earnings reports and so much many more building venture analytic tools, check out our membership options below.

Want to Access the BuiltWorld Index & More?

Members can find additional analysis as well as the full list of target companies and an ability to sort by valuations, acquirers, dates, specialty areas, and more.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.