In another sign of the times, we are adding a new data set to our tool kit this year. In addition to our Venture Investments Dashboard (cataloguing the sector's venture investment deals and investors), we are now introducing a data set focused on the sector's exits - Our Built World Exits Dashboard.

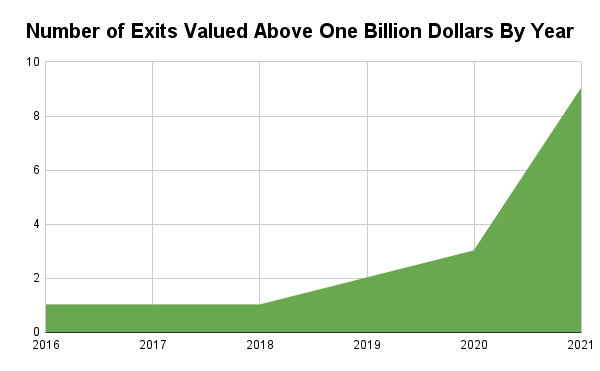

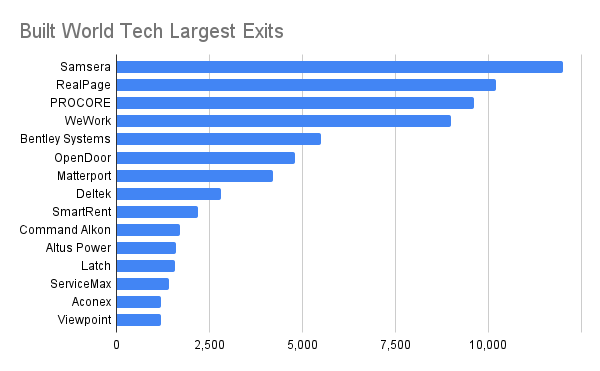

Whether via SPACS, private equity firms, strategic acquirers or initial public offerings, we are now seeing a drum beat of exits with nine, ten, and even eleven figure price tags like never before. In fact, 2021 was a watershed year for exits in the sector, marking more than half the exits we tracked with more than a billion dollar valuation. With this increasing activity, along with analyzing all the venture deals, investors, and rounds lead up to exits, we'll now be providing coverage of the acquisitions, buyers, IPOs, and related data.

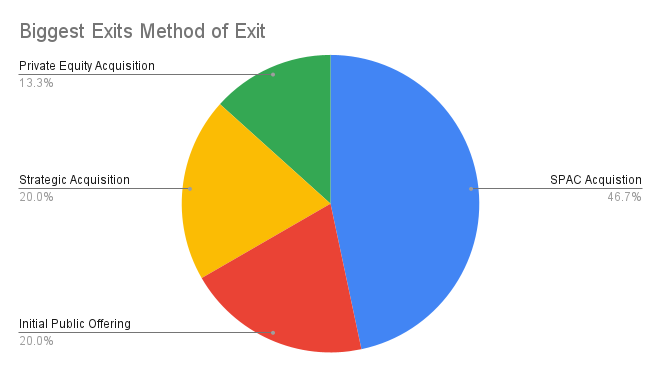

SPACS Fuel the Sector's Largest Exit Activity

Nearly half of all exits in the sector valued at more than a billion dollars were completed via Special Acquisitions Companies, or SPACS. SPAC sponsors have included a range of companies including traditional real estate companies such as CBRE and Cushman & Wakefield, venture investors such as Fifth Wall and , and large private equity companies. While we tracked nine SPAC exits in 2020 and 2021, there are still at least that many PropTech focused SPACS still hunting for acquisitions, almost ensuring that 2022 will see a pace of exits similar to 2021.

Want to Access the Complete BuiltWorld Exits Data Set?

Members can find additional analysis as well as the full list of target companies and an ability to sort by valuations, acquirers, dates, specialty areas, and more.

Depth: Exits Include an Array of Specialty Areas

As larger exits pile up, there is also breadth among smaller acquisitions and other exits. Nearly half of the one hundred exits we indexed in our initial Exits Data Set date from 2021. Like the billion dollar exits, the smaller exits span design, equipment and robotics, bid and project management, materials marketplaces and labor solutions, building products and materials, and buildings and infrastructure operations and management solutions.

What is in Store for 2022?

As explosive as the increase in both the size and number of exits in the sector was in 2021, a number of factors suggest that 2022 may be even more feverish. There remain many PropTech focused SPACS that still need to make acquisitions, and there may yet be more launched in 2022. Exits seem to beget exits, as companies flush with cash spend that money acquiring. The breadth of nine figure raises among companies that have not exited suggests that many of those companies will also be bulking up via acquisition in the coming years. Additionally, the sheer volume of earlier stage tech companies means a more target right environment for acquirers. Via our Venture Dashboard, we have now catalogues more than 200 startups that have received funding rounds in 2020 and 2021. Many of those companies will undoubtedly be 2022's exits.

Want to Access the Complete BuiltWorld Exits Data Set?

Members can find additional analysis as well as the full list of target companies and an ability to sort by valuations, acquirers, dates, specialty areas, and more.

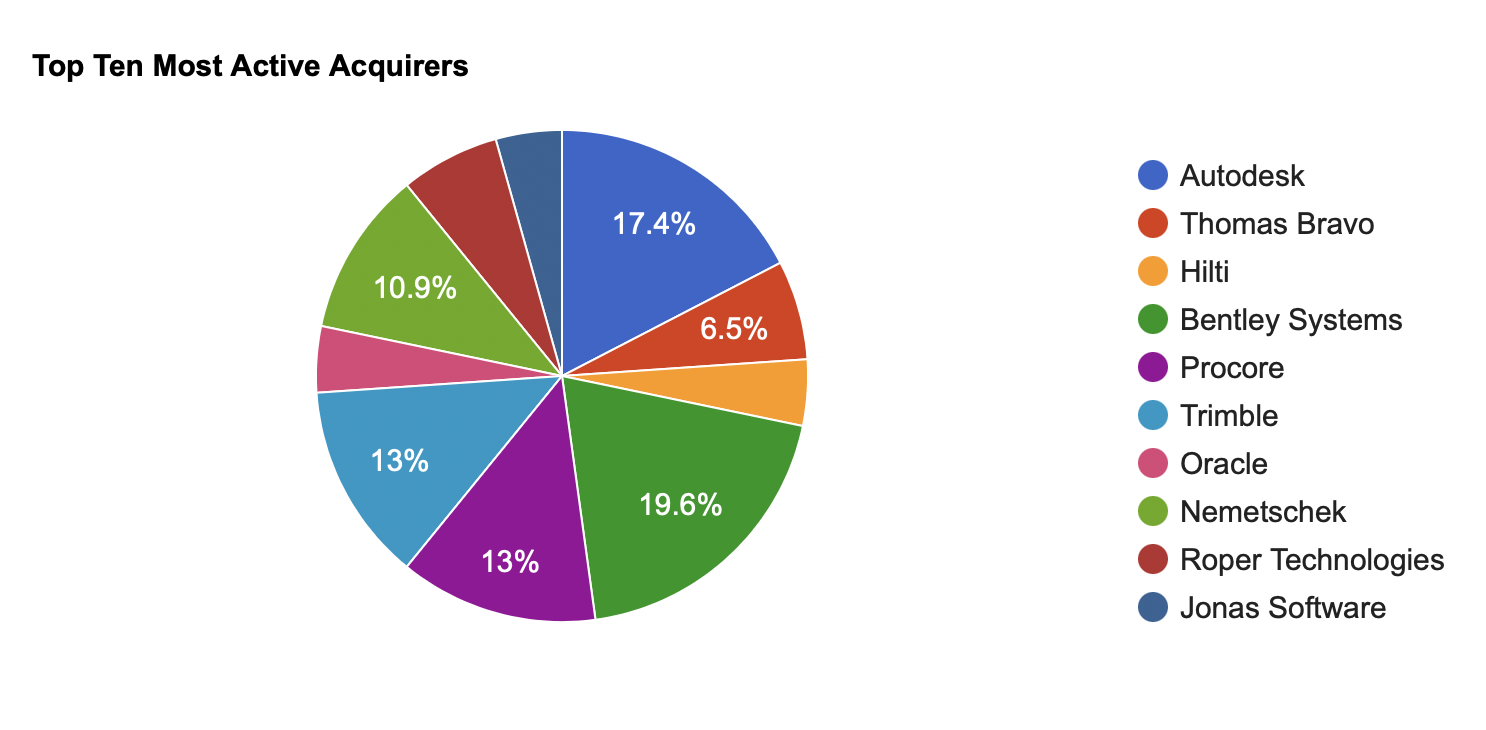

The chart below illustrates the breadth of major acquirers today, beyond the SPAC acquirers. While major players like Autodesk and Trimble continue to lead the pack of acquirers, companies like Bentley, Nemetschek, and PROCORE are putting newly raised capital to work with major acquisitions, and other strategic, tech, and private equity firms have also notched many notable buys.