On December 20, 2018, Autodesk announced it had formally acquired BuildingConnected, a construction technology software that tackles bidding, risk analysis, and other preconstruction tasks, for $275 million dollars. “Let me tell you, it was a very Merry Christmas,” Dustin DeVan, BuildingConnected’s CEO and Co-Founder, said laughing.

The acquisition came at the heels of another high profile purchase from Autodesk, who picked up PlanGrid a month earlier for $875 million. The one-two punch from the software giant was really the capstone to the craziest, most profitable 12 months for the construction technology startup field. An unheard amount of money changed hands, and there were a select few startups who exited for sums the industry had literally never seen before. In the days leading into the New Year, there was a palpable feeling that the industry had changed forever, and things were only going to continue morphing.

After the BuildingConnected deal closed, there was a lot of excitement in the BuiltWorlds’ office. One of our largest members had just bought one of our more exciting members in the ConTech space. But, we were also curious. What was it about this 12 month period that spurred all of these acquisitions and partnerships? What were the motivating factors influencing “legacy” technology companies to swipe up smaller, construction technology startups with such aplomb? The tectonic plates below our feet were just starting to shift and we wanted to know why.

Over the past three months, we sat down with many of the industry’s venture leaders along with a few of these acquisitions’ stakeholders to figure out what caused this eventful year in venture financing, and what this massive change means for the industry moving forward. Here’s what we found:

Historical Capital and Technology in the Built Industry

The construction industry is one of the largest in the world. By next year, it is expected to be valued at $10.3 trillion, worldwide. But the industry has historically been slow to adopt technology. One significant problem was that solutions connecting the office and the jobsite simply did not exist.

“Historically, a lot of the tech solutions have been made for the office or trailer,” said Darren Bechtel, the Founder and Managing Director of Brick and Mortar Ventures, a venture fund dedicated to the AEC industry. “But the thing about construction is that the field and the jobsite are where the work actually happens.” Over the past decade, this has changed as mobile technology reached new heights, and made it easier for people all over the world to connect with the click of a button. In recent years, as smartphones, tablets, and laptops steadily permeated the industry, software and technology solutions became more effective, making it easier for information to flow from the jobsite to the office and vice-versa. “These foundational technologies are becoming more and more ubiquitous, cost-effective, and reliable,” Bechtel said.

Simply put, increasing mobile solutions meant that construction technology became readily available and applicable, garnering significant interest from investors. While the rise of mobile capabilities certainly made the venture field more fertile to VCs and other investors, the AEC industry’s well-documented slow pace to utilize any technology on their projects continued to make the financial industry skittish to invest in construction technology solutions.

There are many venture funds directly investing in the AEC vertical, or that sported a casual interest in the industry, but construction technology startups never raised the capital to rival Uber, Amazon, or Airbnb. There was no unicorn--a company valued at over $1 billion--to indicate to big-time investors that the construction technology space was actually capable of large returns.

That all changed in December 2016, when Procore, a construction project management software that was founded in 2002, raised $50 million from investors and boasted to a valuation of $1 billion. “Procore really rang the bell in 2016,” said Travis Connors, the Co-Founder and General Partner at Building Ventures, another fund focused on the built industry. “They offered a well-integrated set of solutions along with a marketplace of feature functionalities.”

One year later Oracle acquired Aconex, a cloud-based solution that allows the easy exchange of documents among teams working on construction projects for $1.2 billion. The first unicorns were in the wild, and people were starting to take notice. “Investors couldn’t justify spending the money until Oracle’s acquisition of Aconex,” said Bechtel. “When people saw that, they woke up. Now, we’ve seen multiple unicorn exits and valuations; it’s an exciting time.”

A Flurry of Acquisitions and Exits

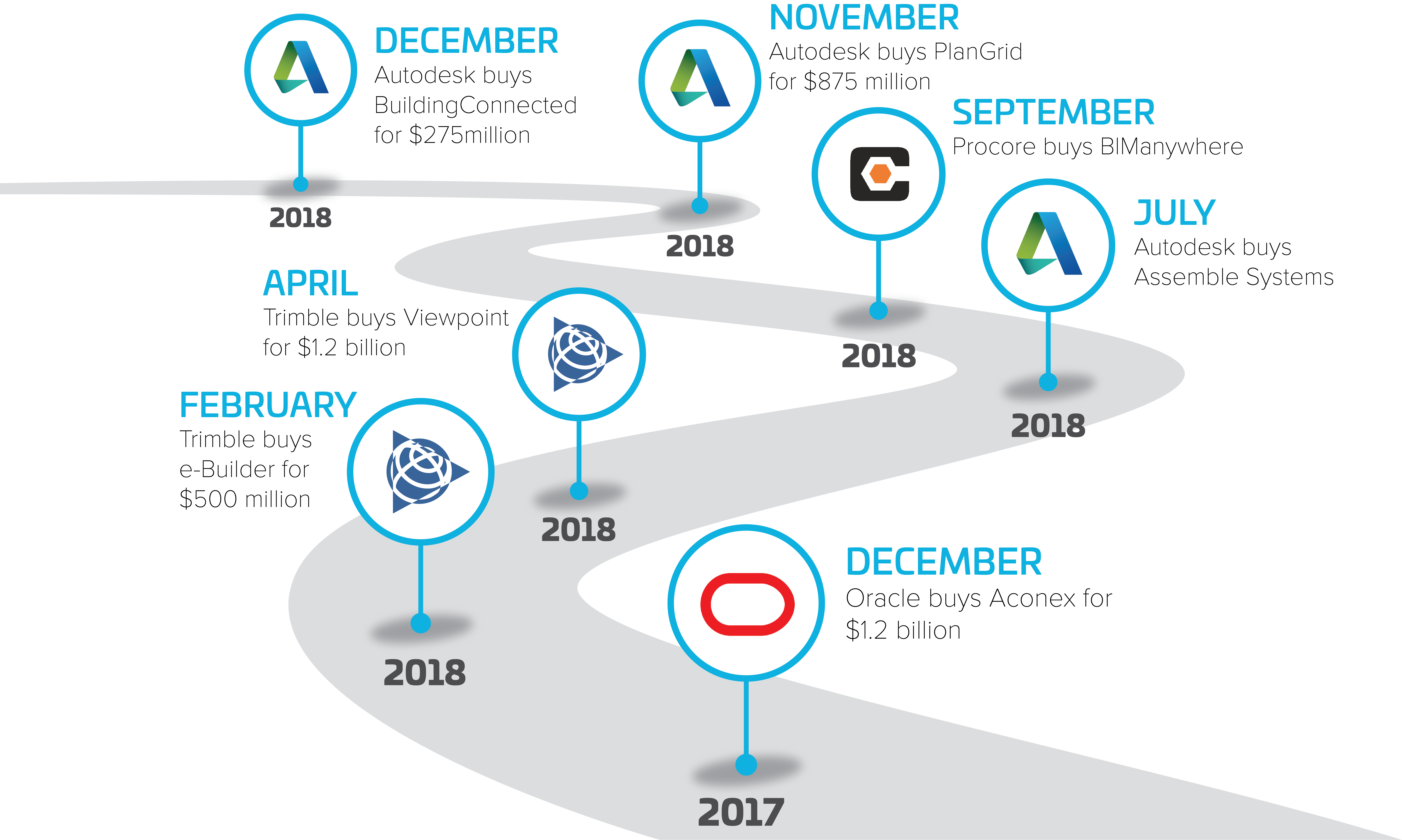

The acquisition of Aconex gave the industry its first actual billion dollar exit and adding validation in the market and fueling an explosive 12-month period. In February, Trimble picked up e-Builder for $500 million and then released the next unicorn when it bought Viewpoint for $1.2 billion. Autodesk entered the fray with its acquisition of Assemble Systems in July. Even Procore got in on the action, acquiring BIManywhere in September. Finally, Autodesk closed out the year, adding PlanGrid to its portfolio for $875 million in November and BuildingConnected for $275 million just a few weeks later.

Construction Technology M&A Roadmap

Source: BuiltWorlds

It was an extraordinary period. We were watching an arms race unfold in real-time. In the midst of all this jostling, Procore raised another $75 million in a round led by Tiger Global Management and was valued at a whopping $3 billion. “Everyone is arming up and getting the right tech on board,” said Jesse Devitte, Building Venture’s other Co-Founder and General Partner. “It’s all a big game of Risk. The armies are on the battlefield, and people are anxious to win.”

Arming Up for a Construction Software Battle

As Procore, Autodesk, Trimble, and Oracle begin arming for battle, two things are becoming abundantly clear. First, these acquisitions are only a sign of the future competition we’ll see in the space. Second, all these companies are seeking to solve the same problems from differently angled solutions.

Procore aims to be the single construction operating system through its self-developed solutions and open integrations with other solutions. “Our customers want to bring all of their projects and all of their point solution data together to have a single view of every jobsite. That means they need an open platform with all their favorite apps integrated,” said Tooey Courtemanche, Procore’s CEO. “All of the Procore apps today run on a single construction management platform. It’s an open platform that’s supported through our growing ecosystem of developers and partners that integrate with us to add value to all users. There are well over 100 integrations available today on the Procore App Marketplace.

Meanwhile, the legacy companies like Autodesk and Trimble, are trying to become the end-all solution for builders by purchasing smaller construction tech solutions that fit a need among their customers. “We are just at the beginning of an arms race where the legacy incumbents are trying to make sure they have a complete suite of solutions,” said Connors.

We talked with representatives from Autodesk and Trimble about what these acquisitions meant and what they added their portfolios. Autodesk has a three-tiered strategy moving forward, according to Jim Lynch, the Vice President & General Manager of Autodesk Construction Solutions: (1) allow customers to digitize their workflows for better collaboration, (2) integrate work process and automate manual workflows, and (3) enable the analyzing and optimizing of data and information from jobsites. The three recent acquisitions help the company fulfill these tiers for its customers. Take BuildingConnected, for example.

“What BuildingConnected did for us, first and foremost, was fill an important gap in that workflow around bidding,” said Lynch. He continued to describe how the company is focused on building out its strategy around what’s best for their customers and what’s required out of their construction technology software. “We believed our customers want an integrated bidding solution,” he said. “That’s why we acquired BuildingConnected.”

Trimble bases their solutions on what they call “the constructible process,” which is comprised of what Roz Buick, Vice President of Trimble Buildings, calls the 3 C’s: connected, content-enabled, constructible models and workflows.“ There are so many people playing in construction that it's important to be able to connect the players with separate workflows they need to do their job, while also connecting the right info between the right players at the right point of time in the life cycle,” she said. “We are big believers in the constructible model that we can deliver and others cannot.”

The acquisitions of e-Builder and Viewpoint help the company fulfill those three C’s. With e-Builder, facility owners are connected to construction professionals to increase efficiency during capital projects. “Customers require rigorous process controls around capital projects,” Buick said. “We thought it was important to have that connection to transform the way the industry works.”

The Catalyst: Listen to Your Customers

So what caused all of this? What was the catalyst behind all these acquisitions? Well, that changes depending on who you ask.

The obvious answer is simply competition. As the construction technology space became more useful to customers and profitable to investors, a few different companies began competing for both their customers and money. “I think you're seeing a bit of a race toward the operating system of construction,” said Bechtel. “This is a race towards construction instead of just design and engineering.”

Bechtel thinks that the sheer number of acquisitions we saw during that 12-month period, was because legacy companies are trying to satisfy their massive customer bases by purchasing solutions that are desired or requested. “Larger incumbent software development groups are realizing it’s difficult to develop from within, and there’s now an opportunity to partner and integrate with different point solutions.”

Connors and Devitte of Building Ventures agree that competition is the key cause for all the activity, but they take things a step further. “They [Autodesk, Trimble, and Oracle] are eyeing the phenomenon that there’s a new unicorn in town coming for their lunch [Procore], and they are making defensive moves,” Connors said. “These companies are working to figure out what else they need,” Devitte added. “None of these companies are truly complete...While they say they are done and they have everything, it’s not the case, never true, never going to happen.”

In contrast, if you talk to the likes of Buick and Lynch, the acquisitions happened in order to fulfill internal strategies, keep customers happy and plug gaps in portfolios. “Listen, all the other acquisitions are good,” Lynch said. “But what they won't do is provide a platform from design through preconstruction and building execution.”

What Does It All Mean?

December 2017 to December 2018 is going to have huge ramifications on the industry moving forward, that will affect every single person working in the built world. Moving forward the landscape will not look the same, and we’ll see the interests of several vital stakeholders shift.

Immediately, we will likely see more investment in construction technology, as that 12-month flurry of activity proved to the world that there are ample users and money to verify this particular space. “If anything, this signals that the financial markets have finally woken up and that this is potentially a multi-trillion dollar industry that is being underserved,” said DeVan.

Following the historic run from the past year, Bechtel thinks that the industry is not too far from a significant monetary milestone. “As has been demonstrated in the last 16 months, this is a whole new ballgame,” he said. “I don’t think it’s far until we see the first ‘deca-corn’ ($10 billion-valued company).”

With more investment, comes more competition. There are sure to be companies out there right now that are just waiting to break into this space, which has just been deemed an incredibly lucrative ground by investors.

“In the end, 2018 was very predictable. There were only so many solutions that legacy players could acquire. There are likely to be some companies that we are not talking about today that will enter the industry in a meaningful way.”

- Jesse Devitte, Co-Founder & General Partner, Building Ventures

Finally, there will be a heightened importance on integrations. While Procore is highlighting this as part of its marketplace and open platform, the legacy technology companies are making moves when it comes to integrating their platform with other, competitive software. “The industry has been so siloed and separated for so long,” said Buick. “The challenge for the industry is self-awareness of its segmentation and fragmentation.”

A Brave New World

Throughout our interview and research process, every single person we talked with expressed their share of excitement for the coming years. While these software companies are certainly preparing for a war, everyone is genuinely excited about what these new developments mean for the industry at large. “People are starting to catch on,” said Devitte. “Mainstream acceptance now is that technology is what is needed to design and build a better world. But we’re still in the early stages of all this.”

Without a doubt, more of these acquisitions are going to come. While neither Lynch or Buick flat-out stated their future interests, they did both indicate that more purchases from their companies are likely. “Trimble has bought over 100 companies since 2000, across five major franchises,” Buick said. “We are always looking to grow, so there’s a good possibility of future acquisitions.”

But even with that possibility, the question becomes, who will win. If these companies are indeed lining up for battle, then by the principles of a free market, there will be winners and losers. Someone isn’t making it out of this fray alive. While it’s too early to tell who will actually claim dominance over the construction technology space, companies that are strategic and inventive will ultimately gain the upper hand.

“What’s exciting now is figuring out who has the full vision and is committed,” said Devitte. “Now is when we figure out who is going to invest in interesting, less predictable startups...We’ll find out, in the next 24 months, who has a plan for the future that works.”

References:

Dustin DeVan, Co-Founder & CEO, BuildingConnected

Jim Lynch, Vice President & General Manager, Autodesk Construction Solutions at Autodesk

Roz Buick, Vice President, Buildings, Trimble

Darren Bechtel, Founder and Managing Director, Brick and Mortar Ventres

Jesse Devitte, Co-founder and General Partner, Building Ventures

Travis Connors, Co-founder and General Partner

Tooey Courtemanche, CEO, Procore

Autodesk agrees to buy PlanGrid for $875 million

Autodesk acquires Assemble Systems to build up its construction tech vertical

Autodesk to Acquire BuildingConnected, a Leading Construction Bid-Management Platform

Global Construction Market Worth $10.3 Trillion in 2020 (50 Largest, Most Influential Markets)

The new age of engineering and construction technology

Traditionally low-tech construction industry attracts $1.3 billion in venture capital

Construction Tech Sector Funding Rises As Prescient Raises $50M More

Construction management software developer Procore raises $75 million at a $3 billion valuation

Procore hits $3B valuation

Imagining construction’s digital future

KPMG report: Construction industry slow to adopt new technology

Trimble Constructable Process

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.