As a precarious economic backdrop drives public market money managers to significantly shorten their portfolios’ duration (focusing on assets with the most immediate-term cash flows), the lower-cost of private equity (multiple compression) and mounting dry powder (VCs’ deployable cash) has pushed future-focused venture capitalists’ investment scope towards the longest-duration assets (significant cash-flows being years away), with a growing penchant for building technology.

BuiltWorlds’ startup ecosystem of value-juiced innovators saw a record number of early-stage rounds close in Q2, as technology adoption rushes into the space. Pre-Seed & Seed stage deal count in bleeding-edge AEC-tech surged 66.67% from the first quarter, and total capital inflows into these early-stage rounds more than doubled year-over-year.

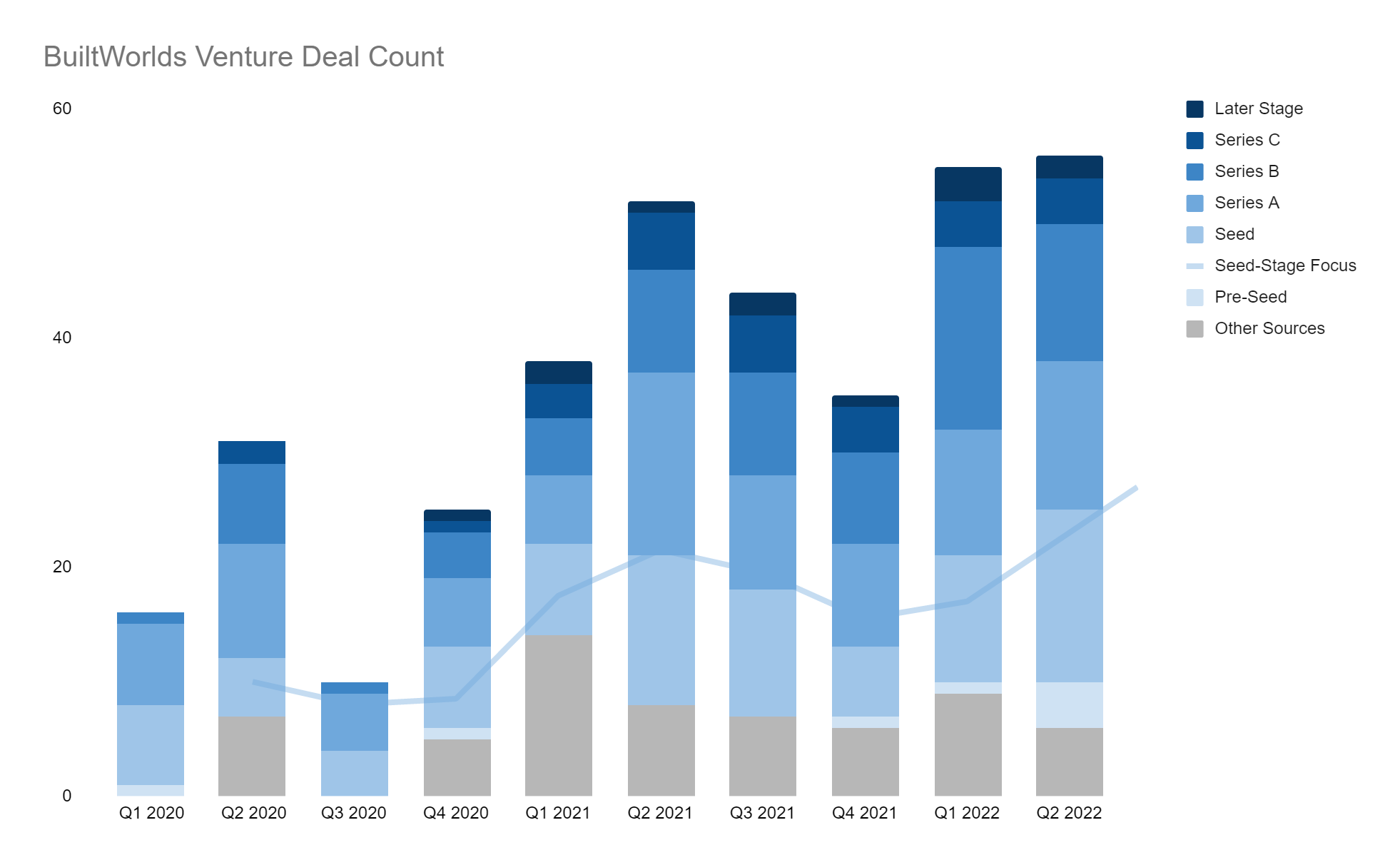

The recent uptick in earlier-stage venture investments from building VCs is depicted in BuiltWorlds rolling deal count chart below (for real-time deal tracking in the ConTech/PropTech space checkout BuiltWorlds’ Venture Dashboard).

Immediate-Term Investment Drivers

The construction industry’s traditionally-grounded culture is finally embracing the margin-expanding benefits of Industry 4.0, which includes cutting-edge innovations in AI (artificial intelligence), virtual, augmented & extended reality (VR/AR/XR), IoT-powered real-time analytics, and so much more, with its arms wide open.

The “if it ain’t broke, don’t fix it” attitude epitomizes this industry’s approach towards adopting the quickly advancing digital tools that the Roaring 2020s have to offer.

Now, with near-term labor shortages (and a longer-term societal shift away from construction jobs, shown below), schedule-trashing supply chain bottlenecks, and budget-crushing inflation driving up material prices at a pace we haven’t seen in more than four decades, this lagging-edge sector is being forced to embrace the latest technologies just to keep their heads above water.

The construction acceleration we’ve been on over the past two years has many AEC businesses sitting on cash and coupled with the immediate need for reliable resources (human & material assets), the built world has been flooding cash into new innovations with adaptation and investments, aka corporate VCs (CVC).

The CVC influx has spotlit the AEC innovation ecosystem to some of the world’s most influential future-guiding venture capitalists (Tiger Global, Insight Partners, Andreessen Horowitz, and Y Combinator, to name just a few) who are just now dipping their toes into this opportunity-primed space.

For access to BuiltWorlds’ full Q2 2022 Venture Report checkout our Venture Forum membership:

Members can find additional analysis as well as the full list of target companies and an ability to sort by valuations, acquirers, dates, specialty areas, and more.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.