When the Dow Jones Industrial Average topped 20,000 for the first time ever this week, some were quick to call it “the Trump effect,” nodding to the new US president sworn in earlier this month. Others, of course, disagreed.

Regardless of the cause, however, investors in the AEC space do agree that world markets right now are looking surprisingly bullish for 2017, and fertile for increased innovation seeding and cultivation.

“People are more optimistic about the future, at least in the construction sector,” says Curtis Rodgers, VP of Brick & Mortar Ventures, the eminently well-heeled San Francisco-based venture capital and private equity firm led by managing partner Darren Bechtel. So far, it has backed up 15 AEC start-ups. “We are getting a lot of inbounds, so I would say the mood is absolutely more positive now than it was a year ago.”

“I have not seen a more optimistic outlook from people in this business in my lifetime,” says Paul Doherty, president and CEO of Memphis, TN-based The Digit Group (TDG) and a globe-trotting “smart cities” evangelist. “Asia is very, very strong right now and will continue to be,” he adds, pointing to contracts tied to the 2020 Summer Olympics in Tokyo and the 2022 Winter Games in Beijing. “And for the first time ever, Europe is fertile ground for our work. We will be opening an office in Dublin by May of this year to accommodate the workload.”

“We are getting a lot of inbounds, so I would say the mood is absolutely more positive now than it was a year ago.”

Rodgers agrees. “Europe and Australia are fantastic for investment right now,” he says. “And in the US, San Francisco and Boston are a step above everyone else” as centers of innovation. Case in point: Last fall, San Rafael, CA-based Autodesk Inc. opened a 70,000-square-foot innovation studio and start-up incubator in downtown Boston as part of its new 250-employee East Coast office there.

“There are two big trends in the market now, one from the buyer side, the other from the entrepreneur side,” says Rodgers, adding that Brick & Mortar is currently raising outside capital in anticipation of deploying even more in 2017 seed rounds. “On the buyer side, we see more construction firms, developers, and facility managers creating their own dedicated innovation teams and getting very serious about execution. And on the entrepreneur side, more mature teams are starting to form. We’ve gone beyond the ‘friends and family’ stage to a next-generation stage that is putting earlier customer feedback to good use. So now, instead of ‘minimally viable products,’ we see much more advanced solutions being released sooner to solve real problems now.”

For example, he says, time card solutions are viable now and poised to grow with ‘reality capture’ technology. Already, virtual reality (VR) use in design has become commonplace, while augmented reality (AR) is being incorporated into more maintenance work, “especially HVAC,” Rodgers says.

AR/VR set for big year

Toward that end, Los Angeles-based AR specialist DAQRI appears to have made a next-gen breakthrough with the latest version of its Smart Helmet, which was joined earlier this month by a new sister product, Smart Glasses (see top). DAQRI unveiled the latter device in Las Vegas at the annual Consumer Electronics Show, which this year featured a raft of new AR products from several manufacturers. Architects are among the market targets for the lightweight Smart Glasses.

The heftier, protective Smart Helmet (above) is designed for field use, and DAQRI now believes the product’s day has come. In November, it was prominently featured onstage at Autodesk University, also in Las Vegas, and showcased as the subject of an ongoing successful collaboration with Autodesk BIM 360 and Mortenson Construction. Mortenson DVC Ricardo Khan says, “We are excited to continue our partnership with DAQRI, and we are investing in another round of field testing. … We are interested in tapping into project information, like RFIs, submittals, and specifications, to help deliver just-in-time information to our field workers.”

“We are interested in tapping into project information, like RFIs, submittals, and specifications, to help deliver just-in-time data to our field workers.”

DAQRI, meanwhile, is said to be seeking some $200 million in private investment to bolster its AR offerings, Bloomberg News reported in late October. While that amount may have once seemed fanciful, it was made all the more realistic last year by news that Dania Beach, FL-based start-up Magic Leap had secured a whopping $1.4 billion in venture funding to help develop and push its AR products out to the general consumer market ASAP. The company expects to release its first product later this year.

“2017 will be a big year for Magic Leap,” wrote founder and CEO Rony Abovitz on his blog earlier this month. “What we are building is no longer just a dream. … We are scaling up so we can manufacture hundreds of thousands of systems, and then millions. … We have made something that is small, mobile, powerful, and we think pretty cool.”

Indeed, from Magic Leap to DAQRI to HTC Vive, IrisVR, Microsoft HoloLens, and more, the AR/VR market is giddy with excitement right now, and investors clearly have found the enthusiasm contagious. “AR is fundamentally a new technology that will enable the next generation of computing,” Fyusion CEO Radu Rusu told the Financial Times (FT) last month. His firm, an AR software developer, is in the process of raising $30 million. AR is “the next step after your phone,” he said. “The technology is ready.”

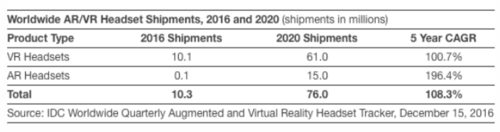

CAGR = Compound Annual Growth Rate Global AR/VR forecast by International Data Corporation (IDC)

Headsets of all shapes and sizes are poised to proliferate like never before. In fact, investors are banking on it, both inside and outside the AEC industry. According to FT, in 2016 alone, three more AR headset makers, ODG, Meta, and Lumus, raised $58 million, $50 million, and $45 million, respectively, in separate venture funding rounds.

“AR may just be on track to create a shift in computing significant enough to rival the smartphone,” said Jitesh Ubrani, a senior research analyst for IDC Mobile Device Trackers, which last month launched the industry’s first Worldwide Quarterly Augmented and Virtual Reality Headset Tracker. “However, the technology is still in its infancy and has a long runway ahead before reaching mass adoption.”

While that undoubtedly is true, investors and competitors seem determined to accelerate the timeline.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.