Click the button to be re-directed to the full report.

ARE YOU ALREADY A MEMBER?

The Benchmarking program offers BuiltWorld’s Engineering and Construction Company members an opportunity to gauge their technology adoption against their peers so they can identify and prioritize the gaps in their technology stack they need to address to be a leading firm in terms of digitization. Since its inception, the BuiltWorlds Survey Report has aimed to identify leading construction technology solutions across five key categories; Preconstruction, Project Management & Oversight, Field Solutions, Advanced Machinery & Equipment and Offsite (Modular) Construction.

Within this report are the aggregated survey results from May 2021 to May 2022 focused on key findings for usage of Preconstruction project delivery technologies within the following tech specialty areas and categories:

The Built World is ever-changing—everywhere you look it is constantly influenced by innovative construction technology and ideas. These new advancements can help companies, regardless of size, expedite processes and increase safety in many areas of their work. Given the many possible directions available when implementing new tech, the decision-making process can seem foreign to both employers and employees.

The contents of this report are the product of surveyed construction companies, of varying sizes, regarding their adoption and implementation of construction technology. Specifically, the topics include construction project delivery technologies, with numerous subtopics embedded within to create a fuller picture of adoption in all areas. The Benchmarking Survey Program is one functionality of BuiltWorlds that is designed to provide actionable insights for our members as they implement different tech into their operations.

It is important to note that the data that is presented in this report is empirically gathered and not the brainchild of BuiltWorlds analysts. As alluded to above, the data is retrieved through our BuiltWorlds Benchmarking Survey Program which examines five major areas of exploration in construction project delivery technology solutions. This allows us to deliver applicable data and insights, regardless of which part of the construction timeline your company operates in. Data is presented in thoroughly crafted Report Cards that are individualized for each eligible BuiltWorlds member company that submits a survey.

The questions in the surveys are designed intentionally as a means to get a more clear picture of how and where technology is used and the overall satisfaction companies have when using it. The collection of this data from year to year allows us to identify trends and potentially understand what drives certain decisions—helping member companies in their implementation process.

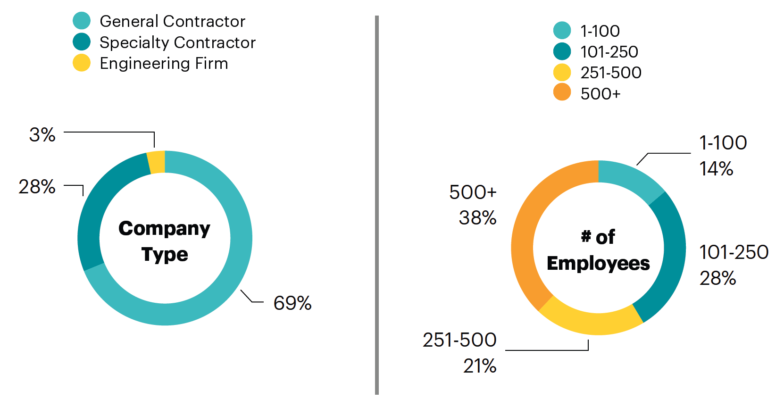

Respondents for this year’s survey included C-Suite leaders, Executives, Presidents, Operations & IT Directors, Directors of Technology/Innovation and Implementation Managers at Specialty and General Contractors. Most respondents are members of the BuiltWorlds Engineers & Contractors (E&C) Technology Adoption Leaders Forum, which meets monthly to discuss trends in construction technology needs and adoption.

DEMOGRAPHICS

COMPANY TYPE AND SIZE

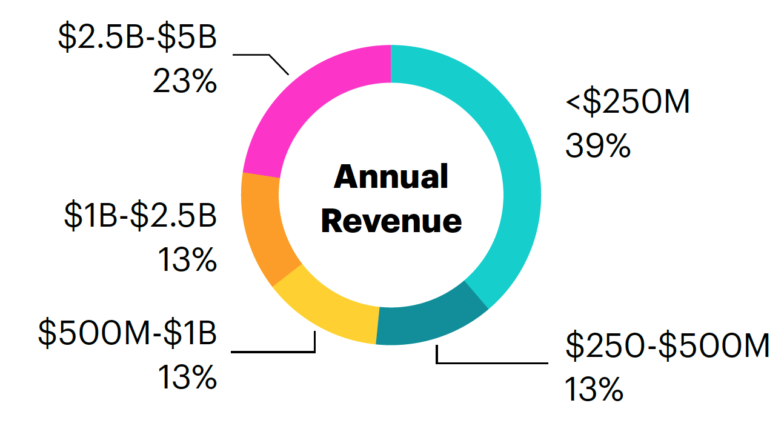

AVERAGE ANNUAL REVENUE

The average annual revenue of this survey’s respondents was $1.41B with a minimum revenue of $1M and a maximum revenue of $19B. The median annual revenue of our respondents was $125M. The total sum of annual revenue of represented in this report was just over $32B across twenty-three General Contractors, Specialty Contractors and Engineering Firms.

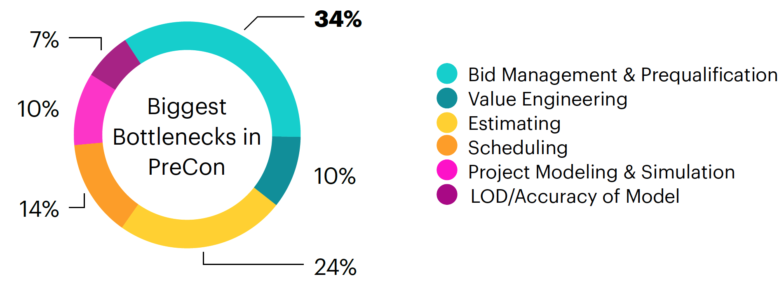

PRE-CONSTRUCTION TODAY

Preconstruction is widely defined as the first phase of the construction project delivery lifecycle. Within this phase, developers, designers and contractors begin the task of designing, scheduling and ultimately pricing the project. We asked our survey respondents about their current levels of adoption, utilization, implementation, ease-of-use and functionality effectiveness of their project delivery team’s preconstruction technologies. We asked respondents to name their company’s largest bottlenecks in preconstruction this last year, the results are shown below:

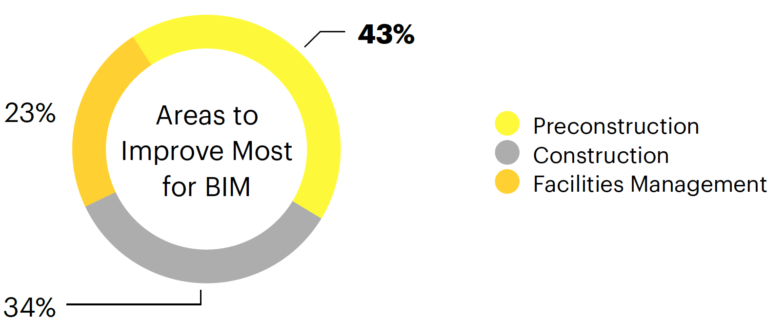

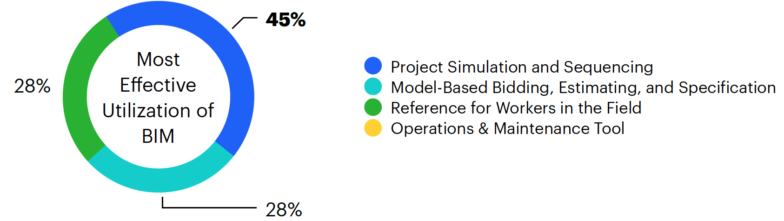

When asked if the construction industry effectively leverages BIM; 82% of respondents feel that the industry does not while 14% are unsure. Only 4% of our respondents feel confident that the construction industry effectively leverages BIM. On average, 44% of our respondent’s projects currently leverage BIM in project delivery.

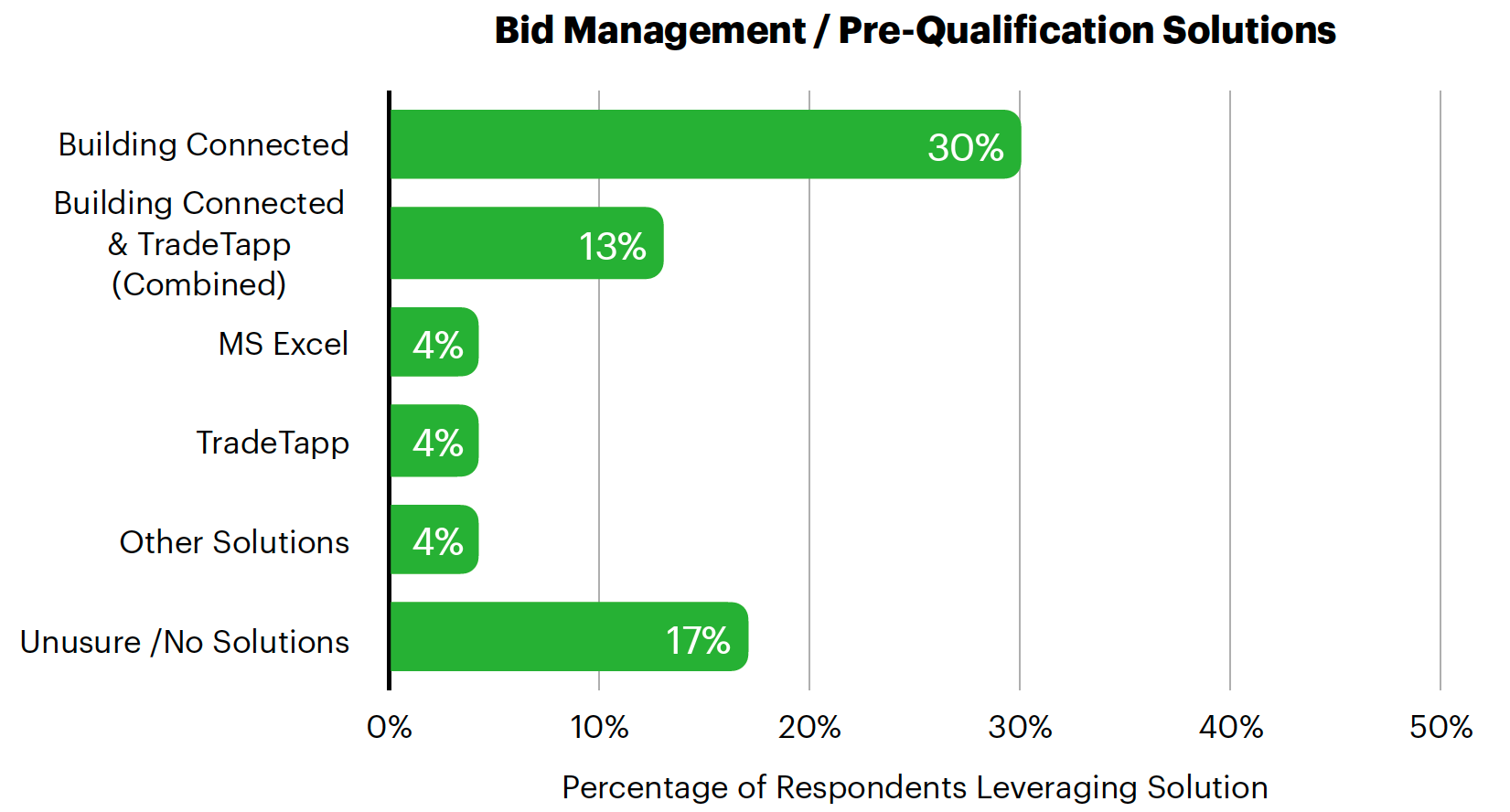

BID MANAGEMENT & PRE-QUALIFICATION

Bid management and pre-qualification are the processes in preconstruction that involve soliciting a request for proposal from contractors and trades for performing a specific scope of work on the project. The process of comparing and analyzing proposals received from competing bidders is considered bid management. The process of qualifying which bidding companies can qualify to work on the project based on project and company level acceptance criteria, if awarded a contract, is considered the bid qualification phase.

We asked respondents to identify solutions specific to the project level bid management and pre-qualification for their project delivery.

top solutions

Other Notable Solutions

Other solutions identified as having 4% or less adoption by this year’s respondents are listed below:

- CMiC

- Procore

- Bidtracer

- Pantera

- Trimble Viewpoint

- Bidmail

- Contractors Score

WANT TO ACCESS THE FULL REPORT?

The full Preconstruction Benchmarking Report covers all of the topics listed above and will show you the top solutions that are currently being implemented throughout the industry. Check out our membership options by clicking the button.