With the news that 3D Printing Construction Company, ICON, has just raised $35 million in funding in a round led by Chicago-based real estate tech-focused, Moderne Ventures, with participation from Austin-based, industrial ecosystem-focused Ironspring, and also the well known architecture firm BIG-Bjarke Ingels Group, it seems an opportune time to take stock of 3D printing as an important area of emerging tech in the industry.

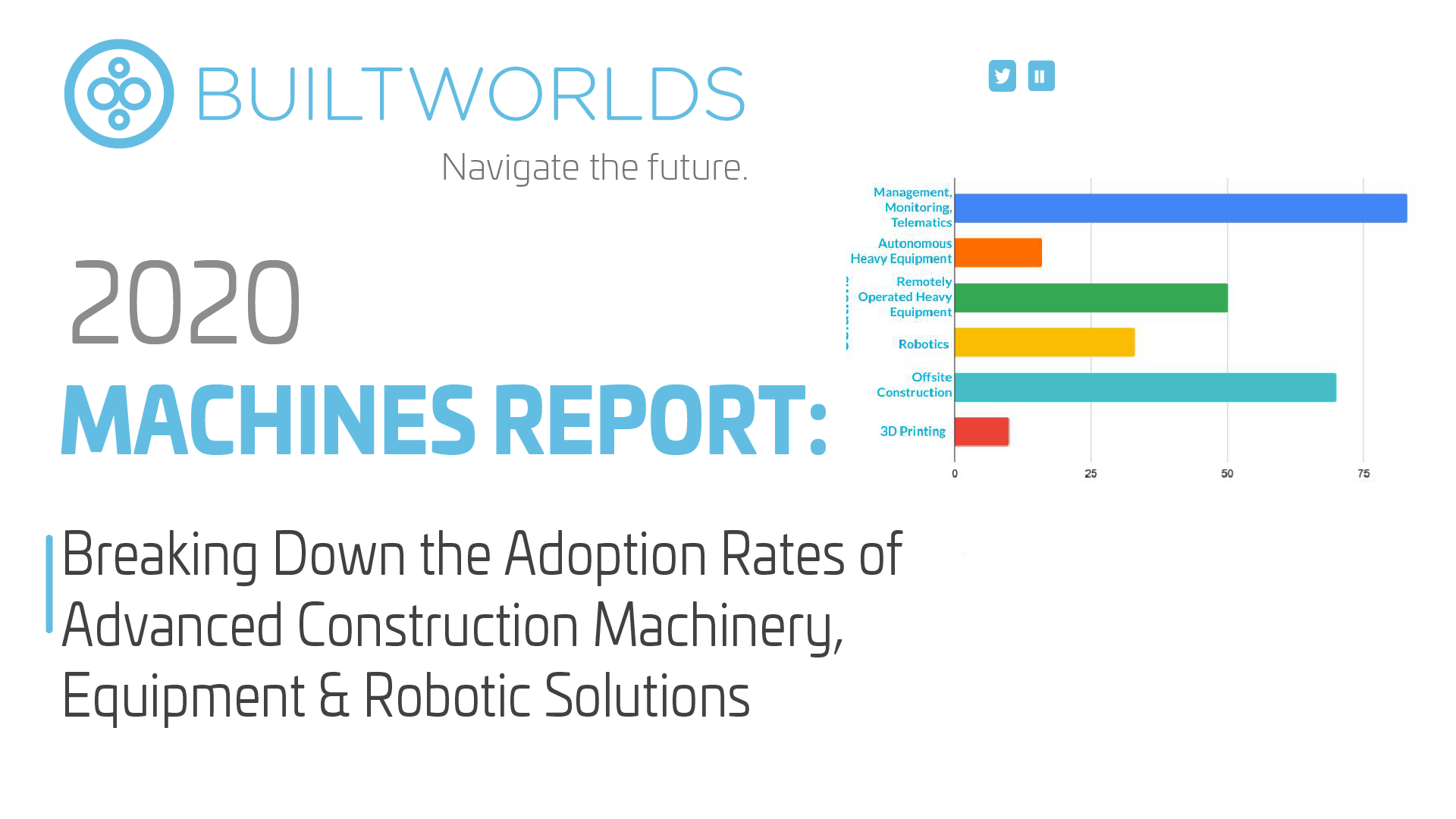

Of all the areas of advances in equipment and robotics in the industry, 3D printed construction ranked lowest in terms of adoption by our early adopter contractor members (see our 2020 Machines Report), but given how new the companies in the sector are and the complexities involved, perhaps that shouldn't be surprising. Other sectors such as project management software, digital modeling, and one form or another of asset tracking have been around for decades. By comparison, commercial scale 3D printing in the industry is really just getting started. Of the more than 20 "building scale" 3D printing companies we are tracking in our company directory, at least fourteen were founded in the past seven years, and none appear to have provided commercial-scale offerings until the last few.

There are many more companies focused on 3D Printing of components, and smaller parts, but creating entire buildings or major building systems poses a myriad of challenges. There have been questions surrounding areas such as the best materials to use, how to comply with building codes, ensuring structural integrity, slow speeds, accounting for various site conditions and constraints, and more. However, as companies in the sector proliferate, raising more sums from influential players, the number of completed projects around the world is steadily increasing.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.