The US equity markets are stabilizing going into the Federal Reserve’s monetary decision Wednesday afternoon (9/20). The FOMC’s benchmark Fed Funds rate has been driven up over 6,500% since this rate hike cycle began in the spring of 2022 – Fed Funds going from 0.08% to 5.33% – to temper unprecedented inflationary pressures in the most hawkish monetary tightening in 4-decades.

Despite the 10th conservative rate hike by the European Central Bank last week, the FOMC is expected to hold rates steady for the 2nd meeting in a row. The real market-moving action is expected to come from a fresh set of interest rate outlooks and economic projections from the FOMC (released once a quarter), and Fed Chair, Jerome Powell’s post-meeting press conference beginning at 2:30 PM (ET) on Wednesday.

Despite a halt in this current rate hike cycle, the timeline for the Fed's monetary loosening (reducing rates) continues to get pushed out. We will understand more once the Fed releases its interest rate projections tomorrow afternoon.

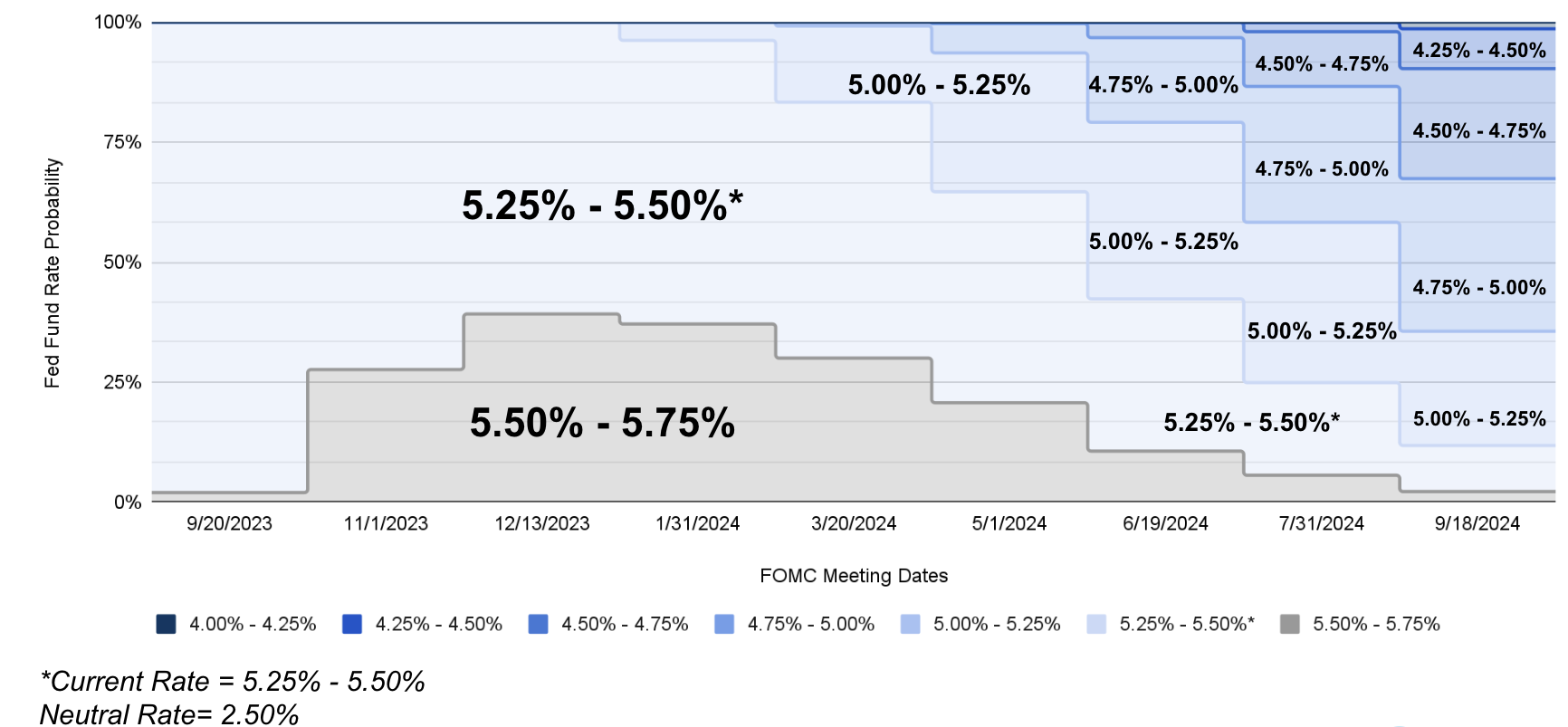

Below you can see the 12-Month Fed Funds outlook (according to CME traded Fed Funds futures), which depicts a September 2024 rate that's over 1% higher than what the markets were forecasting only 10 weeks ago.

12-Month Projection of Fed Funds Rate

The Pressure

Inflation has entrenched itself in every sector of the global economy, with pervasive and prolonged supply chain disruptions pushing the supply curve onto its heels while demand exploded in the post-pandemic spending frenzy. This persistent supply and demand imbalance created the perfect storm for the bilateral price explosions we’ve seen in the past 2 years.

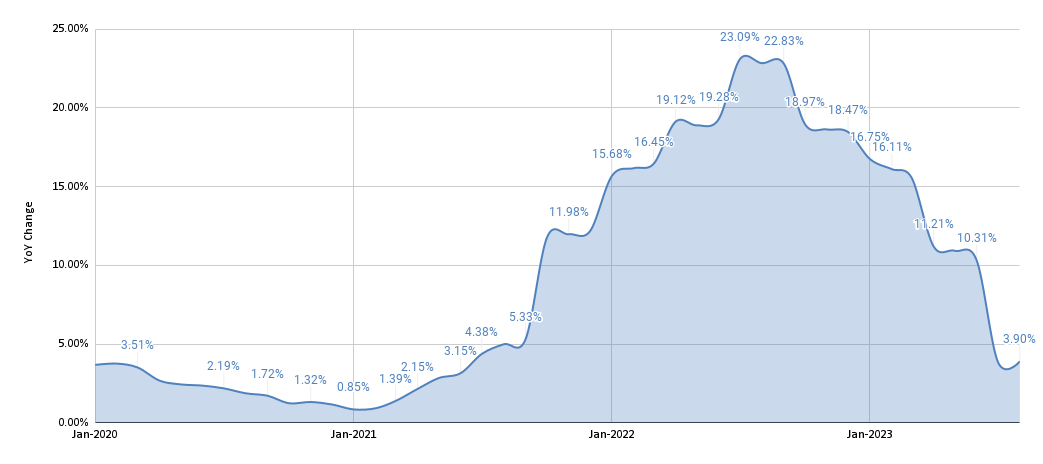

Despite booming construction output – US construction spending reaching all-time highs in the past 6 consecutive months – this industry has experienced a 36% increase in input prices since the pandemic began. Below you can see the YoY increases in construction input costs peaked at 23.1%.

US Construction Input Costs (YoY Change)

Inflationary pressures have materially subsided in recent quarters, indicating that the FOMC’s aggressive rate hikes have been at least effective in controlling much of the demand-driven price increases (monetary policy doesn’t directly impact supply-side pressures).

What's Next

Investors are now able to quantify peak rates, which has led to the latest public equity market rally we've seen since the beginning of 2022. However, with the US economy remaining unexpectedly buoyant in the past 6 months, the extent to which the benchmark Fed Funds rate will hold materially above the neutral 2.5% rate remains increasingly uncertain.

Fortunately, the VC community and their very long-duration investment approach (investing in assets that will not see their most substantial profitability for years to come) will be less impacted by the near-term timing of interest rate reversals.

The recent push towards successive priced investment rounds and away from the down/bridge rounds looks to be a trend that will continue into the back half of 2023 as VCs deploy pent-up cash to avoid capital recalls. The cascade of Climate Tech funds, Industrial Tech VCs, and Corporate Venture groups in the AEC ecosystem over the past 3 years positions this startup niche nicely for this industry's impending digital transformation.

Deals of The Week

$150M | Series E + | 9/14/2023

Investors: Led by funds affiliated with BDT & MSD Partners

Origin: Columbia, Missouri

EquipmentShare is a nationwide equipment and digital solutions company serving the construction industry. EquipmentShare is on a mission to give contractors and construction companies build with control thanks to our T3 technology platform and equipment rental, retail, and service solutions.

$52M | Growth Capital | 9/12/2023

Investors: Led by Saudi Aramco’s Wa’ed Ventures and BOLD Capital, with participation by Khosla Ventures, KB-Badgers, and 15 other new and existing investors

Origin: Oakland, California

Mighty Buildings' 3D printing technology, advanced materials, and robotic automation make beautiful and sustainable homes a reality for all.

N/A | Strategic Funding | 9/12/2023

Investors: Holcim MAQER Ventures

Origin: Switzerland

Neustark is a leading provider in this rapidly growing field, having developed a solution to permanently store CO2 from the air in recycled mineral waste such as demolished concrete.

Want To Learn More About the Mission-Critical Tech & Investments Driving The Built Environment?

Check out BuiltWorlds' Venture East Conference in Miami this November

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.