With each week bringing new headlines about ongoing woes in the real estate industry, it is tempting to assume that the construction sector must be suffering as well. However, the latest data show that the construction industry is doing just fine, and the divergence of fortunes is playing out in the previously closely linked proptech and construction tech sectors.

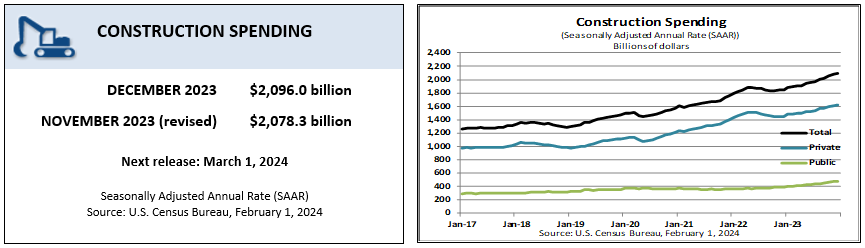

According to the latest census bureau data, the value of construction put in place in 2023 in the United States was $1,978.7 billion, a 7% increase over the $1,848.7 billion spent in 2022. With continued strong spending, construction companies are continuing to implement new technology, even as real estate companies are becoming much more selective about their investments.

Initially Drawn to Proptech, Many Investors Struggle to Understand How Construction Is Different.

For the past decade, as investors have poured into proptech, drawn in by high flying startups like WeWork, AirBnB, Zillow, and Opendoor, they have also occasionally found their way into the decidedly B2B, SAAS world of technology for the design, construction, and maintenance of structures. Morphing from “proptech shops” to “built world funds,” many investors and related stakeholders who were initially focused on commercial real estate-related tech have sought to invest in architecture, engineering, and construction technology as a subset of the sector.

However, the reality is that commercial proptech and construction tech have a lot less in common than investors and others might think. As last week’s US Bureau of Labor Statistics report makes clear, the fortunes of these two sectors of the economy are diverging, widening the gulf between.

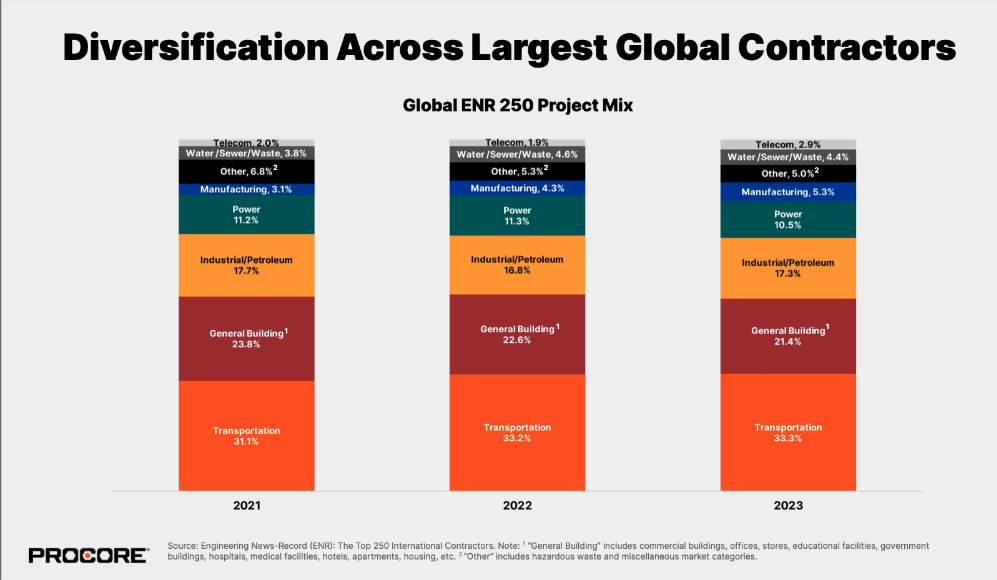

Perhaps the best illustration of how the construction industry is different from the real estate industry, and also of the extent construction tech companies are going to these days to highlight that difference to investors, came in the form of last fall’s investor day presentation by Procore, one of the construction industry’s leading tech companies. Kicking off the lengthy presentation, Procore CEO Tooey Courtemanche led with at least 11 slides showing the ongoing resiliency and diversity of the global construction sector and particularly highlighting the fact that “general building” - which includes hospitals, education, and other building types in addition to offices, hotels, and retail - comprises 21.4% of the total construction mix for the world’s 250 largest construction companies.

With transportation and industrial spending strong, the overall construction industry is fairly easily compensating for weaknesses in commercial and residential markets with major opportunities in other sectors that are not part of the traditional investment real estate mix.

And it is not just nonbuilding markets that contractors can access to offset weakness in the commercial markets. Contractors are also busy serving public sector customers where construction in 2023 was up 16.3% to $437.7 billion, compared to private lodging, office and commercial construction which totals only $258 billion, up from $231.9 billion in 2022.

With the markets traditionally covered by commercial real estate representing as little as 13% of the overall construction mix in the United States, and with segments like hospitality even showing strength within that mix, contractors appear to have plenty of room to keep their backlogs robust. As a result, for those construction tech companies that can also hone their products to meet the needs of construction companies working outside of the commercial building arena, they will continue to find financially healthy customers with lots of capacity to continue to spend. We can also expect to see more movement of investors into the many areas of construction less affected by the headline grabbing office market.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.