Summary

The Benchmarking program offers BuiltWorld’s Engineering and Construction Company members an opportunity to gauge their technology adoption against their peers so they can identify and prioritize the gaps in their technology stack they need to address to be a leading firm in terms of digitization. Since its inception, the BuiltWorlds Benchmarking Program has aimed to identify leading construction technology solutions across five key categories; Preconstruction, Project Management & Oversight, Field Management Solutions, Tools, Equipment, & Robotics, and Offsite (Modular) Construction.

Within this report are the aggregated survey results from the 2023 survey focused on key findings for usage of Project Management & Oversight project delivery technologies within the following tech specialty areas and categories:

Research Overview

The built world is ever-changing—everywhere you look it is constantly influenced by innovative construction technology and ideas. These new advancements can help companies, regardless of size, expedite processes and increase safety in many areas of their work. Given the many possible directions available when identifying and implementing new tech, the decision-making process can seem chaotic to both employers and employees.

The contents of this report are seek to provide clear, concise understanding of a chaotic space through primary data provided by construction companies across the globe. Specifically, the the data provided includes the adoption, implementation, and quality of construction project delivery technologies, with numerous subtopics embedded within to create a complete picture of adoption in all areas.

Data Details

It is important to note that the data that is presented in this report is empirically gathered and provided through an entirely neutral, 3rd party lens. As alluded to above, the data is retrieved through our BuiltWorlds Benchmarking Survey Program which examines five major areas of exploration in construction project delivery technology solutions. This allows us to deliver actionable data and insights, regardless of which part of the construction timeline your company operates in.

Participation in the benchmarking surveys will in turn provide you with a technology assessment report from the BuiltWorlds analyst team. This report provides you with information relating your company's use of technology in comparison to the industry average, and can be used to provide input into your future innovation strategies.

Respondents for this year’s survey included C-Suite leaders, Executives, Presidents, Operations & IT Directors, Directors of Technology/Innovation, project teams, and preconstruction teams at construction companies. Most respondents are members of the BuiltWorlds Engineers & Contractors (E&C) Technology Adoption Leaders Forum, which meets monthly to discuss trends in construction technology needs and adoption.

Technology Specialty reports

This benchmarking report is intended to provide a high-level overview of the most adopted solutions and aggregate quality ratings. For additional insights on technology adoption trends, year-over-year analysis, and detailed solution ratings, check out our library of technology specialty reports here.

PROJECT MANAGEMENT & OVERSIGHT TODAY

As the construction industry continues to progress into an age of digitization, project management technology plays a critical role in the process of managing a construction project. The concept of a technology "platform" by which project teams can support a variety of functionalities required for day-to-day activities has taken hold in the industry, and is increasingly critical to efficiently manage projects. Conversely, smaller contractors are still seeking cost-effective ways to move from pen & paper or excel solutions to project management software. No matter where in the journey, the reasons to turn to project management solutions are clear: they provide an effective way of storing and communicating wide varieties of data across numerous stakeholders.

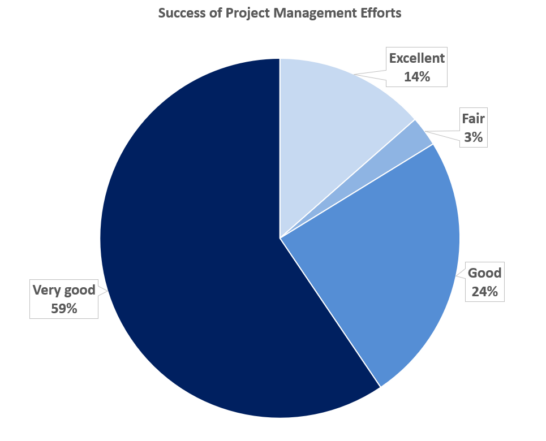

The below visual indicates how contractors feel they are performing project management & oversight activities. The rating scale is excellent, very good, good, fair, and poor.

Below are details on technology adoption in each of the 4 tech specialty areas within the project management & oversight category:

- What solutions were identified as the most adopted today by contractors

- How often were those solutions typically utilized

- How well did those solutions perform across a variety of functionality criteria

ERP ("Enterprise Resource Planning") solutions provide project teams with functionality to digitally complete a wide variety of activities on a day-to-day basis. Some of the activities that may be completed with an ERP system, or integrated with an ERP system, include accounting, procurement, document control, change management, scheduling, and more. The intent of the ERP solution is to provide a place where a project team can manage all of these activities in a clear, coordinated manner.

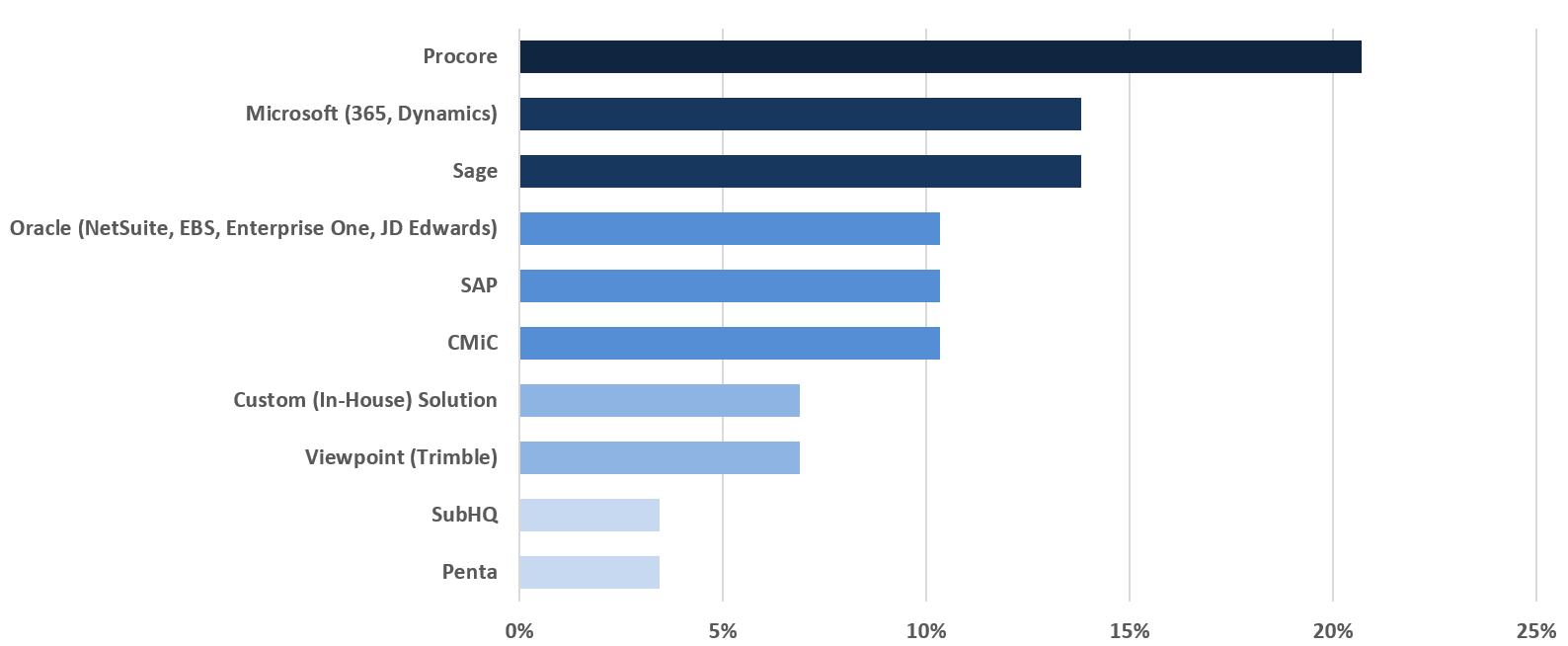

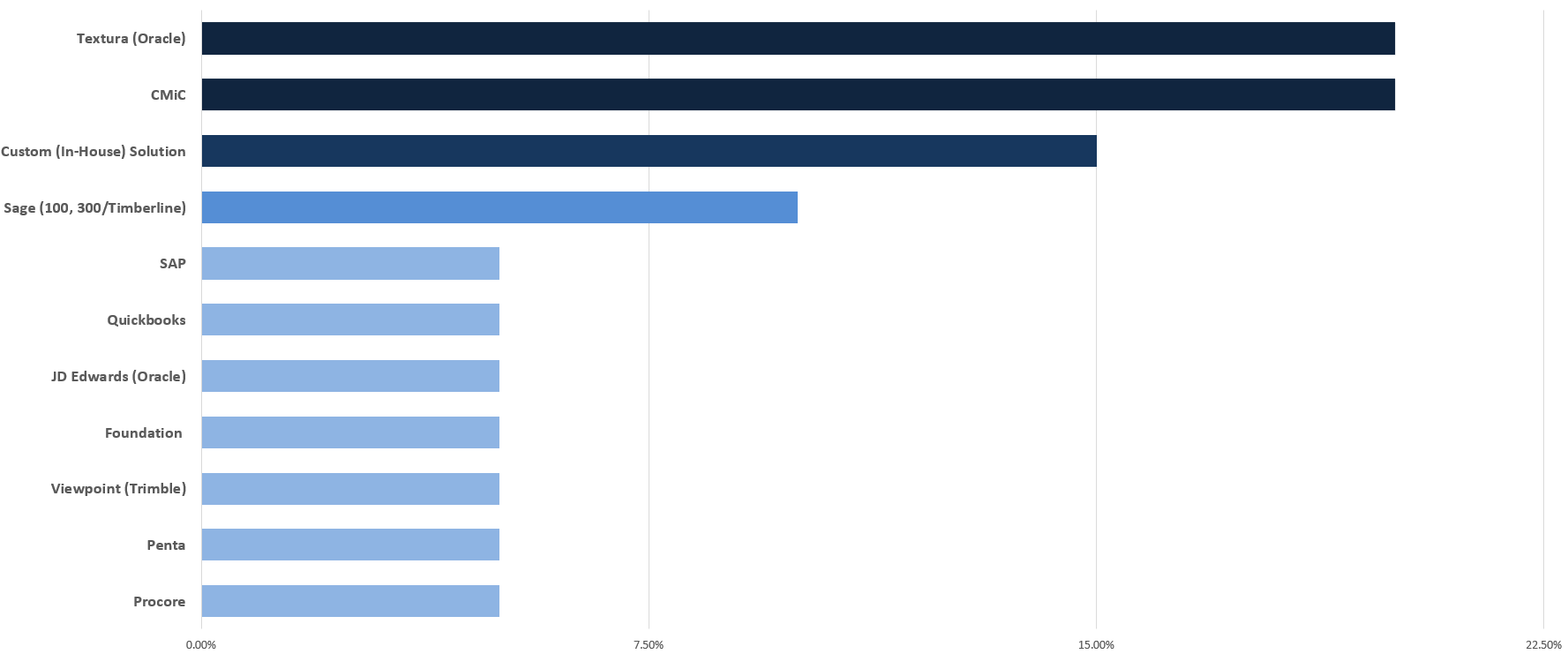

The below visual provides data on the rate of adoption for the most commonly adopted solutions as identified by 2023 survey respondents.

top solutions

Implementation

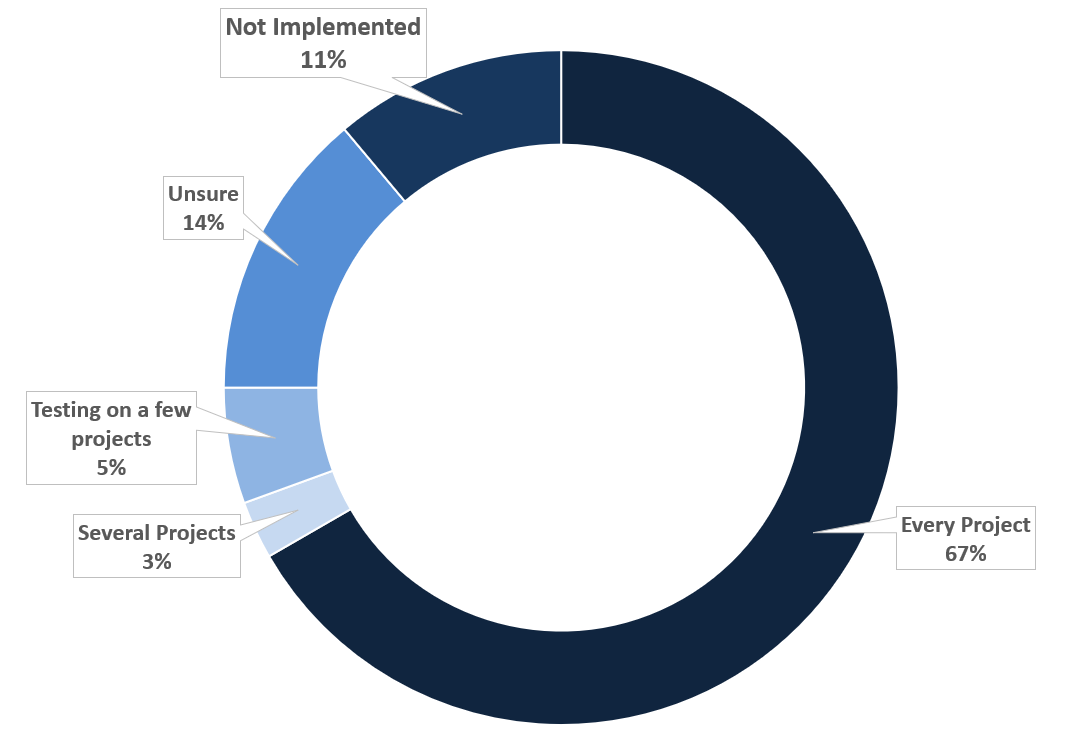

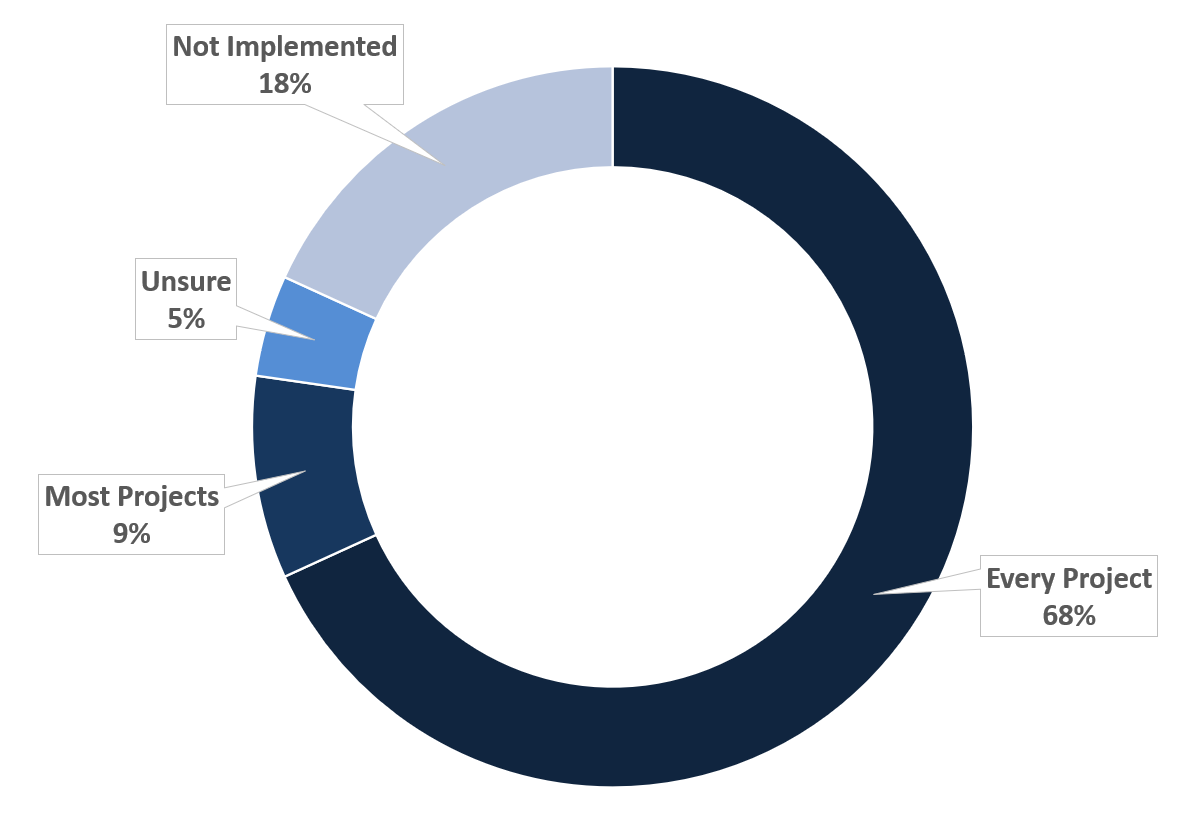

Respondents identified use of an ERP system at a rate of 75% of the time. Factoring in only medium and large general contractors, 100% of respondents were utilizing an ERP system.

The below visual provides a full breakdown of the implementation of ERP solutions per 2023 survey data.

Summary

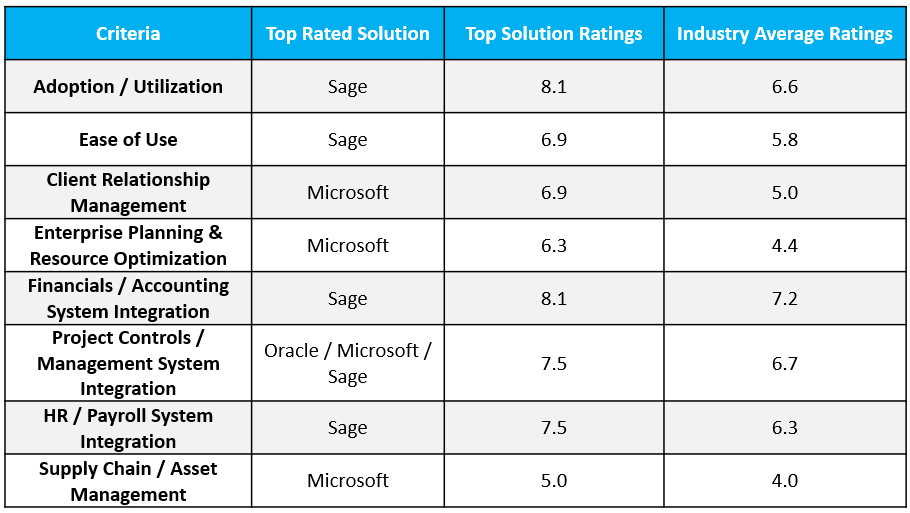

Procore was identified to be the most commonly adopted ERP solution per 2023 survey data. While Procore received slightly above industry average ratings overall, Sage and Microsoft led the majority of the surveyed criteria. Overall, Sage was identified as the highest quality solution per survey responses.

Top Rated ERP Solution:

Most Used ERP solution

Accounting & Payment solutions provide contractors the ability to digitally manage, track, and report payments. Project teams, accounting teams, finance teams, and leadership all work together to ensure a project's financial health, and the use of technology enables each team to work together in real time. Use of effective accounting & payment solutions leads to more accurate cost tracking and forecasting, faster payment flow, and better financial reporting.

The below visual provides data on the rate of adoption for the most commonly adopted solutions as identified by 2023 survey respondents.

TOP SOLUTIONS

IMPLEMENTATION

Nearly 80% of 2023 survey respondents indicated use of an accounting & payment digital solution. When factoring only medium and large general contractors, the implementation rate on all projects is 100%.

The below visual provides a full breakdown of the implementation of accounting & payment solutions per 2023 survey data.

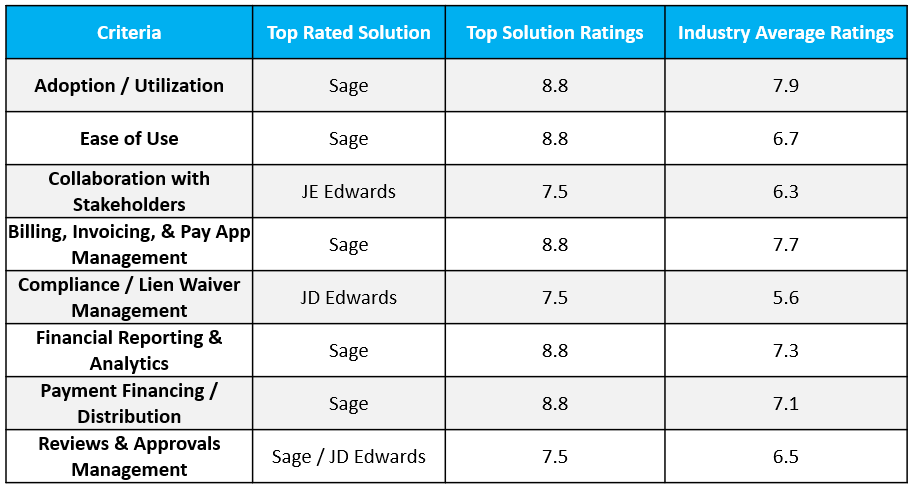

Summary

While Textura and CMiC were rated as the most adopted accounting & payment solutions, Sage was rated the highest quality solution. Sage led or was above average across all surveyed criteria.

Top Adopted Accounting & Payment Solution

Highest Rated Accounting & Payment solution

Business Intelligence & Data Analytics

For additional information on business intelligence & data analytics innovations and solutions, check out the tech specialty report

Business intelligence solutions continue to gain momentum as the construction industry's ability to gather and aggregate data grows. As solutions and process continue to trend towards digital, information can now be stored and used to understand trends, forecast future outcomes, and make informed decisions. This can be applied to cost, schedule, safety, quality, and other aspects of a construction project.

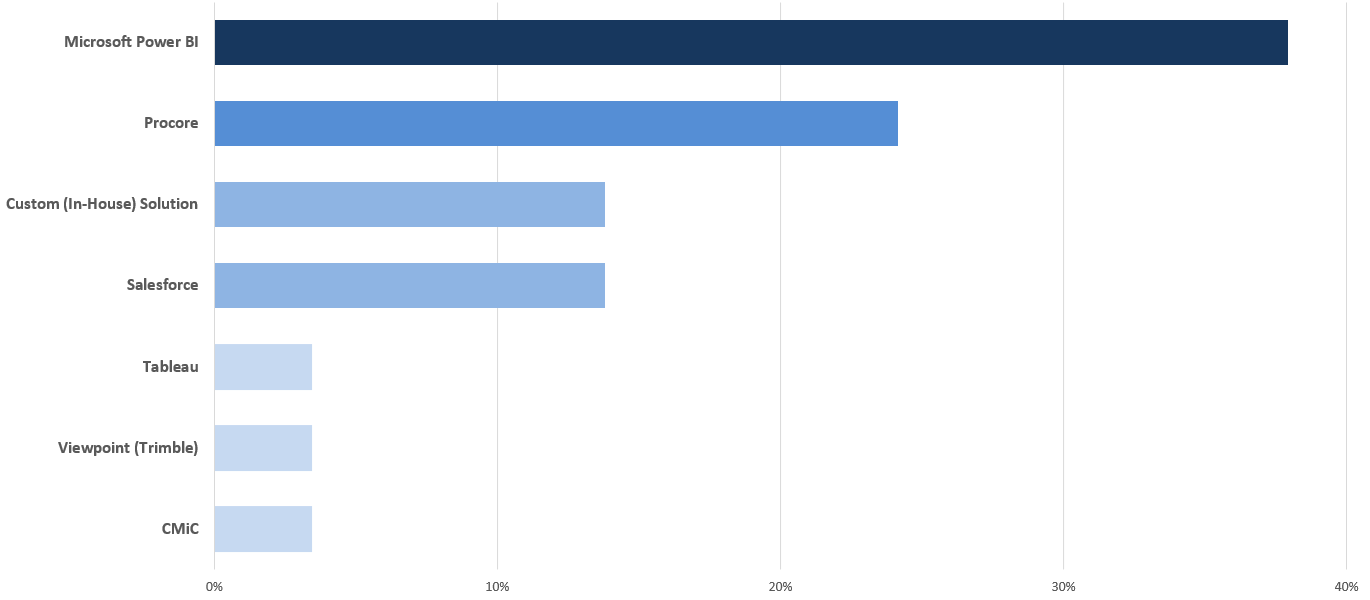

The below visual provides data on the rate of adoption for the most commonly adopted solutions as identified by 2023 survey respondents.

TOP SOLUTIONS

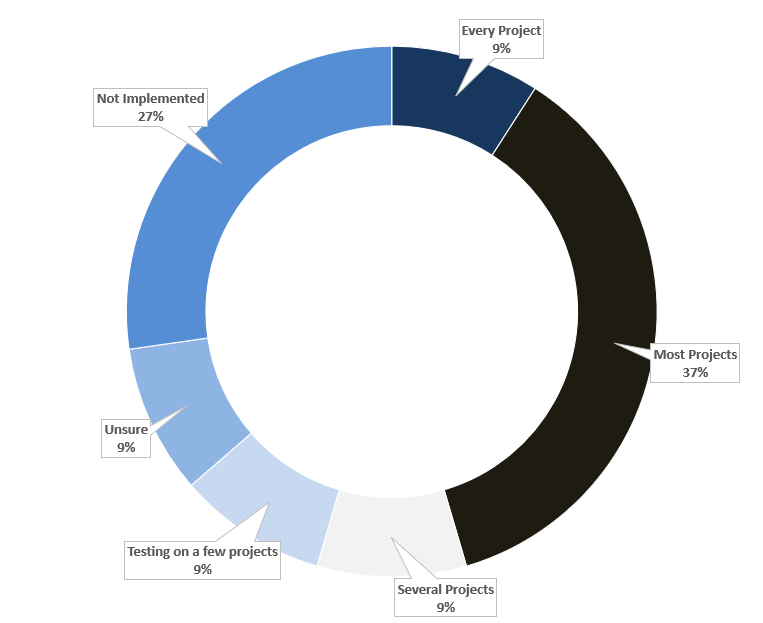

IMPLEMENTATION

Only 46% of 2023 survey respondents indicated use of business intelligence solutions on every or most projects. Implementation ratings indicate a very low rate of adoption for business intelligence solutions.

The below visual provides a full breakdown of the implementation of business intelligence solutions per 2023 survey data.

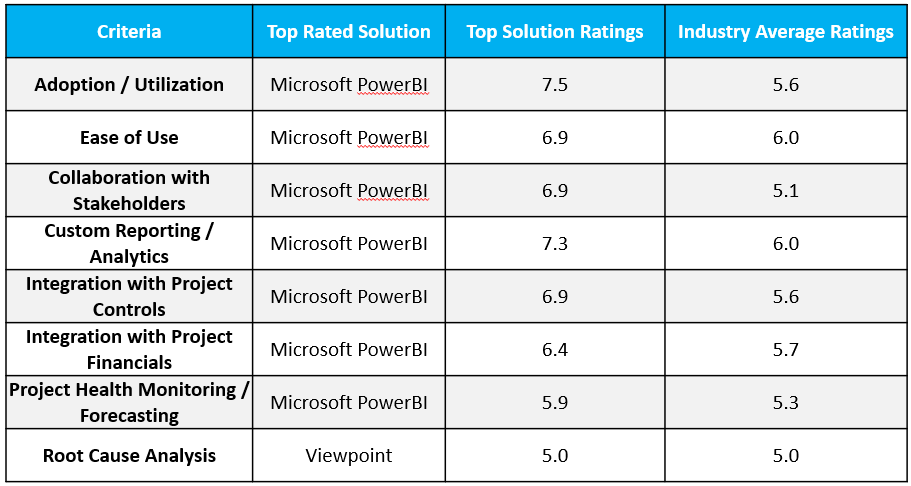

SUMMARY

Microsoft PowerBI was consistently indicated to be the both highest rate of adoption and highest quality solution for business intelligence activities. Tableau, a similar solution, was identified as a lower rate of adoption and lower quality. Additionally, ERP platform solutions were also identified as BI solutions, including Procore, Viewpoint, and CMiC.

Below are the overall ratings of the top solutions within this category:

HIGHEST RATED & MOST ADOPTED BUSINESS INTELLIGENCE & DATA ANALYTICS SOLUTIONS

Collaboration & Document Management

For additional information on collaboration & document management innovations and solutions, check out the tech specialty report

Document Management solutions provide contractors the ability to digitally collaborate and track documents across a variety of stakeholders and processes. Leaving a time of printed drawings, manila folders, and binders means being able to trust a solution that can accurately and effectively manage document storage, changes, and conversations.

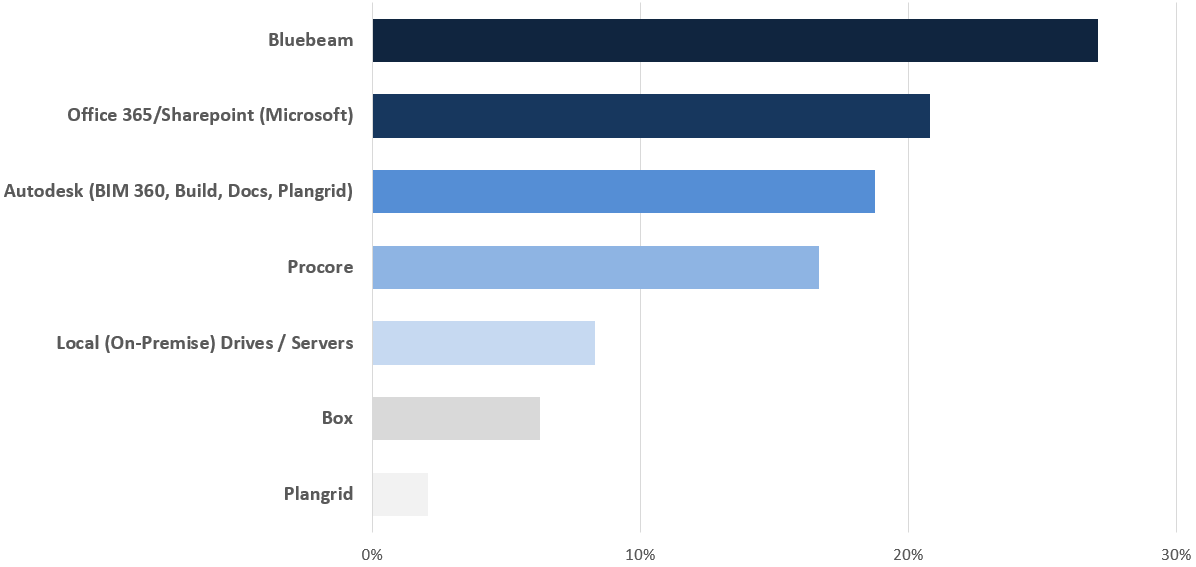

The below visual provides data on the rate of adoption for the most commonly adopted solutions as identified by 2023 survey respondents.

TOP SOLUTIONS

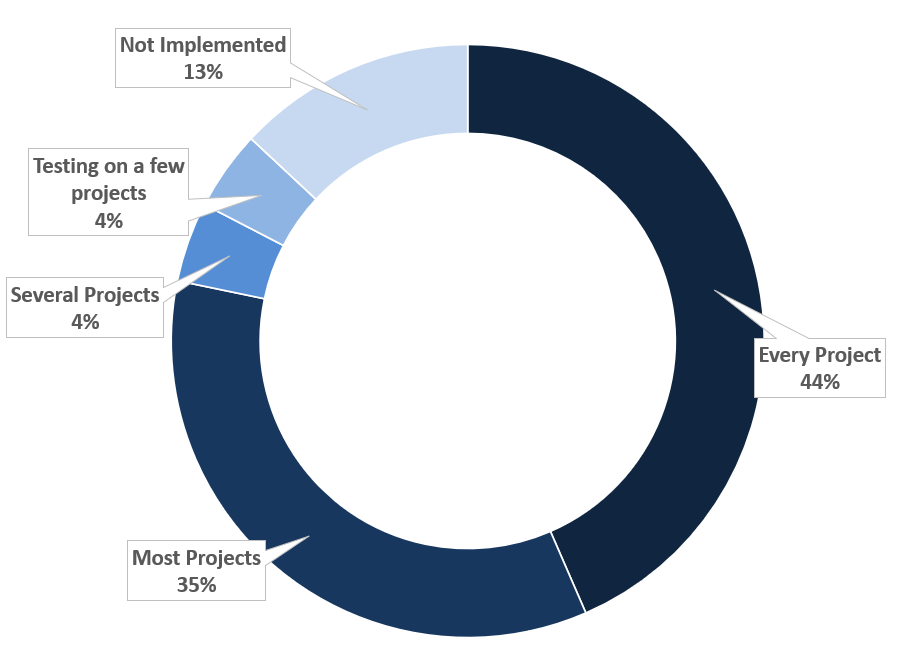

IMPLEMENTATION

Nearly 80% of 2023 survey respondents indicated use of a collaboration & document management solution. When factoring in only medium and large general contractors, implementation is 100%.

The below visual provides a full breakdown of the implementation of business intelligence solutions per 2023 survey data.

SUMMARY

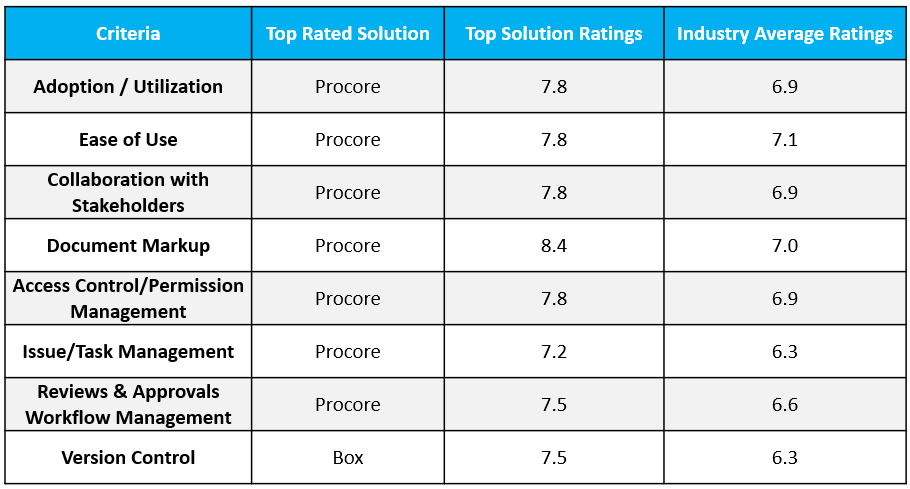

Though Bluebeam was the most adopted solution, Procore was consistently indicated to be the highest quality solution for collaboration & document management activities. Box, a cloud storage platform, led quality ratings in the version control category.

Below are the overall ratings of the top solutions within this category:

TOP ADOPTED COLLABORATION & DOCUMENT MANAGEMENT SOLUTION

HIGHEST RATED COLLABORATION & DOCUMENT MANAGEMENT SOLUTION

Next Steps:

Take the remaining surveys. By completing the Builtworlds Benchmarking Program surveys, you gain the ability to compare your own technology adoption and utilization among industry peers. Additionally, we are now conferring a Digital Leader Badge on industry players who score the highest for the extent of their technology implementation, and we also are making public the names of the solutions that the most respondents indicated using. Click the below link to be taken to the BuiltWorlds Benchmarking home page.

Additional Resources

E&C Tech Adoption Leaders Forum

As a member of Builtworlds, your company is invited to participate in our monthly tech adoption leaders forum. This is a private forum for the technologists leading the tech adoption in their engineering and construction (E&C) companies to share best practices, dialogues around the benchmarking and surveying program and explore best practices with each other. It is also a companion to our online calls and in person meetings with this group. Access to this group is by invitation only and restricted to leaders of technology initiatives at Engineering and Construction Companies. Email research@builtworlds.com for more details.

Research Demographics

The data provided in the visuals and verbiage above is taken directly from the 2023 project management & oversight survey data. The survey included 36 responses from 5 countries across North America, Europe, and Asia. Construction companies that provided responses to the survey ranged from <$30M of annual revenue up to $5B+ of annual revenue.