The US Federal Reserve announced it would be keeping its benchmark Fed Funds rate steady at 5.25% to 5.50% while continuing to reduce its balance sheet holdings (quantitative tightening) last week, aligning with expectations. The FOMC (Federal Open Market Committee – the voting member of the US Federal Reserve) materially revised GDP growth expectations upward for the next 2 years, as the US economy continues to prove its resilience to the current rate hike cycle.

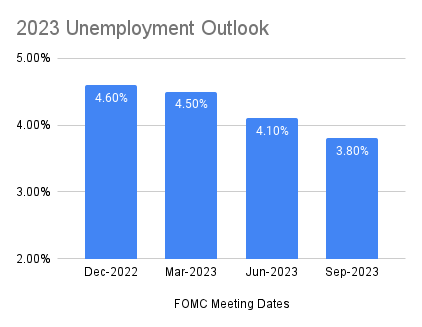

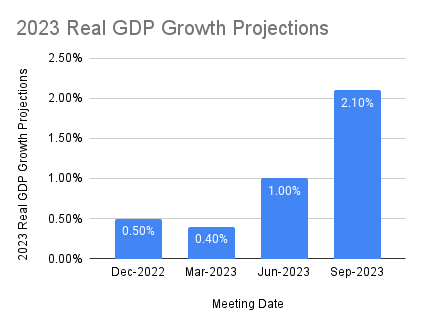

The FOMC’s 2023 real GDP growth projections came in at 2.1% last week up from the 1% forecast in June and 0.4% in March, while unemployment expectations continue to drop. See the evolution of FOMC projections depicted below.

However, the US’s economic resilience comes with a caveat: elevated monetary flexibility for the FOMC to drive inflation down to the 2% target. With unemployment holding at record lows and continued economic resilience the Federal Reserve is talking about holding interest rates higher for longer.

What really seemed to drive market action was the FOMC’s 50-basis point increase to the upper limit of their longer-run interest rate projections (aka, the neutral rate) – from between 2.5% & 2.8% to now between 2.5% & 3.2%.

This change in Central Banker sentiment has significant implications for the financial markets, which has been reflected on the publicly traded exchanges over the past week.

The US 10-Yr Treasury yield shot up to north of 4.5% for the first time in over 25 years, while US equities retracted in response to valuation contractions from this higher discount rate.

A higher neutral rate would force public equity analysts to discount a company's terminal value (largest value for growth stocks) of their DCF models at a higher cost of capital rate, suggesting that we could be entering a lower valuation period. The interest rate narrative will continue to evolve as new economic data comes to light.

The Impact On Built-World Innovation

Despite this new valuation discount rate and public equity retraction, VCs in the built environment are not likely to slow down deployment as a reaction to this shift in Central Banker sentiment.

Venture investors are required to deploy a certain amount of capital following each drawdown (call for capital from LPs), typically spread over a 5 to 7-year time horizon, or risk a capital recall from its LPs or limited partners (investors of the fund).

VCs generally structure their fund with a regular drawdown schedule for the fund's commitment, with 80% of VCs calling for capital each quarter in those first 3 years of its lifecycle.

Early-stage built-world investors have managed to raise roughly $6B in venture capital over the past year and a half, positioning this innovative ecosystem nicely for growth over the next 2 years.

3 Highlighted Venture Deals

$19M | Series A | 9/21/2023

Country: Germany

Investors: New investors included Deep Tech and Climate Fonds (DTCF), Munich Re Ventures, Bayern Kapital, and Klaus Kleinfeld

Fernride is on the mission of solving two major challenges: the driver shortage and the huge negative impact of transportation on the environment. With over 10 years of research and high-profile partners, such as Volkswagen, DB Schenker, and B/S/H, Ferniride is delivering the future of automated logistics today.

The Company's unique approach is gradual autonomy with teleoperation first, allowing drivers – known as teleoperators – to fully control electric vehicles without actually sitting in them.

Fernride was spun out in 2019 by Hendrik Kramer, Dr. Maximilian Fisser, and Jean-Michael Georg after ten years of research at the Technical University of Munich (TUM) and quickly attracted venture capital (>€10M 2021).

$2.1M | Seed | 9/25/2023

Country: United Kingdom

Investors: Led by Insurtech Gateway with participation from ClimateTech fund One Planet Capital, University of Surrey, and angels Chris Adelsbach and Rahul Munjal

Renew Risk provides deep-science-driven B2B SaaS solutions for improving the financial lifecycle of large renewable energy assets. This platform provides software products for financial planning, banking, and insurance of renewable energy, from Offshore Wind Farms, to Onshore wind, Tidal, Hydrogen, etc.

Renew Risk serves insurers, bankers, offshore wind farm developers, and asset managers who need our product for pricing, capacity, financial planning, and risk management.

$1.6M | Pre-Seed | 9/21/2023

Country: United Kingdom

Investors: Led by Cavalry Ventures, with participation from climate investor Übermorgen Ventures

Enter helps millions of people to decarbonize their homes by providing the easiest end-to-end solution of one-stop energy audits, procurement, financing, and energy monitoring. With Enter, clients have all the data of their homes in one app.

Want To Learn More About the Mission-Critical Tech & Investments Driving The Built Environment

Check out BuiltWorlds Venture East Conference in Miami this November

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.