At BuiltWorlds, we actively track investment and deal activity across the built environment through our Deal Dashboard. Much attention has been paid to major players in the tech industry pouring billions into generative AI companies, with OpenAI’s monumental $6.6 billion funding round being a prime example. In this article, however, our focus shifts to the AI-powered startups securing investment within the building, construction, and infrastructure tech sectors.

Read on below to see key companies driving innovation in the built world and where investment dollars were spent in Q3.

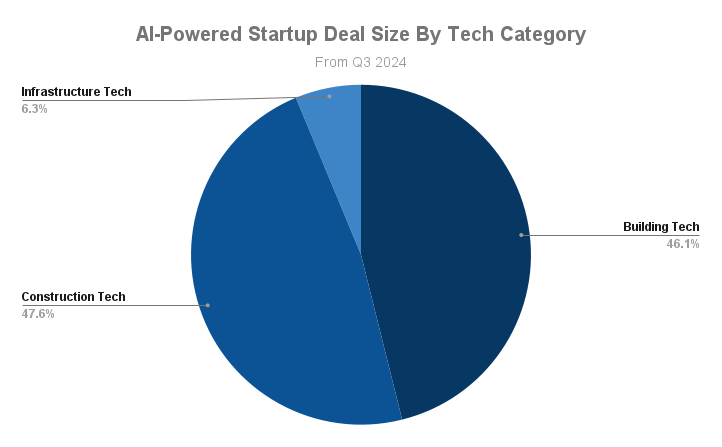

Investment Break Down By Category

Building Tech

In the third quarter of 2024, companies in the building tech category led the way in terms of deal volume, though not in deal size. The Deal Dashboard tracked investments in 12 unique building tech companies incorporating AI/ML, totaling approximately $213 million. Key focus areas for these AI-powered building tech solutions included tenant services and user experience, planning and design, and proptech.

Construction Tech

In the third quarter of 2024, BuiltWorlds’ Deal Dashboard tracked investments totaling approximately $220 million across 11 construction tech solutions. Building tech and construction tech were closely matched in both the number and size of deals. Key tech specialties among these AI-powered ConTech solutions included accounting and payments, site capture, and document management.

Infrastructure Tech

Infrastructure startups incorporating AI saw the fewest deals and lowest investment totals in the third quarter of 2024. Among the six AI-powered infrastructure companies tracked in the Deal Dashboard, deal size data was available for four, amounting to a combined $29 million-significantly less than investments in the construction tech and building tech sectors. Mobility emerged as a key tech specialty within infrastructure tech investments this quarter.

Five Largest Deals of Q3

1. Placer.AI

This building tech solution for location intelligence raised $75 million in Later Stage funding. Investors include GEM Realty Capital, WndrCo, Fifth Wall, Array Ventures, and others.

2. EliseAI

Tied for the largest deal size is another building tech company, EliseAI, receiving $75 in Later Stage funding from Sapphire Ventures, Navitas Capital, Point72 Private Investments, DivcoWest Ventures, and Koch Real Estate.

3. Trio Mobil

Trio Mobil is a construction tech solution that received $26.5 million in Venture funding from NewSpring Growth, 212, and TIBAS Ventures.

4. Swiss-Mile

The only non-American company as well as seed round on this list, Swiss-Mile, received $22 million from Bezos Expeditions and HongShan, Amazon Industrial Innovation Fund, Armada Investment, and Linear Capital. The impressive sum for a seed round is a testament to the potential of autonomous machinery.

5. Trunk Tools

Trunk Tools is another construction tech solution that raised $20 million in their Series A round from Redpoint Ventures, WND Ventures (DPR), Suffolk Technology, AEC Angels, STO Building Group, Liberty Mutual Strategic Ventures, Thornton Tomasetti/ TTWiiN, Charps, and others.

Interested in learning more about AI-Powered Solutions in the AEC INDUSTRY?

Register for BuiltWorlds 2025 AI/ML Conference to be a part of this important conversation

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.