The third quarter of 2023 witnessed a surge of dynamic venture deals, investments, and growth within the built world. This is a vital time for the industry, as Q3 sets the tone for the upcoming year and it usually flooded with many deals for companies within the industry. From a rise in capital inflows to the emergence of new players within the funding realm, this quarter was filled with exciting developments within the space. In this piece, we will uncover three points of growth from the Q3 2023 Venture Report that show the growth of the AEC venture landscape.

Want to Uncover Key Insights from Q3?

1. Record Quarter for Capital Inflows

Q3 witnessed an astounding $7.23B in early-stage investments that were deployed across 129 deals, indicating a significant YoY growth of 210% and 47%, respectively. Although there was record level capital inflows, the total number of completed deals within the built world declined significantly compared to recent quarters.

2. Emergence of Climate Tech VCs

Amid the surge in capital inflows in Q3, there were over 450 unique investors across 129 deals. Within this boost Climate Tech funds spearheaded 22.5% of these transactions, amounting to 31.2% of total deployment. The rising interest in climate VCs demonstrates the shift towards sustainability within AEC, which may be a response to the stricter environmental regulations within the U.S.

3. New Venture Capital Sources

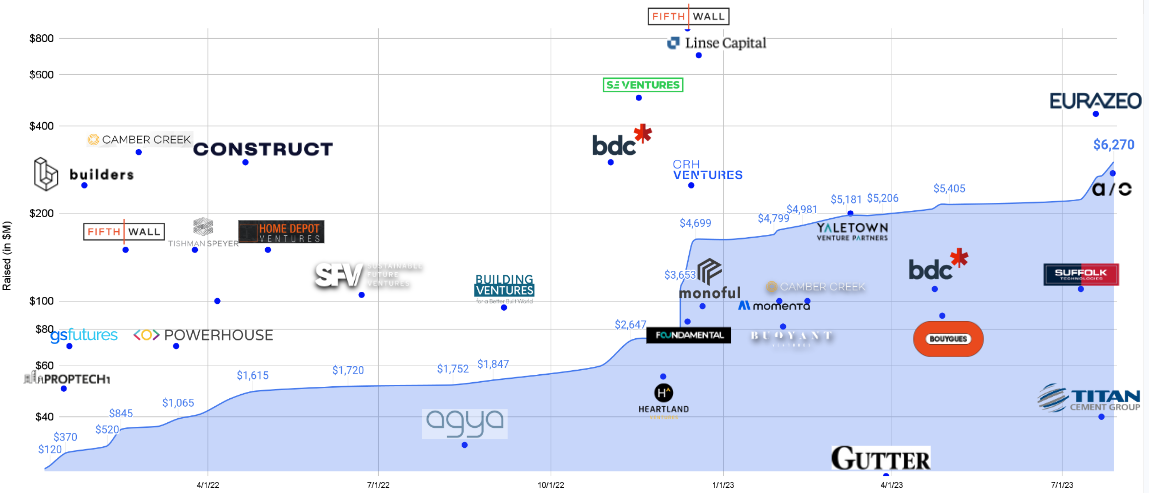

Q3 marked the introduction of four new pure-play built world funds, adding $865M in deployable capital into the space. There have been a total of 36 new funds entering the market since 2022—bringing in an exciting $6.3B in new transformation venture capital. Below is a figure that highlights this era of substantial growth within the built world, signaling promising prospects for the future of AEC.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.