It turns out that $1B in Series C fundraising is enough to turn VC heads towards the European market. Earlier this month, Wayve, a UK-based AI startup for autonomous driving, hauled in the UK’s largest fund raise and one of the top 20 AI fund raises to date (Tech Crunch).

While seemingly unrelated, it is a signal that the European markets can compete with the U.S. mega-rounds. This raise shows that Europe is looking to challenge U.S. hegemony in the AI entrepreneurship space and that investors are willing to match the capital requirements.

By the numbers

According to BuiltWorlds' Deal Dashboard, the U.S. startup ecosystem has received 127 built world VC investments so far in 2024, compared to 15 from the U.K., 12 from Germany, five from Sweden, four from Denmark and three from France.

Despite a slow start to 2024, European startup activity has been on the rise over the last several years. In 2023, the U.K. accounted for 51 deals (9.3%), France accounted for 18 deals (3.3%), and Germany accounted for 34 (6.2%).

French startups punch above their weight with an average round size of $80.73M in 2023, compared to an average of $33M in the U.S. So far in 2024, two rounds out of the French built world VC exceeded $100M - Electra raised a $330M round and Stonal closed a $108M round.

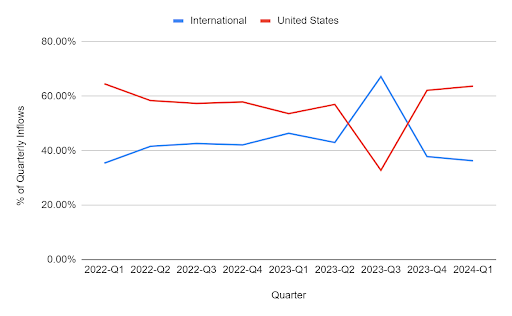

One of the most interesting trends of the last year in built world venture investing was the U.S./non-U.S. VC investing inversion seen in Q3 of 2023. U.S. - as long as BuiltWorlds has tracked venture data, VC deal counts have outpaced non-U.S., but in Q3 2023 this trend momentarily reversed.

Following the overfunding of U.S. startups in 2022, investors sought refuge in what they deemed as safer plays in the European startup markets. Having not received nearly the level of investment that U.S. startups did in the near-zero interest rate environments, startups outside the U.S. were more capital-constrained and thus had to more effectively manage their runways. This created some quality investment opportunities for VCs when the overfunded U.S. market showed signs of slowing in 2023.

For a quarter, investors side-stepped down rounds in the overfunded U.S. space and instead invested their capital abroad. This trend has since reverted to the status quo.

Aidan Halter, head of corporate venture and development at Bouygues Construction, and a speaker at this year's Paris Summit, provides key insights into the differing investment trends between the U.S. and Europe:

1) VC Availability

One reason for the disparity in AEC tech investments between the U.S. and Europe is the established VC infrastructure in the U.S. The history of tech investing is deeply entrenched in the U.S. with Sand Hill Road and Silicon Valley representing the Mecca of VC, which has made it easier for startups of all sectors to receive funding as VCs look to new horizons. With a high degree of VC dry powder in the U.S. and eager investors, funds of all sizes and theses are displaying a willingness to pivot to backing AEC tech companies.

Europe does not have the same degree of VC infrastructure which has led to a slightly slower adoption rate of AEC tech.

2) Europe’s Fragmentation

Europe is diverse politically, culturally and linguistically. A high concentration of different countries with entirely different government structures and languages creates challenges in establishing hubs like in the United States (e.g. New York as a financial hub, San Francisco as a tech hub, etc.).

Fragmentation also creates a hurdle for startups. In order to scale a business in Europe, founders must cater to many languages and disparate regulations across borders. A multinational go-to-market strategy is important for European startups as smaller populations than the U.S. reduces market sizes for single-country strategies.

While cultural and regulatory differences exist across state lines in the United States, they are minor in comparison and do not involve language barriers.

The Opportunity

While these points paint a dour portrait for the European VC market, the reality of the matter is that Europe, and France in particular, present a massive market opportunity for European AEC tech founders.

France boasts two of the top 10 construction companies in the world: Vinci and Bouygues. Skanska, Hochtief, Starberg, ACS Group and Ferrovial, all considered in the top 10, are European-based as well.

Although European countries are fragmented, Halter says that if a startup were to land, for example, the big three French contractors (Vinci, Bouygues and Eiffage) as clients, “You would have access to a $60B construction output in Europe alone.” This is an ideal market opportunity for built world tech startups.

Also according to Halter, while European AEC companies have a strong interest in BIM and sustainable technology solutions, there is a large untapped market for technologies used on project execution. The market is saturated with software, but fewer startups are providing the hardware innovations needed to meet the demand for building renovations in Europe.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.