When assessing the venture capital landscape in Latin America you’ll notice that FinTech & e-commerce have dominated VCs’ focus in this region accounting for 18 of its 26 Unicorns (private startups with $1B+ valuation). Built world tech, specifically residential property management accounted for 2 of the 10 largest.

This is a direct result of the immediate necessities this region faces in its early stages of digitization. The historic lack of consumer accessibility to financial support in the region has triggered the rapid expansion of both FinTech and PropTech innovations providing this region with the digital banking & lending support it needs. The pandemic-fueled requirement to order everything online gave rise to a number of e-commerce winners, including one focused on construction materials & equipment, Tul, which has raised more than $210M to date while achieving a valuation of $800M as recent as November 2022.

Still, this VC-back community remains in the early innings of its development (in line with the developing nature of most of this region's economies).

For context on the maturity of the comparatively small Latin American VC market, consider that the US has roughly 700 active unicorns (53% of total Global Unicorns) with more than 1000 venture capital funds continuing to fuel entrepreneurial initiatives.

Nevertheless, VC activity in Latam has skyrocketed since the onset of the pandemic with 10 years of digital pull-forward during the 10 months of global lockdowns, inciting a tidal wave of innovative capital that flooded into this region in 2021 and 2022.

2021 saw more than 900 VC deals injected nearly $20B into the Latin American startup ecosystem, depicting growth to the magnitude of 5x to 10x in the prior year. This VC activity has since subsided in the wake of the recent economic slowdown, sliding over 70% year-over-year in Q2 but remaining buoyant to pre-pandemic levels.

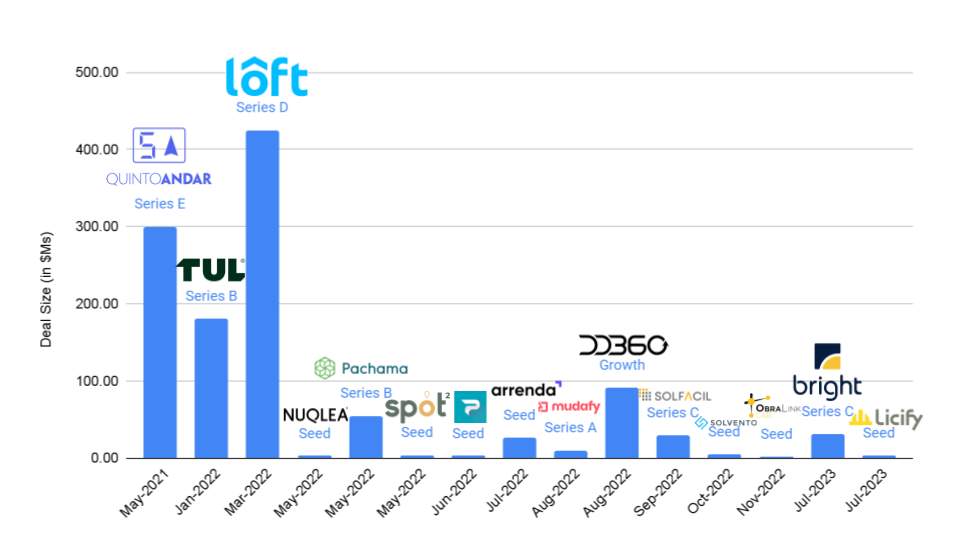

These 26 LATAM-based startups obtained their 3-comma valuation between 2018 and early 2022 (70% of which were obtained in the risk-on-capital environments of 2020 or 2021). It remains to be seen whether these groups have maintained this unicorn status. Below are some of the most noteworthy VC deals in the Latin American built world.

Want to Learn More About Latin American Startup in The Built World

Check out BuiltWorlds Venture East Conference in Miami this Fall

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.