As we indicated last August ( $4 Billion White Cap, Construction Supply Group Merger Highlights Changing Construction Supply Chain), mergers and acquisitions have been heating up the construction materials supply sector this year, driven by a variety of factors including technology. Within that context, news this week of Home Depot’s $8 billion acquisition of HD Supply was not a surprise. In its announcement, Craig Menear, chairman and ceo of the Home Depot, cited the attractiveness of the maintenance, repair, and operations (MRO) market, characterizing it as “a highly fragmented $55 billion marketplace.”

Dominant in Maintenance, Repair, and Operations, Will Home Depot Embrace the Full Life Cycle?

It was not immediately clear the extent to which the acquisition would lead Home Depot into the new construction market, as well as the MRO market. As Covid 19 spurs more people to buy up the available stock of single family homes, the new construction market would appear to be a significant opportunity. With $7 Billion in revenue, HD Supply would appear to command about 13% of the overall MRO market. That is a sizable chunk of the market when added to Home Depot’s existing market position, and Home Depot faces strong competitors like Fastenal and W.W. Grainger in the balance of the sector. However, with an estimated $1.4 trillion dollars of construction put in place on an annualized basis in the United States in 2020, according to the US Census Bureau, the total value of materials that go into all construction work in the United States is likely an order of magnitude higher than the $55 Billion figure cited by Mr Menear for the MRO Market. For a company with 2019 revenue of $110 billion, it would seem this broader construction materials market would be an important target.

How Will Technology Affect the Battle for The Construction Materials Market?

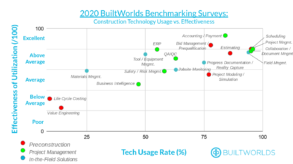

As we indicated, previously, contractors see significant potential to improve jobsite productivity with better technology for materials logistics. Based on the surveys examined in our 2020 construction technology survey, material management technology ranked near the bottom for adoption of solutions but ranked above the average of the pack for sentiment about the utility of the technology where it was adopted, suggesting a real opportunity for emerging technology to impact the sector. Companies like Agora, Intelliwave, Manufacton, Propergate, TruckIt, and Ynomia are among the increasing number of examples of BuiltWorlds network member companies offering solutions in the sector. Voyage Control, another emerging player in the materials logistics sector is one of the companies that will be presenting at our upcoming Venture Conference Demo Day.

While reducing jobsite delays and improving planning through better logistics software is one important area where a deeply resourced player like The Home Depot could help advance the industry, we have also catalogued areas such as purchasing of materials, identifying more sustainable and higher performing materials, and also leveraging modularization and offsite pre-fabricaiton as well as other innovations that can reduce the onsite labor requirements and improve health, safety, and quality on projects. As our surveying highlights, the construction sector is still early in the adoption of high tech supply chain management solutions, but with hundreds of billions of dollars at stake, it seems certain that big players will have their eyes on that segment of the industry’s value chain as it matures.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.