BuiltWorlds Q2 Venture & Investing Report has finally been released, and here is a little taste of the insights this comprehensive market breakdown has in-store.

Q2 has concluded with broad market uncertainty remaining as elevated as it was when we began the quarter. However, the built environment continues to defy the Federal Reserve's economically-suppressing monetary policy (the most rapid rate hike cycle in over 40 years) as VC inflows touch record levels while US construction spending hits all-time highs for the 5th consecutive month in May.

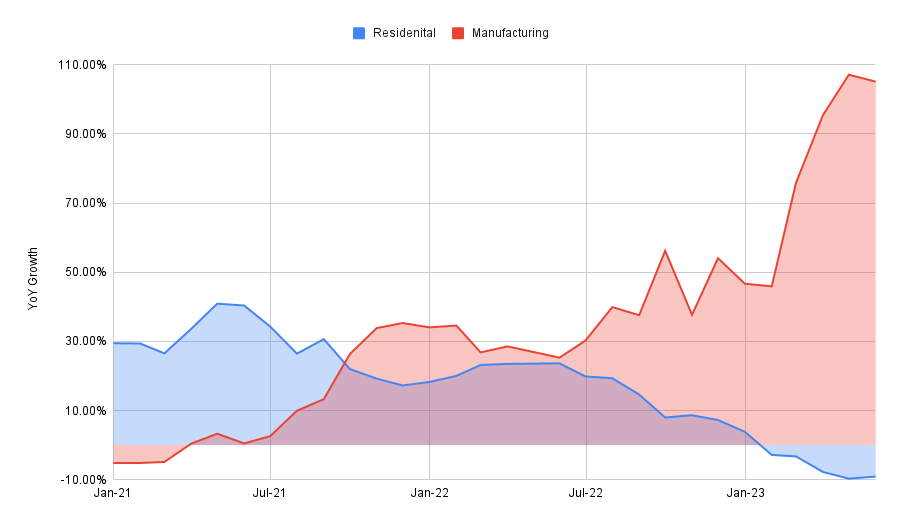

Cascading foundational investments into the buildout of Industry 4.0 have created an economically agnostic US construction space with spending on next-generation manufacturing facilities being at the core of this secular expansion. You can see illustrated in the chart below that despite the recent pullback in residential construction (historically the primary driver of construction cyclicality) investments into industrial sectors continue to support the AEC ecosystem.

Venture Deal Flow

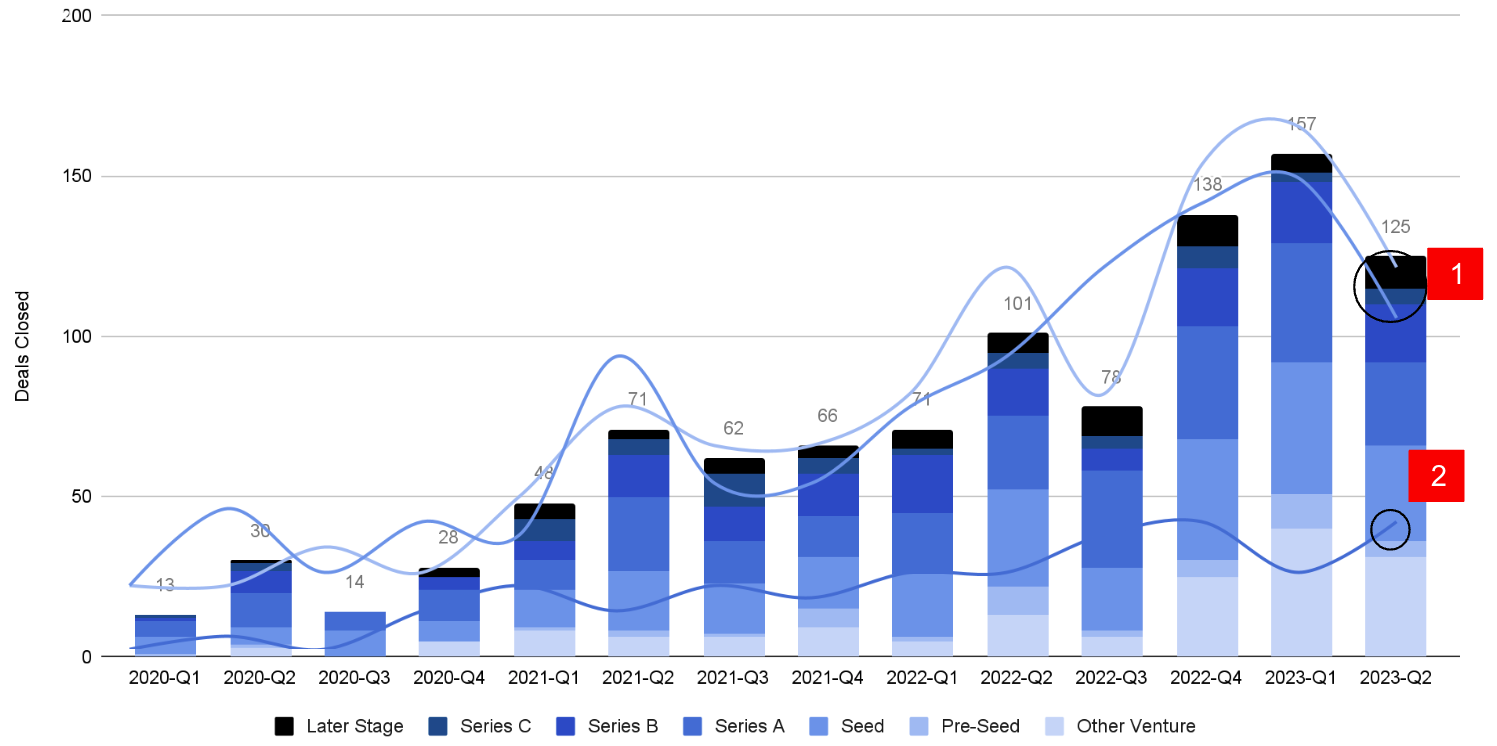

Venture investing in the built environment reached record levels in Q2 as investment groups began providing financial support to some of their most promising later-stage portfolio companies in need of a capital injection. Later-Stage investments (Post-Series C) ticked up to all-time highs (see #2 in the chart below), while Seed & Series A investments, which accounted for two-thirds of Q1 deal flow, saw a dip from the highs they hit in Q1 (see #1 in the chart below) – these highs were a result of investors' longer-duration focus (representing the earliest stages of development) during this sector's abbreviated period of capital hoarding. Fortunately, the climbing number of environmentally-focused VCs and corporate venture capital (CVC) groups has brought the built innovation nich back to life this past quarter.

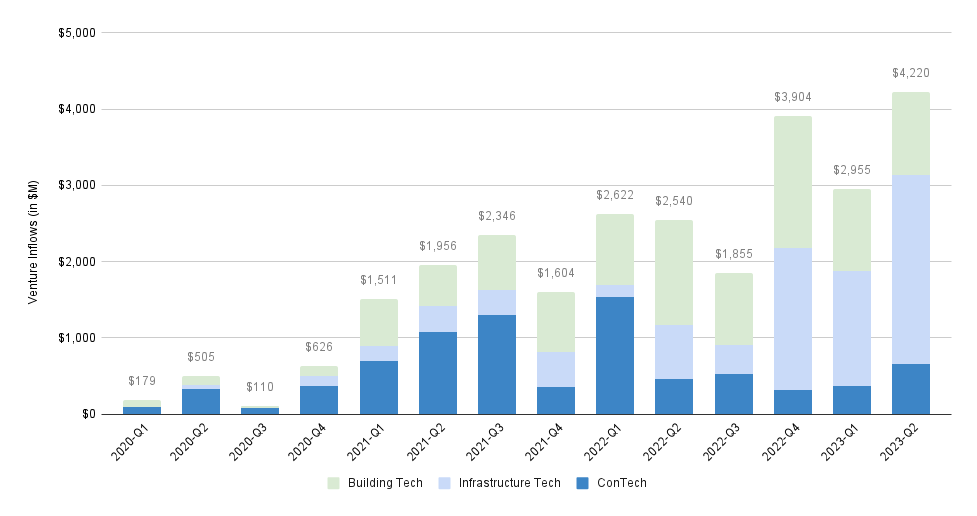

Infrastructure Tech continues to drive investment activity in the built VC ecosystem with EV charging, clean energy production/management, and water-focused solutions leading the capital charge.

Built world's burgeoning innovative ecosystem saw capital inflows breach $4B in Q2 for the first time ever, illustrating 66% year-over-year growth (43% quarter-over-quarter). At the same time, deal count this past quarter dropped by over 20% quarter-over-quarter and showed only a modest 24% increase from the same period last year.

This asymmetrical deal trend is due to the shift toward later-stage deals as the investment community looks to the end of this unprecedented rate hike cycle.

Next Week's Q2 Report

The full report goes much deeper into the weeds of the trends described above, examining the impact of the latest AI revolution, analyzing the sustainable advantage, looking into the rise of industry consolidators, and much more.

BuiltWorlds Q2 2023 Venture & Investing Report is available to BuiltWorlds members via the link below.

BuiltWorlds 3 Largest VC Deals of Q2

$290M | Venture | 4/19/2023

Investors: Led by BDT Capital Partners, also included participation from RedBird Capital Partners, Tru Arrow Partners, and Sound Ventures, as well as Brown Advisors

EquipmentShare is a nationwide equipment and digital solutions company serving the construction industry. The group is on a mission to give contractors and construction companies build with control thanks to our T3 technology platform and equipment rental, retail, and service solutions.

More than a rental company, Equipment Share is building a new vision for construction -- one that is connected and more efficient. For the first time, contractors can gain complete visibility over their entire construction operations. Receive alerts on jobsite and fleet bottlenecks, such as safety and security issues or down machines. Run reports on utilization, job expenses, and maintenance. Monitor your staff for compliance and efficiency. Manage your entire fleet and more with T3.

$272.9M | Venture | 5/11/2023

Investors: APG, Mirova, and Corsica Sole

As a French pioneer in vehicle charging, DRIVECO's mission is to make electric mobility accessible to all, by offering the simplest experience, developing the most reliable grid and providing renewable energy, to build a greener society.

As a charge point operator, DRIVECO places the user at the heart of its system. DRIVECO’s users benefit from the largest and most reliable charging network in France. Recharging your electric vehicle with DRIVECO is intuitive and economical through a smart mobile application or a badge from a mobility operator.

DRIVECO aims to install and operate more than 60,000 charging points by 2030 throughout Europe. As a result, DRIVECO offers to finance the turnkey installation of charging stations in the parking of supermarkets, commercial properties, or companies while paying rent to the parking owner.

A pioneer in solar mobility and real-time energy management, DRIVECO also can create solar-powered charging stations in order to create a virtuous circle of 100% carbon-free energy production for electric vehicle use.

$225M | Later-Stage | 5/17/2023

Investors: Led by BoltRock Holdings and Centaurus Capital

Gradiant is a different kind of water company, deploying a full technology stack of creative solutions to help the world’s leading industries achieve sustainable operations through responsible water use. The company offers the design, build, and operation of end-to-end water and digital solutions across industries, including microelectronics, pharmaceuticals, food & beverage, lithium and critical minerals, and renewable energy.

Gradiant’s innovative solutions reduce water used and wastewater generated, reclaim valuable resources, and renew wastewater into freshwater. The Boston-headquartered company was founded at MIT and has over 900 employees worldwide.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.