Economies of scale are one of the few large business advantages that the construction industry has failed to obtain with each additional project adding more risk than benefit in this paper-trailing space.

A dislocated value chain, lack of project-to-project visibility, and lagging tech adoptions within the built world have actually created diseconomies of scale – negative incremental cost-benefit per unit – which every contractor reaches at a critical size threshold, leaving this low-margin industry highly fragmented.

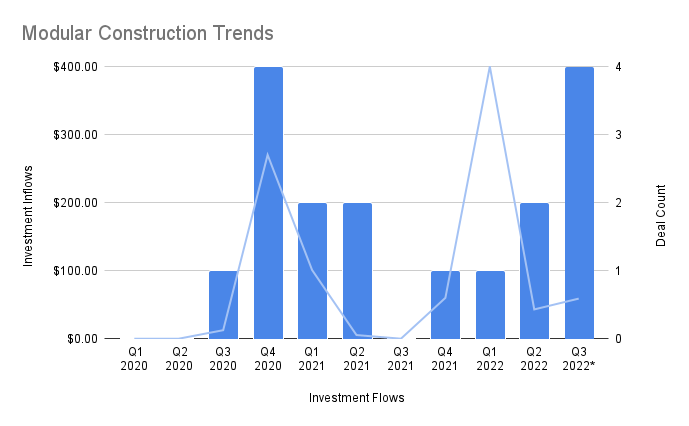

Modular construction has been one of the fastest emerging technologies of the past decade, reaching $140 billion in 2021 and expected to grow at a CAGR of 8% through the remaining years of the Roaring ‘20s (Strait Research). The rapidly digitalizing process of prefabricated buildings provides industry leaders with an avenue to achieve those coveted economies of scale that nearly every other sector has been able to achieve in the commencing Industry 4.0 (The 4th Industrial Revolution).

As the skilled labor market sees a system down shift – younger generations are moving away from hands-on construction jobs/careers – augmenting worker productivity has never been more important. Modular construction is a clear-cut solution to this issue, which is why this AEC-tech theme has seen the largest capital inflows since 2020 began.

Digital improvements in manufacturing processes and custom building materials provide prefabricated buildings with the necessary characteristics to drive profit-improving consolidation into this rapidly evolving built ecosystem.

The global socioeconomic nightmare the world has been struggling with since the pandemic began seems to have no end with geopolitical chaos in Eastern Europe, broken supply chains, and rocketing building material prices that have put general contractors’ already paper-thin margins at risk of inverting.

Strategic corporate funds from leading contractors have been popping out of the cash-swelling construction bender that we’ve been on over the past 2 years, and these groups (along with cash-gorged generalist VCs desperately searching for that next blue ocean sector) have been pouring capital into increasingly energy-efficient & cost-effective manufactured building ventures.

Is modular construction the answer to mounting supply shortages and the more system employment shift away from skilled labor jobs – employment in the construction space never recovered from its 2008 peak, and may never – that GCs are grappling with today?

Watchout for the link to the full "Modular Movement: Venture Report" which will be available shortly in a link below (circle back to this page for the link). This report will break down the areas of opportunity along with a few actively raising early-stage investment opportunities in this niche space.

Check out some of BuiltWorlds latest research & insights as we build out our analytics team and thought leadership by clicking here.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.