Saudi Arabia’s construction boom, underpinned by a number of so-called “giga projects” as part of its historically ambitious Vision 2030 plan, is set to see the country spend over $1 trillion on construction projects over the next six years. While the effort is well underway, with several projects already reaching significant milestones en route to completion, the area and market present unique challenges that threaten to disrupt the country’s 2030 goal.

We caught up with a friend in the region, Dr. Hassan Albalawi, founder of WakeCap Technologies and a speaker at our upcoming Paris Summit, to learn more about the Kingdom’s construction market, from its projects and progress to its problems.

Saudi Arabia’s Many Construction Projects

“The scope of Saudi Arabia’s construction boom is enormous,” says Albalawi, who, while operating out of UAE, hails from Riyadh, Saudi Arabia’s capital. “(The Kingdom) seeks to diversify away from oil and has seen a huge level of investment and development across many different sectors, from tourism to sport, to construction and technology.”

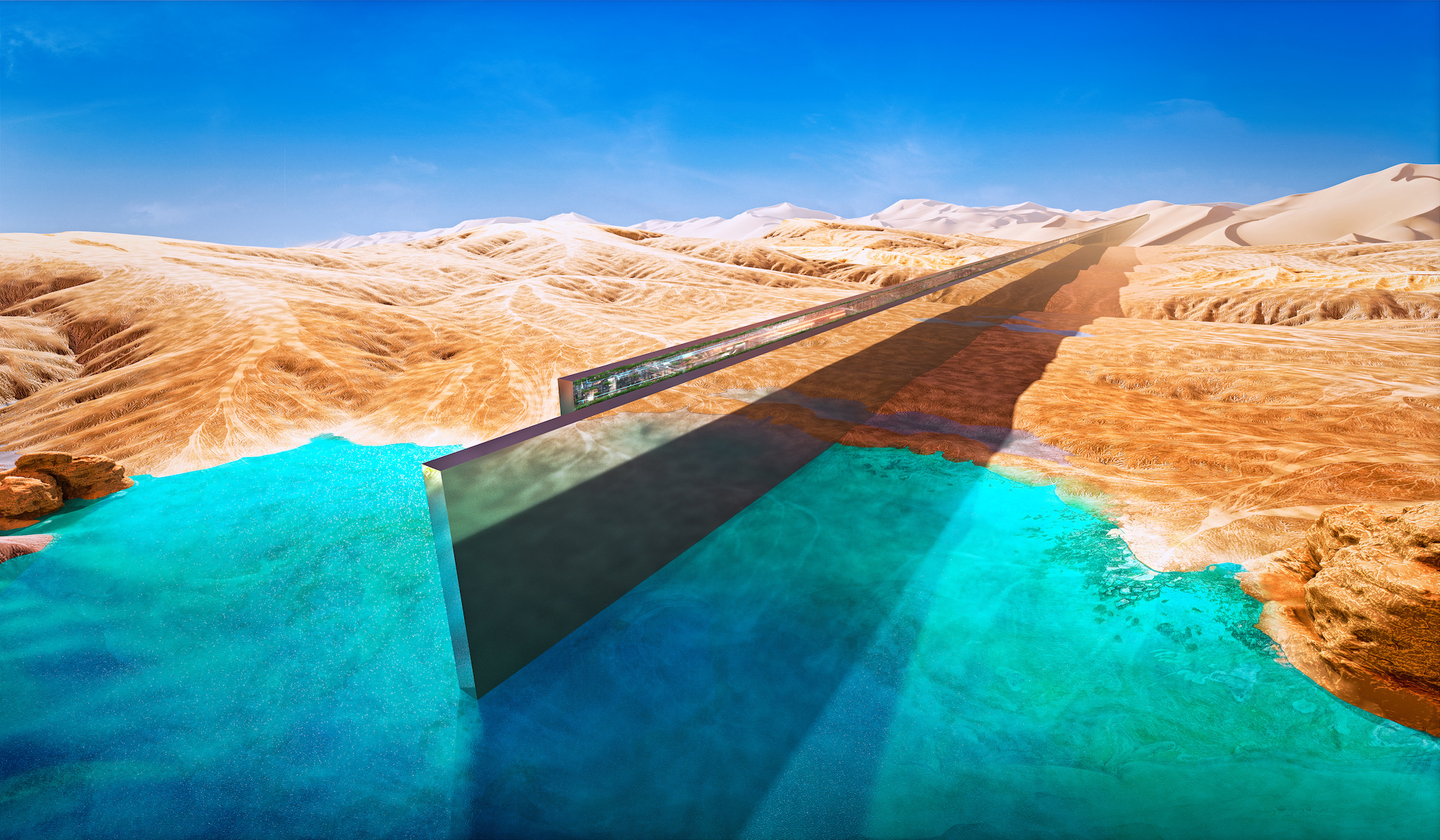

He mentions NEOM, a giga project that’s grabbed headlines the world over on account of both its, to say the least, ambitious scale and frightening controversies.

“It’s a mega-city hub,” Albalawi says, “set to showcase innovation and sustainable development and reimagine the cities of the future.”

NEOM famously (or perhaps now infamously) features The Line, a development with an unclear future that, as its original announcement framed it, was envisioned as a 105-mile long “belt of hyper-connected future communities, without cars and roads and built around nature.” It has been said that The Line aims to contribute 380,000 jobs and $48 billion to the country’s GDP by 2030.

He mentions the Red Sea Project, describing it as a “tourism megaproject” meant to turn the Kingdom’s west coast into a destination spot, complete with a litany of luxury resorts and nature reserves. Saudi Arabia’s publicly-owned Red Sea Global is the developer leading the project, and it advertises a goal of having 50 resorts along the coast complete by 2030.

Albalawi mentions Qiddiya, an entire city to be dedicated to entertainment; and the King Salman Energy Park, also known as Spark, a 50-square-kilometer area meant to appeal to and ultimately “drive global energy companies to the Kingdom.”

While these projects alone represent billions in investment and huge lifts for construction companies, they account for only a small fraction of the reportedly 250-plus projects (some reports put that figure in the thousands) totaling more than $1.7 trillion in value that Saudi Arabia has planned over the next several years.

“The rate of construction in Saudi Arabia has not yet reached its zenith,” Albalawi says. “The potential growth for the country is enormous and we are still very much in the early phases.”

Vision 2030’s Progress

There is no getting around the reports that Saudi Arabia, for a number of reasons, is supposedly scaling back its construction efforts. Still, there is also no denying the country has made considerable progress in the space and on a number of specific projects.

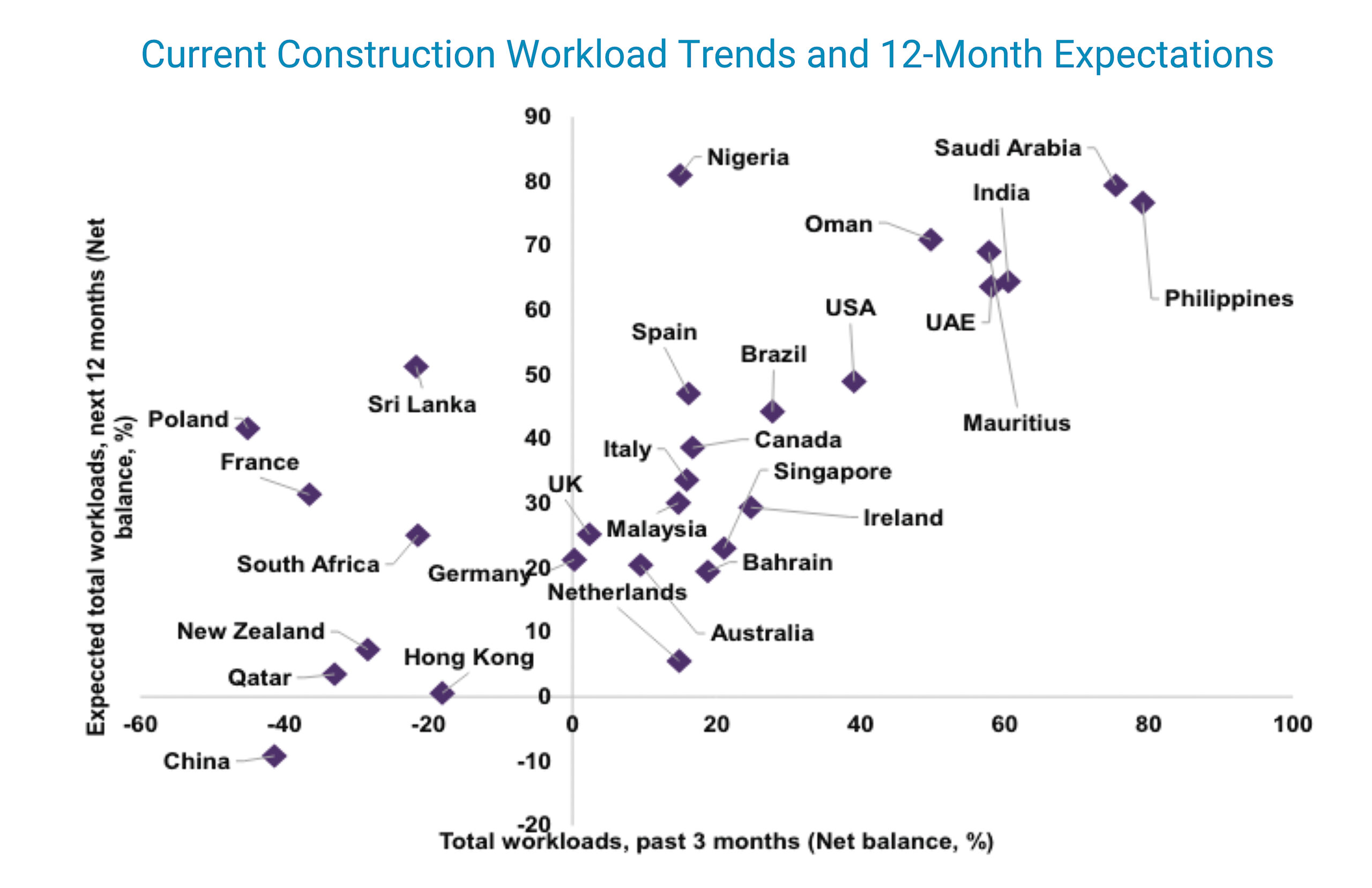

The Kingdom, for instance, is leading construction activity in the region, according to the London-based Royal Institution of Chartered Surveyors (RICS). In its Q1 Global Construction Monitor report, RICS researchers wrote that Saudi Arabia “continues to dominate the MEA construction landscape.” What’s more, the report shows Saudi Arabia leading the world in construction workload trends and 12-month expectations.

Faisal Durrani, who heads Middle East and North Africa research for international real estate consulting firm Knight Frank, wrote in a blog post:

“The scale of infrastructure improvements in the country is phenomenal. The aggressive targets laid out by the government around attracting 100 million annual visitors to the country by 2030 means both adequate and first-class gateways need to be created. And we’re already seeing the first of these trickling through.”

Already the Kingdom is seeing increases in port traffic and railway passenger demand, and the country has reportedly dedicated at least $300 billion of its anticipated construction spending to infrastructure projects—some of which include the $22 billion Riyadh Metro, $60 billion Makkah Metro, and $147 billion Riyadh Airport, meant to house a new national airline. And while many are underway, some, like the $270 million expansion of the Jeddah Islamic Port in the Red Sea, have already been completed.

Albalawi says that “the population is young, and growing, fueling development in infrastructure.”

Elsewhere in the country, contractors are similarly making headway on a number of non-infrastructure-related projects.

Red Sea Global, the developer leading the Red Sea Project, has, for instance, already opened one resort and plans to open 16 more between this year and next. At NEOM, recently released satellite images appear to show progress in the form of an expansive golf course along the Red Sea coast. And the Jeddah Tower, a skyscraper aiming for the title of “world’s tallest”—which began construction in 2013 (prior to the announcement of Vision 2030) only to have progress paused in 2018 following political unrest—has restarted construction and is reportedly aiming for a 2028/2029 completion date.

The Unique Barriers to Construction in the Kingdom

Despite reports of construction slowing down and/or scaling back, the Saudi government remains firm in their position that things are moving ahead as planned.

In a recent special meeting with the World Economic Forum, when asked about widespread rumors of problems and slowdowns with NEOM-related construction projects, the country’s Economic Minister, Faisal Al Ibrahim, told CNBC that “all projects are moving full steam ahead.” He furthermore added, “We set out to do something unprecedented and we’re doing something unprecedented, and we will deliver something that’s unprecedented.”

But while things may be moving “full steam ahead,” there remain fundamental hurdles the country still has to clear—or, in some cases, work around.

Building for Heat

“(Construction in the Kingdom) is different (from other regions of the world) due to quite a lot of factors,” Albalawi explains, “starting with the obvious: Saudi’s extreme heat.”

In the summer months (ie, June, July, August), temperatures in Saudi Arabia average 93 degrees Fahrenheit, with highs averaging 106 degrees.

“It impacts labor productivity, safety and even which construction materials are suitable.”

Timber can lose mass in extreme temperatures. Vinyl and plastics can break down. And contractors building for excessive heat have to consider how the structure is built, from its solar orientation and aspect ratio down to the architectonic features, like cantilevers and porticos. It has to be designed for prolonged and persistent periods in high heat.

Keeping Pace with Construction

Labor is also a challenge for Saudi contractors—which may not seem too unique a problem to most markets in the world. But it is in the Middle East, where reports of labor and skills shortages are lower than other regions. That is, apart from Saudi Arabia.

“The picture is very different in Saudi Arabia,” the RICS report reads, “given the sheer pace of output growth.”

The London-based Institution reported that 77% of its contributors in the region have experienced problems with both finding skilled workers and labor in general. The report specifically cites labor problems in Al Hofuf, Jubail, Riyadh, and Dammam.

Catching Up with Tech

Technology is also a significant challenge in Saudi Arabia, as the country has historically been slow to adopt new advances.

“As there has been more education and awareness of the huge potential for technology in construction, adoption has grown.” -Dr. Hassan Albalawi

A Riyadh-based contributor to RICS’s Global Construction Monitor provided some insight on the problem, reporting a “lack of awareness of the importance of BIM in the construction industry.”

But unlike the unavoidable heat or widespread labor problems reminiscent of many other markets around the world, there appears to be a clear path forward. One that Albalawi is helping pave.

“There is a palpable appetite for construction technology in Saudi Arabia,” he says. “During talks with government officials, we’ve discussed opportunities for integrating technology into one of the most ambitious construction industries in the world.”

Specifically, Albalawi talks of interest in BIM, prefabrication, and 3D printing.

“As there has been more education and awareness of the huge potential for technology in construction, adoption has grown,” he says. “I think we are catching up with the rest of the world!”

Whether the Kingdom will ultimately catch up and whether its many, multi-billion dollar megaprojects will ultimately come to fruition remains to be seen. But one thing is clear: they’re putting forth a serious effort.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.