Investors are breathing a sigh of relief as the chaos from the first 3 months of 2023 is put in the rearview mirror. Economic vulnerability tied to a conceivable credit crunch has begun to depress leveraged spending across most sectors, further decelerating inflationary pressures, while driving the US Federal Reserve’s rate-hike trajectory back toward its neutral rate of 2.5%.

FUD (fear, uncertainty, & doubt) continued to control the early-stage investment narrative this past quarter with global VC deployment slowing 53% year-over-year (YoY) – from $162B in Q1 2022 to $76B in Q1 2023.

Cautious optimism continues to prevail among the built world’s leading players, who are sitting on record cash balances after a 2-year building boom and are still looking at record backlogs (albeit a lagging economic indicator, but quickly adjust to reflect capital calls in the case of economic distress).

The seemingly perpetual cloud of economic uncertainty continued to plague most VC-supported markets. Early-stage investors have been sitting on their hands, allowing the overzealous capital deployment of the past 2 years to flush out startups unable to achieve sufficient market traction while spotlighting next-generation winners.

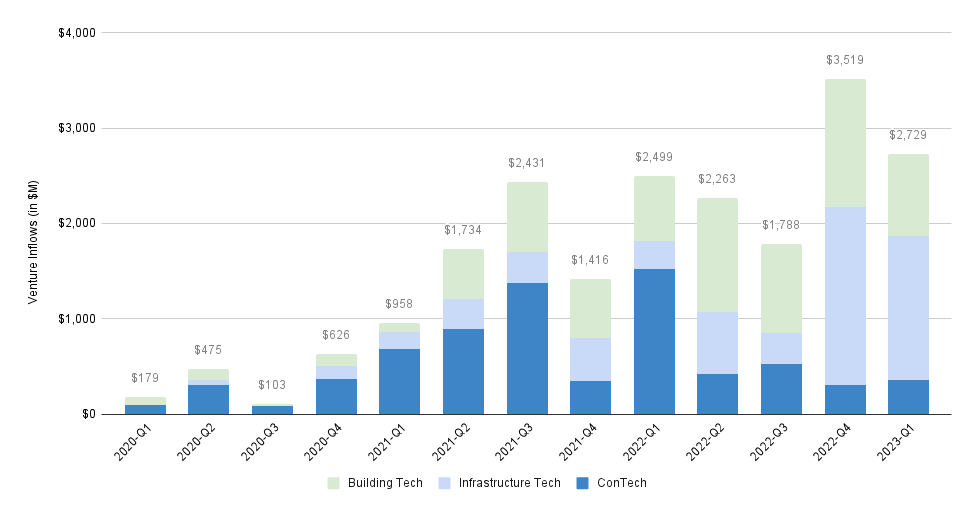

Nevertheless, the mission-critical improvements needed in the built world provided this still nascent innovation ecosystem with some insulation from broader economic pressures, with VC inflows into AEC-tech increasing by 9.2% YoY.

BuiltWorlds Venture team tracked 148 deals worth $2.73B in venture capital inflows into the nascent global AEC startup ecosystem in Q1 2023 across our 3 Venture focus areas (ConTech, Building Tech, and Infrastructure Tech), with strategic investors taking control - corporate/government innovation funds leading 36% of venture deals in the past quarter compared to 12% in the first quarter of 2022.

Read the full report to see a detailed breakdown of current & future venture trends in the built world, including BuiltWorlds Venture Forum's forward-looking sentiment, how the latest VC & CVC fund launches will fuel this innovation niche in the quarters ahead, and the implications of macroeconomic headwinds on the increasingly secular AEC ecosystem.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.