This article was written by Judy Schriener

Today’s workplaces are changing. For entrepreneurs, freelancers and other remote workers, traditional office spaces and cubicles aren’t part of the equation — and working from home leaves a lot to be desired. So what’s the new order of things?

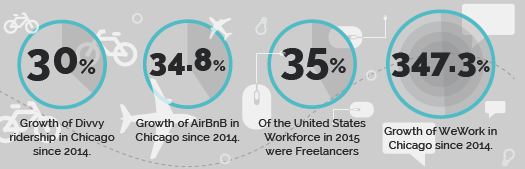

The sharing economy is growing, and with it, coworking spaces, according to JLL’s research.

The answer: Shared workplaces. They’re proliferating, and millennials (now the largest cohort in the U.S.) are especially drawn to the shared services, amenities, and conversation. People with different skill sets are just a few feet away, and the community atmosphere encourages interaction and collaboration.

Shared workspaces now comprise more than 27 million square feet across the country, according to research conducted by Chicago-based commercial real estate consulting firm JLL. Shared workplaces began some 20 years ago but have recently blossomed, adding 3.7 million sq ft of leased office space since mid-2014. New shared office companies are popping up and established ones are expanding.

Is the growth in coworking space good for our future?

Well, the longer-term outlook is unknown. If there were another economic downturn, cost vs. benefit could diminish and supply of shared spaces might outnumber demand. In Chicago, specifically, the coworking industry has doubled its square feet since 2011, with more than 100 locations in downtown alone, says Hailey Harrington, JLL’s senior research analyst for downtown Chicago.

“It’s worrisome,” she says. “It’s unclear how this industry reacts to a downtown — if negative, and some companies to go belly-up, that would create a lot of vacant office space.”

But for now, the outlook is positive. More than 50 million Americans (more than 30 percent of the workforce) are independent workers, and nearly 80 percent of them are under age 40. The U.S. Bureau of Labor Statistics estimates that in the next five years that number will grow to 40 percent — and those people will need workspaces.

Cory Davis, CEO/owner of software developer Capital Construction Solutions, is one such person. Currently, he rents space in a startup-focused coworking community called 1871. He sees several benefits to the space, despite that sharing means he can’t have the same table every day. Davis says the seminars on how to do business, raise money, etc., are especially beneficial to him. Renters also have to apply to get in to 1871, which he likes. But as the space fills up, he says, “The internet [speed] is getting worse, but they’re addressing that.”

Where are we seeing the most growth?

As with commercial real estate in general, brand, reputation, and location are the major factors that make coworking office spaces successful. Urban locations and central business districts have the most demand, and two-thirds of leasing activity over the past two years has been within urban and mixed-use submarkets that cater to today’s millennial workforce, according to JLL. New York City, Chicago, and Los Angeles are the top three locations for shared workspace. For Washington, D.C., ranked seventh, nearly half of leasing expansions have come from coworking spaces in the past two years.

“Flexibility is probably the biggest benefit, especially if a company doesn’t know where it’s going to be in six months or a year,” says Julia Georgules, director of JLL’s U.S. office research. Square-foot costs for shared workplaces are higher than for standard office spaces, but for many people, the advantages justify the extra cost.

For Davis, some of these advantages include being around people in other industries who are using cutting-edge technology that can be used in his own. He also enjoys the corporate-sponsored weekly happy hours on Fridays, where fellow renters can get together.

Davis says the only factors that would make him consider leaving the coworking incubator, as he calls it, are if he decided to give employees more flexibility to work from home or work together. However, he’s pretty sure he would stay even if the economy took a turn. “It would have to get to the point where we have no sales,” he says.

And others seem to share the same positivity. As of now, it doesn’t look like co-working spaces are slowing down.

“It’s like any other up and coming area of the market, similar to any younger industry. I don’t think we’ve seen the peak of it,” Georgules says.

To learn more about the trend in coworking spaces, click here to read JLL’s original research.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.