BuiltWorlds tracked 50 venture deals completed across 16 countries driving more than $960M in early-stage capital inflows across our three venture categories in the first 30 days of 2023, surpassing the booming fundraising environment this paper-trailing startup ecosystem saw in 2022.

International innovation in the built environment is providing a healthy buoy to global entrepreneurial efforts with more than half of 2023’s VC inflows coming from outside US borders.

At the same time, the US economy has illustrated extraordinary resilience to the Federal Reserve’s most hawkish rate hike cycle in over 4 decades with inflation-adjusted Q4 GDP growth coming in marginally above expectations at +2.9%, while employment data continues to support a robust economic narrative.

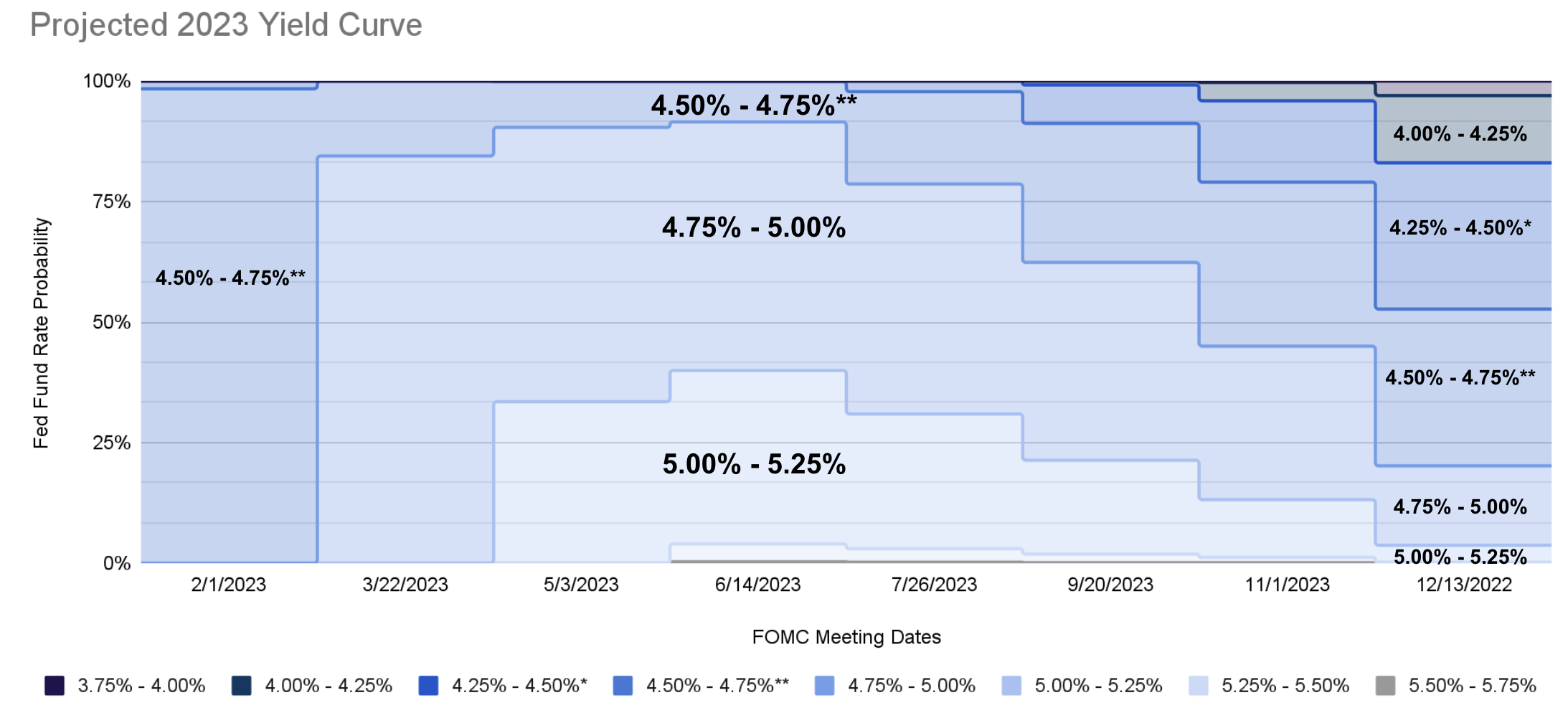

New ventures exploded in 2022, with the number of small businesses doubling to 33 million, generating millions of new jobs while supporting healthy digitally empowered B2B resilience. Inflationary pressures have been decelerating for 6 months now, and now the Federal Reserve is looking towards a rate reversion in mid-to-late 2023.

Below depicts the Fed Fund's projected rates hike schedule with each date representing an FOMC meeting (Fed policy decision). These projections are driven by big banks via Fed Fund futures contracts (hedging mechanisms that depict traders'/bankers' forecasts for the Fed Fund rate). These probabilities can be understood as the minimum expected rate following each preceding FOMC meeting throughout 2023.

Current Rate*

Expected Rate (2/1)**

The Fed is poised to announce an additional 25-bps hike tomorrow (Feb 1st), with Jerome Powell’s post-meeting press conference expected to set the stage for 2023 rate activity.

There has been a notable uptick in the funding of capitally intensive (& low adoption) robotic technology, with four built-world robotic startups receiving VC dollars in the past week alone. Early-stage built world capital has been focused on the immediate-term necessities of this space with things like supply chain solutions and decarbonization being the primary focus throughout 2022. Now as 2023's economic restructuring kicks off, investors are turning their capital-backed attention toward the systemic economic shift away from skilled labor by funding the augmentation of the future workforce.

Below are BuiltWorlds featured deals of the week:

Grupyos | $109M | Series B

Country of Origin: Austria

Tech Category: ConTech - Modular/Prefab (Robotics)

Scythe Robotics | $42M | Series B

Country of Origin: United States

Tech Category: Building Tech - Commercial Landscaping (Robotics)

Raise Robotics | $2.2M | Pre-Seed

Country of Origin: United States

Tech Category: ConTech - Robotics

Kewazo | $10M | Series A

Country of Origin: Germany

Tech Category: ConTech - Scaffolding (Robotics)

Interested in becoming a part of BuiltWorlds' mission to bolster AEC innovation?

>>> If Already a Member Claim Your Venture West Tickets Now

>>> Or Join our Network of Growing Members to get yours Today

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.