Building energy demand hit record levels in 2021 as the pandemic lockdowns began to ease and the new normal commences (3% above 2019’s pre-pandemic demand). The world saw 10 years of digital pull-forward in a matter of 10 months, shifting the built world's energy consumption patterns towards electricity-intensive technologies like EV-charging, data center powering/cooling, and next-generation manufacturing (e.i. semiconductor fabrication & semi/fully-autonomous plants).

According to the international energy association (IEA), 30% of global emissions in 2021 were attributed to building operations and embodied carbon (emissions associated with the manufacturing of building materials accounting for 6% of total emissions).

How Sustainability Was Synonymized with Profitability

The pandemic-driven fears surrounding our own mortality seem to have catalyzed a pronounced existential crisis about the health of our planet, accelerating innovative venture funding into sustainable technologies and energy alternatives. This environmentally friendly flame was further stoked by the surge in post-pandemic energy prices caused by a global shortage of fossil fuel supply and exacerbated by the conflict in Eastern Europe, spotlighting the economic vulnerability surrounding the world's overreliance on oil & gas.

Net-zero building initiatives have been seeing a cascade of government and investor financing with regulatory incentives & requirements providing that economically agnostic tailwind that continues to grow this startup ecosystem. This support coupled with improving economies of scale on the latest clean tech innovations has made sustainability a critical component of all businesses' long-term profitability strategy.

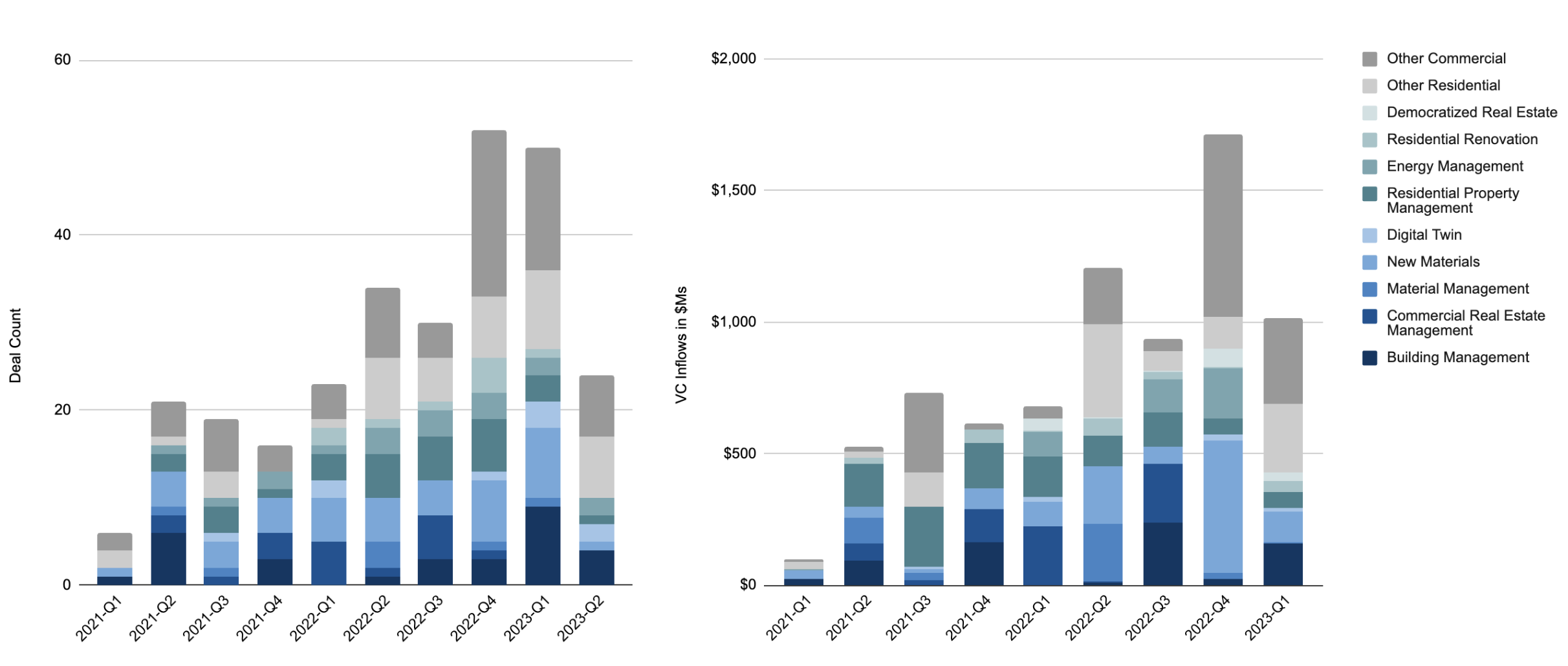

Since the beginning of 2021, built-world startups with a decarbonizing focus have received $3.23B in venture funding, accounting for over 50% of the VC inflows that early-stage Building Tech innovations have seen in the past 2+ years (global VC funding in climate tech reaching a record $70B+ in 2022, up 89% YoY). Clean Energy funds are launching on a seemingly weekly basis, and the unadopted built environment is a primary target of VC dollars in the years ahead.

3 Key Clean Building Tech Deals

$250M | Series E | 5/3/2023

Investors: Linse Capital ($50M Add-On)

Redaptive makes buildings more efficient one saved kilowatt hour at a time. We are breaking down the barriers to portfolio-wide energy efficiency deployments through our Efficiency-as-a-Service (EaaS) platform – empowering companies to optimize their real estate portfolios and save millions on their energy bills. Our EaaS platform builds the foundation for future investments in both resource efficiency and smart building innovation.

Founded in 2014, Redaptive manages a national portfolio of energy efficiency projects across 30+ states for leading F500 companies like, McKesson and Aramark, among others. Redaptive has received funding from CBRE, the world’s largest commercial real estate services and investment firm, ENGIE, a global energy player, GXP Investments, the venture capital arm of Great Plains Energy Incorporated, and Linse Capital, a Silicon Valley-based growth capital firm.

$20M | Strategic | 4/28/2023

Investors: Québec Government ($10M Grant) and ABB

BrainBox AI uses deep learning, cloud-based computing, algorithms, and a proprietary process to support a 24/7 self-operating building that requires no human intervention and enables maximum energy efficiency. Pre-commercialization tests have demonstrated that BrainBox AI enables a reduction in total energy costs of up to 25% in less than three months, with low to no CAPEX needed from property owners. It also improves occupant comfort by 60% and decreases the carbon footprint of a building by 20-40%.

$21M | Series A | 4/24/2023

Investors: Led by Target Global, with participation from Coatue, Foundamental, A/O Proptech, and Partech

Enter helps millions of people to decarbonize their homes by providing the easiest end-to-end solution of one-stop energy audits, procurement, financing, and energy monitoring. With Enter, clients have all the data of their homes in one app.

Want To Learn More About the Mission-Critical Tech & Investments Driving Buildings' Net-Zero Initiative

Check out BuiltWorlds Buildings Conference in Chicago this Week

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.