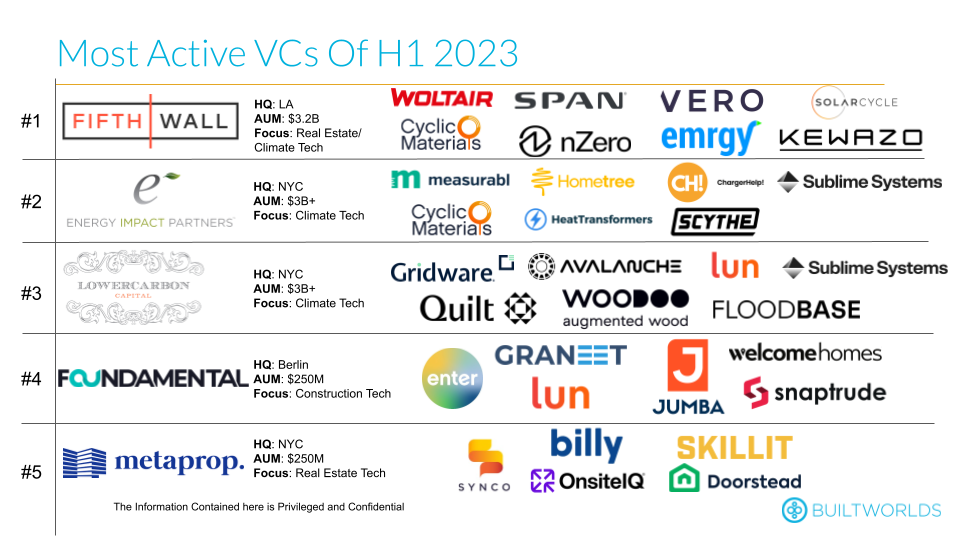

The top early-stage investors of the first half of 2023 were overweight on decarbonizing/sustainable initiatives, which has become one of the most pervasive themes of 2023 built world venture investing.

Fifth Wall, which has been recognized as the most active Climate Tech VC in the market today, was also the most active built world VC in the first 6 months of 2023, which really comes as no surprise (having been the most active VC in this space since 2020). Climate Tech VCs Energy Impact Partners and Lowercarbon Capital took the 2nd and 3rd spots, respectively, which was more of a novel development but with 40% of global emissions originating from the built ecosystem, it's not entirely surprising that these groups are entering this space with vigor.

The best-positioned climate tech startups have managed to keep their valuations relatively robust through the first 6 months of 2023, as broader VC markets begin to see down rounds (or bridge rounds), with regional government incentives & demands drawing an overwhelming amount of interest toward environmentally-friendly innovations.

Foundamental and MetaProp join these Climate Tech VC behemoths on BuiltWorlds' most active investor list following the closer of Foundamental's $85M Fund II at the end of 2022 and MetaProp's over $100M Fund III in the summer of 2021. These pure-play built world VCs are finding increasingly healthy opportunities at the earliest stages of development, with average participating round sizes falling between $10M & $15M.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.