This page is a preview version of our full Construction Tech Report -- available to members. If you are a member please login to your account and follow the link to view the full report.

2022 Project Management & Oversight Construction Technology Report: Preview

Want to view the full report?

The Benchmarking program offers BuiltWorlds Engineering and Construction Company members an opportunity to gauge their technology adoption against their peers so they can identify and prioritize the gaps in their technology stack they need to address to be a leading firm in terms of digitization. Since its inception, the Builtworlds Survey Report has aimed to identify leading construction technology solutions across five key categories; PreConstruction, Project Management & Oversight, Field Solutions, Advanced Machinery & Equipment and Offsite (Modular) Construction.

Within this report are the aggregated survey results from January 2021 to February 2022 focused on key findings for usage of Project Management & Oversight technologies in construction within the following categories:

About this Report

The Built World is ever-changing—everywhere you look it is constantly influenced by innovative construction technology and ideas. These new advancements can help companies, regardless of size, expedite processes and increase safety in many areas of their work. Given the many possible directions available when implementing new tech, the decision-making process can seem foreign to both employers and employees.

The contents of this report are the product of surveyed construction companies, of varying sizes, regarding their adoption and implementation of construction technology. Specifically, the topics include Project Management & Oversight, broken into numerous subtopics to create a more complete picture of adoption in all areas. The Benchmarking Survey Program is one BuiltWorlds offering designed to provide actionable insights for our members as they implement different tech into their operations.

It is important to note that the data that is presented in this report is empirically gathered and not the product of subjective BuiltWorlds analysis. As alluded to above, the data is retrieved through our BuiltWorlds Benchmarking Survey Program which examines five major areas of exploration in construction project delivery technology solutions. This allows us to deliver applicable data and insights, regardless of which part of the construction value chain your company operates in. Data is presented in thoroughly crafted Report Cards that are individualized for each eligible Builtworlds member company that submits a survey.

The questions in the surveys are designed intentionally as a means to get a more clear picture of how and where technology is used and the overall satisfaction companies have when using it. The collection of this data from year to year allows us to identify trends and potentially understand what drives certain decisions—helping member companies in their implementation process.

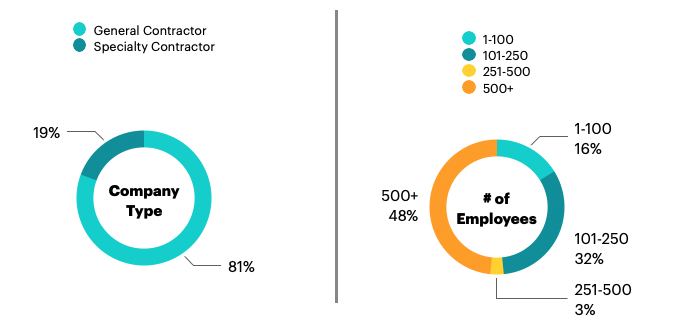

Respondents for this year’s survey included C-Suite leaders, Executives, Presidents, Operations & IT Directors, Directors of Technology/Innovation and Implementation Managers at Specialty and General Contractors. Most respondents are members of the Builtworlds Engineers & Contractors (E&C) Technology Adoption Leaders Forum, which meets monthly to discuss trends in construction technology needs and adoption.

DEMOGRAPHICS

Company Type and Company Size

Want to view the full report?

Members can view the entire un-redacted report. Members also are afforded a specific amount of our Technology Specialty reports each quarter that take a deeper look at each of the subcategories here.

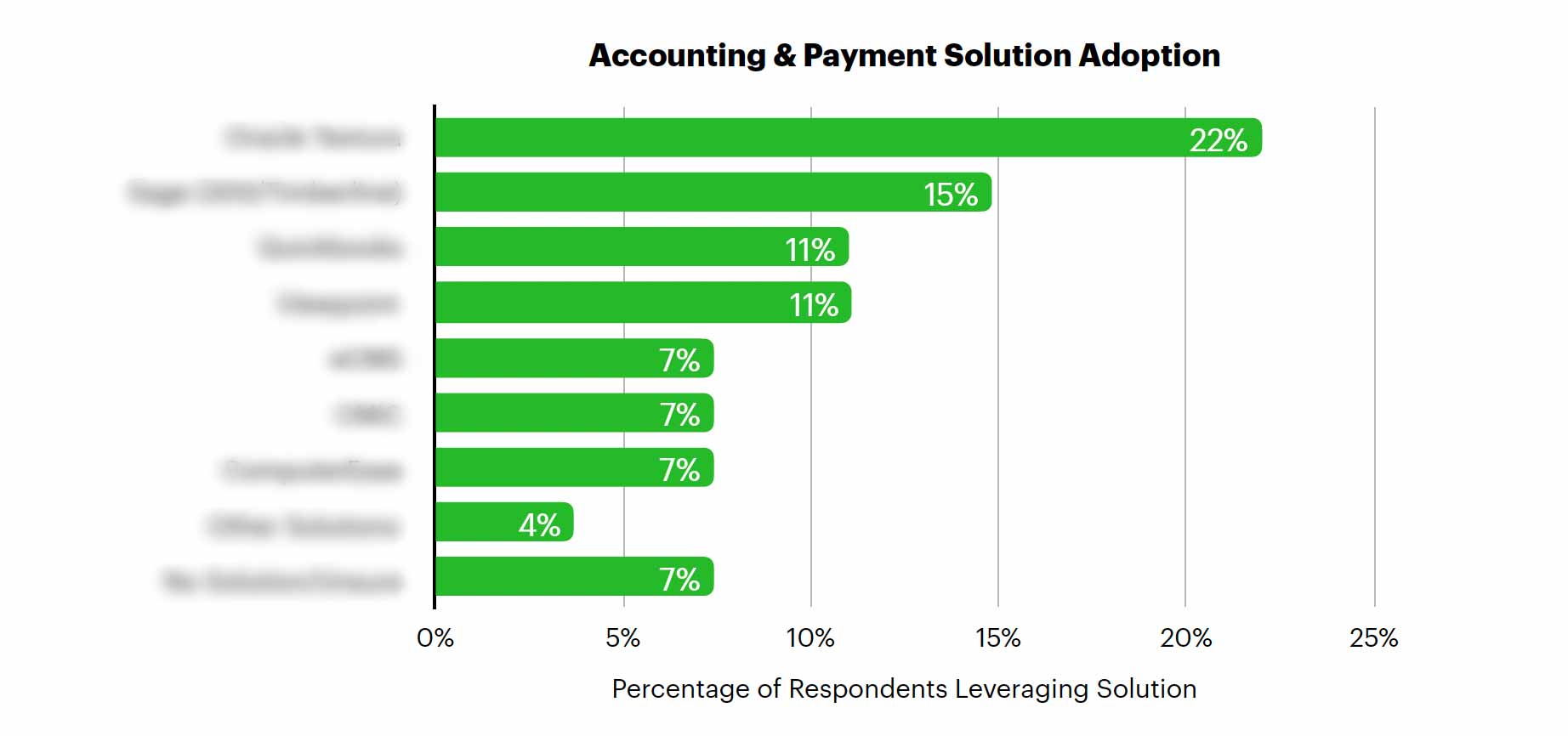

ACCOUNTING & PAYMENT

We asked respondents to identify solutions specific to the project level accounting and payment processes for fulling payments between external stakeholders and their companies. The scale of implementation of Accounting & Payment solutions ranked high with 93% of respondents currently leveraging an Accounting & Payment solution(s) on every project. This is up from 84% in 2020. Around 7% have either not implemented a solution or are unsure of which solution is currently leveraged.

TOP SOLUTIONS

Below you will find the top used Accounting & Payment Solutions listed by our respondents:

Summary

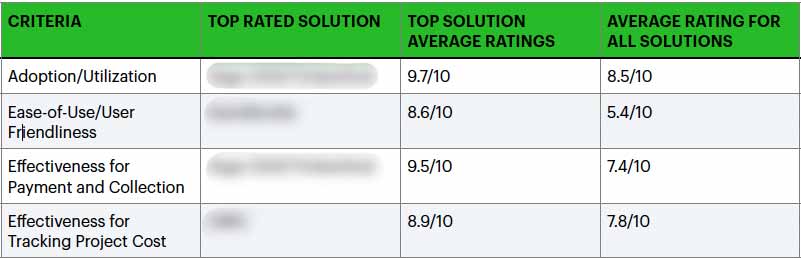

Below you will find a redacted view of the average of the top solutions along side the average ratings for all solutions:

Want to view the full report?

Data points we have available in the full report for Accounting & Payment Solutions Include:

- Unredacted list of top solutions

- Unredacted overview of top solutions ratings

- Highest rated accounting & payment solutions

- Most used accounting & payment solutions

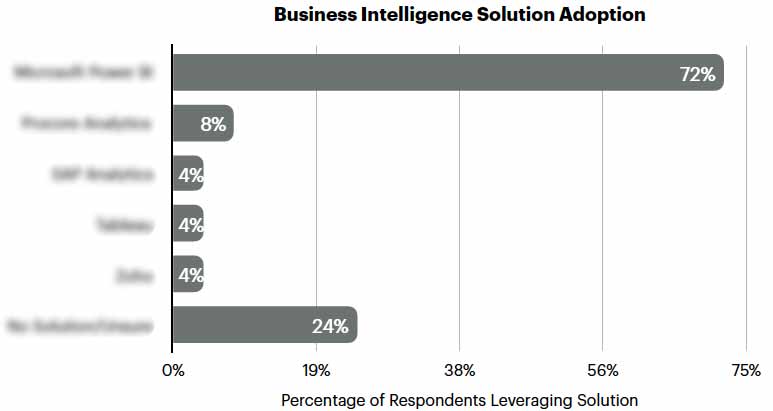

BUSINESS INTELLIGENCE

Increasingly, BuiltWorlds Members are leveraging Business Intelligence solutions to gain valuable insights from the data extracted from jobsites to optimize enterprise-wide and project-specific operations. As more data is collected from the jobsite, contractors are looking for more ways to put this valuable information to work. That’s why 70% of respondents now leverage a Business Intelligence Solution at their company. This is up from 47% from 2020-2021.

TOP SOLUTIONS

Below you will find the top used Business Intelligence Solutions listed by our respondents:

Want to view the full report?

Data points we have available in the full report for Business Intelligence Solutions Include:

- Unredacted list of top solutions

- Implementation information for BI solutions across the industry

- Implementation level vs. revenue data

ENTERPRISE RESOURCE PLANNING (ERP)

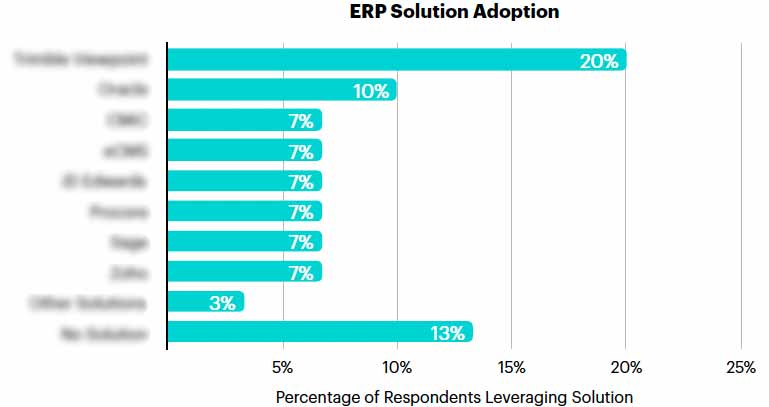

Enterprise Resource Planning (ERP) solutions are identified as solutions that enable contractors to manage and plan day-to-day business activities such as accounting, procurement, project management teams, risk management, compliance, and supply chain operations. An increasingly popular conversation within the BuiltWorlds E&C Technology Leaders Forum and other digital meeting formats has been around the integration of project management, financial reporting, and other processes into a master data management format.

TOP SOLUTIONS

We asked companies list their ERP solutions, the top used ERP solutions and the percentage of respondents using them are shown below: Trimble

Want to view the full report?

Data points we have available in the full report for ERP Solutions Include:

- Unredacted list of top solutions

- Implementation information for BI solutions across the industry

- Implementation level vs. company size data

- Implementation level vs. revenue data

- Top rated solutions and their ratings

- Highest rated ERP solution

- Most used ERP solution

COLLABORATION / DOCUMENT MANAGEMENT

IMPLEMENTATION

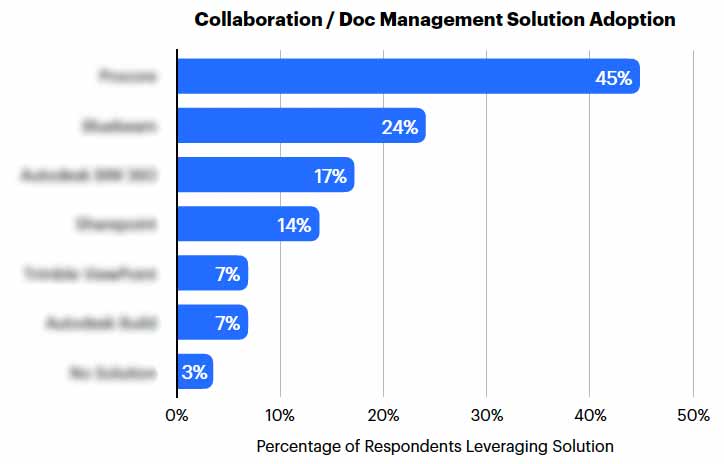

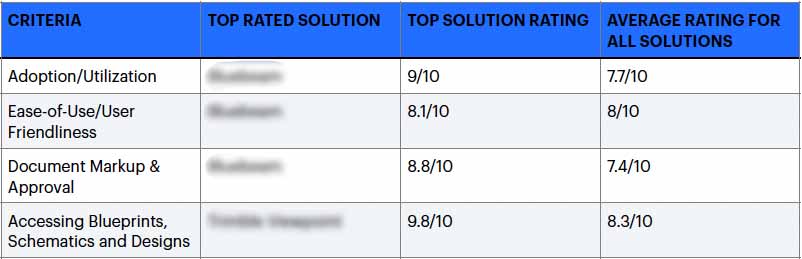

We asked respondents to list and rate their company’s Collaboration / Document Management solutions. We evaluated these solutions based on ease-of-use, internal adoption/utilization, effectiveness for document markup & approval, and effectiveness for accessing blueprints, schematics, and designs. Almost all respondents (97%) are currently leveraging a collaboration and management software. Procore was identified as the most leveraged solution with 45% of respondents using it internally. The top adopted solutions are shown in the chart to the right.

Within their own organization, 45% of respondents leverage multiple document management solutions. The most common solution combinations are SharePoint & Bluebeam or Procore & Bluebeam. Lesser leveraged solutions identified were Microsoft Office 365, Projectmates and Zoho.

SUMMARY

Bluebeam was identified as the highest rated Collaboration / Document Management Solution while Procore was the top used solution amongst General and Specialty Contractors. Although leveraged in combination with other solutions, 24% of respondents identified leveraging Bluebeam as one of their internal solutions in this technology area.

Want to view the full report?

Data points we have available in the full report for Collaboration and Document Management Solutions Include:

- Unredacted list of top solutions

- Implementation information for Collaboration and Document Management solutions

- Top rated solutions and their ratings

- Highest rated ERP solution

- Most used ERP solution

PROJECT MANAGEMENT

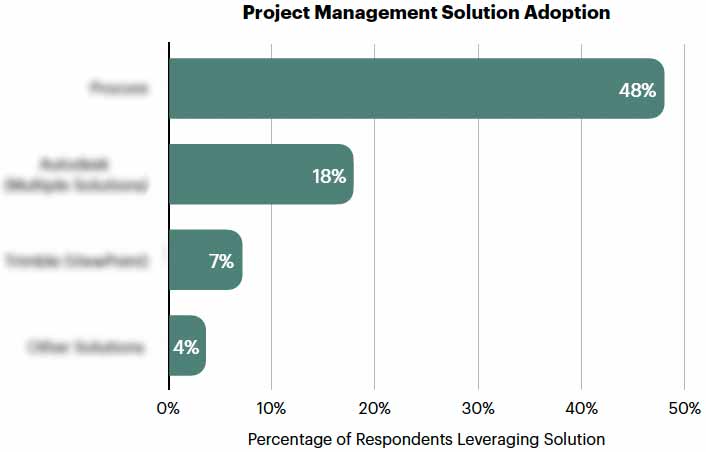

We asked respondents to list and rate their company’s Project Management solutions. We evaluated these solutions based on ease-of-use, effectiveness for communication between the office and field, effectiveness for communication with other project stakeholders (Owner, AE,..etc.), effectiveness for change management, and effectiveness for integration with other solutions. Almost all respondents (93%) are currently leveraging project management software. Procore was identified as the most leveraged project management solution with 48% of respondents using it internally. The top leveraged solutions are shown below:

SUMMARY

Project Management persists as a largely adopted solution in the construction technology sphere. Of the survey respondents, only 7% indicated that they have not employed a Project Management solution on any of their projects. This is down from 10% in the same period from 2020-2021.

Want to view the full report?

Data points we have available in the full report for Project Management Solutions Include:

- Unredacted list of top solutions

- Implementation information for Project Management usage across the industry

- Top solutions annual revenue

- Highest rated PM solutions

- Most used PM solution

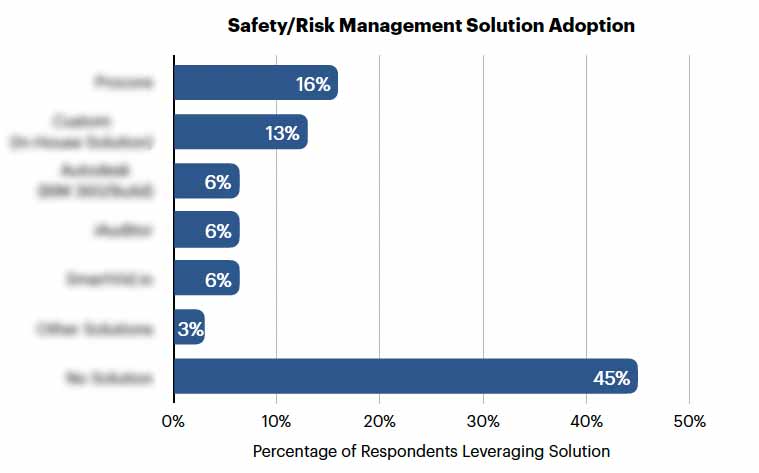

SAFETY & RISK MANAGEMENT

As safety on project sites continue to become more prevalent, the need for safety and risk management solutions continues to increase. Attention has clearly shifted in this direction as we have seen a 20% increase in adoption from 2020. As technology advances, it is no surprise that over 50% of respondents use safety and risk management solutions for every project.

SUMMARY

Want to view the full report?

Data points we have available in the full report for Safety and Risk Management Solutions Include:

- Unredacted list of top solutions

- Implementation levels of Safety and Risk Management solutions

- Utilization rates for Safety and Risk Management solutions

- Top solutions rating information

- Highest rated Safety and Risk Management solution

- Most used Safety and Risk Management solution

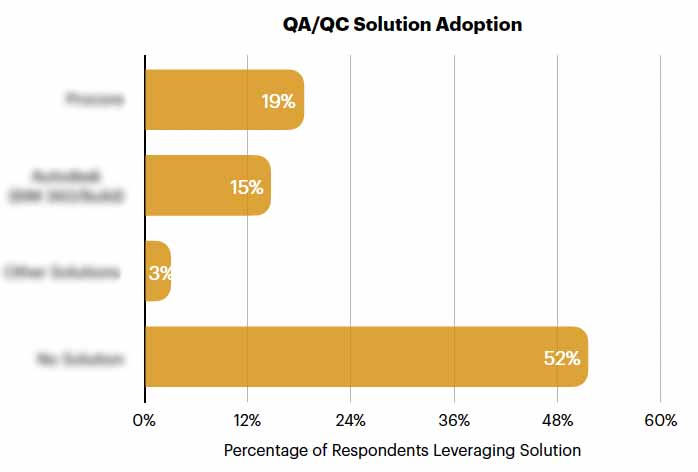

QA/QC

Quality assurance (QA) and quality control (QC) can be defined as a solution that enables contractors to monitor, track, and communicate the installation of various building products and materials on the job site. To achieve success in construction project delivery and prevent additional expenses, schedule delays, and installation errors; both QA and QC must be planned, tracked, and executed. With the availability to capture project site conditions and the connectivity of job sites to the internet, the availability to monitor quality in the field is now more available than ever.

TOP SOLUTIONS

Survey results indicate that respondents have not identified a clear leader in this category. Join our member network and see what companies are growing in adoption.

SUMMARY

Although 48% of respondents are leveraging a QA/QC solution there no solutions identified with widespread adoption by our respondents.

Want to view the full report?

Data points we have available in the full report for QA/QC Solutions Include:

- Unredacted list of top solutions

- Implementation levels of Safety and QA/QC Solutions

- Implementation levels vs. annual revenue

- Top solutions rating information

- Highest rated Safety and Risk Management solution

Next Steps:

Take the remaining surveys. By completing the Builtworlds Benchmarking Program surveys, you gain the ability to compare your own technology adoption and utilization among industry peers. Additionally, we are now conferring a Digital Leader Badge on industry players who score the highest for the extent of their technology implementation, and we also are making public the names of the solutions that the most respondents indicated using.

The remaining reports connected to the following surveys will be released quarterly with the final report being published at the end of the year.

Please see below for survey topics:

Surveys

- PreConstruction

- Project Management & Oversight (Current Report)

- Field Solutions

- Offsite Construction

- Advanced Machinery & Equipment

Additional Resources

E&C Tech Adoption Leaders Forum

As a member of Builtworlds, your company is invited to participate in our monthly tech adoption leaders forum. This is a private forum for the technologists leading the tech adoption in their engineering and construction (E&C) companies to share best practices, dialogues around the benchmarking and surveying program and explore best practices with each other. It is also a companion to our online calls and in person meetings with this group. Access to this group is by invitation only and restricted to leaders of technology initiatives at Engineering and Construction Companies. Email research@builtworlds.com for more details.