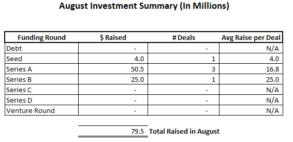

The late spring/early summer hot streak for construction tech investments has continued to slow down as we enter the fall and look to close out the roller-coaster funding year for built tech startups. The nearly $200 Million in investment activity seen in May (which can be largely attributed to Procore's $150M interim financing round) has seen a steady decline as we've progressed through the summer. August funding (~$80M total) saw a drop of about $40M in total investment activity when compared with July (~$120M total). Make sure to join us at our Venture Conference in December, as we'll look to cover all recent venture news affecting the sector, and hear from investment professionals & technologists on the current state of funding in the space.

Recently, we added our 2020 Venture Dashboard to the suite of tools we offer our members to help them understand investors, investments being made, start ups looking for investment, exits, and more in the Buildings & Infrastructure venture sector. While these resources are reserved for members, for our broader community, each month we'll look to break down notable investments made in the sector. There continues to be significant activity across a variety of themes, suggesting a continuing maturing of the sector and more choices and more robust solutions for the industry in the months to come.

In terms of specific topic sectors, in August we saw investment made into areas like Building Products, 3D Printing, Collaboration & Documentation, & Design. Explore below for a summary of total YTD Investment Activity, an August recap of deals by funding round, and the specific raise and investor information for the built industry venture investments from August.

For more on the companies and the investors below, click through companies to find them and other companies of their type in the BuiltWorlds Directory.

Have a deal we missed? Submit the information to the link below and we'll review to get it published on our Venture Dashboard!

Built Industry Startup looking to raise capital from strategic investors? Submit your company's information in the questionnaire below to be considered for Investment and/or Pilots from the BuiltWorlds Corporate Venture Forum.

Company Name: ROOM

Company Specialty: Building Products

Funding Type: Series A

Amount Raised (USD): $12,500,000

Announced Date: 8/5/20

Investors: Slow Ventures, SJF Ventures, FJ Labs, Lerer Hippeau

Company Name: Arevo

Company Specialty: 3D Printing

Funding Type: Series B

Amount Raised (USD): $25,000,000

Announced Date: 8/11/20

Investors: Defy Partners, GGV Capital, Khosla Ventures, Alabaster

Company Name: Icon

Company Specialty: 3D Printing

Funding Type: Series A

Amount Raised (USD): $35,000,000

Announced Date: 8/19/20

Investors: Moderne Ventures, Bjarke Ingels Group, CAZ Investments, Citi, Crosstimbers Ventures, Ironspring, Next Coast Ventures, Oakhouse Partners, Trust Ventures, Vulcan Capital, Wavemaker Partners

Company Name: MSUITE

Company Specialty: Collaboration & Documentation

Funding Type: Seed

Amount Raised (USD): $4,000,000

Announced Date: 8/20/20

Investors: Next Level Ventures, Stanley Ventures, US CAD

Company Name: Transcend

Company Specialty: Design

Funding Type: Series A

Amount Raised (USD): $3,000,000

Announced Date: 8/10/20

Investors: Vespucci Partners

Members can learn more about the firms investing in the sector and what they've invested in via the Venture Dashboard. They can also find and connect with companies in the market raising money on the BuiltWorlds Deal Board. And for even more, members can access BuiltWorlds Private Demo Days throughout the year.

Interested in Learning More About Built World Start-Ups, Investors, and the Investment Landscape?

Access the power of our insights, tools, and community by signing up for our "Venture Forum" or "Venture Plus" Programs.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.