“What many people don’t realize is that data centers have quietly become a part of our national infrastructure, and really across the world,” said Scott Ruch, leader of the critical facilities sector at architecture and design firm Corgan.

And that part is only expected to grow.

At the end of April 2017, market research media company Technavio released a report projecting the global data center construction market to be worth nearly $75 billion by 2021.

Is this shocking? The biggest players in the data center construction space would tell you no.

“The industry has been headed towards this sort of growth for several years,” said Ruch. “There is tremendous growth in terms of the amount of data that humans are consuming, the content that is out there in the world today, and the move to look at everything online,” added Terence Deneny, head of Structure Tone’s mission critical group.

The numbers back Ruch and Deneny up. According to a report produced by IBM looking at marketing trends for 2017, 90 percent of the data in the world today was created in just the last two years.

Ruch believes there are two main drivers for this growth: 1) the overall use of technology and 2) the cloud. “If you look at every part of your life that you use technology, [all of that] has to run through built data centers at some point in time. It has to be processed,” he said.

As for the cloud, not only has personal use for it increased, but services offered to businesses — like Salesforce, Microsoft 365, Procore — have grown exponentially, as well.

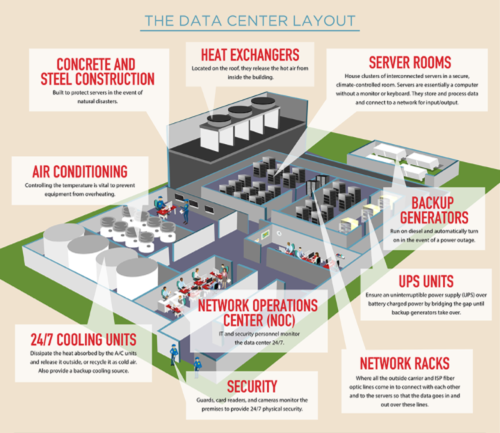

Contrary to popular belief, this data doesn’t get stored in floating, technology clouds. No, no. Instead, it gets sent to large, resilient structures that contain complex infrastructure and mechanical and electrical systems.

While data centers might not be the next Guggenheim Museum in terms of appearance, they’re definitely not your typical build. In fact, they’re so specialized, they’re treated similarly to power plants and water treatment facilities. In other words, they’re “mission critical.”

“What really makes [a building mission critical] is the fact that you don’t ever want it to stop operating,” said Drew Thompson, director of data center solutions at Black & Veatch. There must be key elements in place to ensure the servers never lose power, otherwise known as uninterruptible power systems (UPS).

To ensure data centers never lose power, massive emergency generators exist onsite. However, it usually takes a little time for those systems to kick in. The UPS acts as an intermediary power source that immediately switches on if something happens to the power coming from the grid.

Since the servers constantly run, they release a great deal of heat. If the cabinets holding the servers overheat, the system could go down, which is why cooling methods are also important to data center construction.

There are a few different ways data center designers and MEP professionals can plan to cool their systems. Traditionally, facilities used chillers and cooling towers, but “today being very energy efficient, a lot of data centers are looking at separating the hot and cold environments inside of these buildings,” said Deneny.

Basically, the cabinets are backed up to a “chimney,” where the hot air is exhausted, and the cool air from outside comes in from the front, so the two sources never mix. This setup “allows you to use for adiabatic cooling solutions and, in some cases, to be 100% outside air like the Yahoo Data Center we built up in Buffalo,” Deneny continued.

Innovating cooling systems aren’t the only trends the data center construction industry has seen. While companies once placed these systems in remote areas, now they’re looking at getting the data closer to the user. People want their information quicker so there’s a “need to reduce latency and have the data closer to the sources and the users,” said Thompson, which is why Silicon Valley, Dallas, Chicago, Northern Virginia, and New York/ New Jersey are currently the five biggest markets for data center construction.

While it’s seemingly clear why the industry isn’t surprised that they’re expected to see an exponential growth in their market, one last question remains: Can the supply keep up with demand?

“Yes and no,” said Thompson. “Yes from the standpoint where I think we can build buildings fast enough and get the reliable systems to be able to meet the capacity or the needs for this ever-growing quantity of data.” The challenge, however, will be “the ability of our infrastructure to keep up with the needs for the requirements of the data centers.”

In other words, it’s not the building centers fast enough that’s the issue — it’s the question of whether or not the desired sites have the infrastructure needed to power a data center. “That is truly a differentiator when you go globally,” he explained. “You could probably find sites in California, but if you want six 20-megawatt data centers in Mumbai, are there locations that are ready to operate at 10:00 am when all the air conditioners kick on? Probably not.”

Overall, the industry seems optimistic — at least when it comes to the MEP systems and builders keeping up with demand. As for whether or not infrastructure will be able to match the growth, that’s something we’ll just have to wait and see.

Check out this informative time-lapse of Structure Tone’s work on “The Dock”!

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.