The financial markets appear to be returning to a healthy state after an 11-month public equity rally that drove the US stocks back into bull market territory (20%+ above recent lows), despite the US 10-year Treasury yield (benchmark interest rate) holding at a nearly 16-year high.

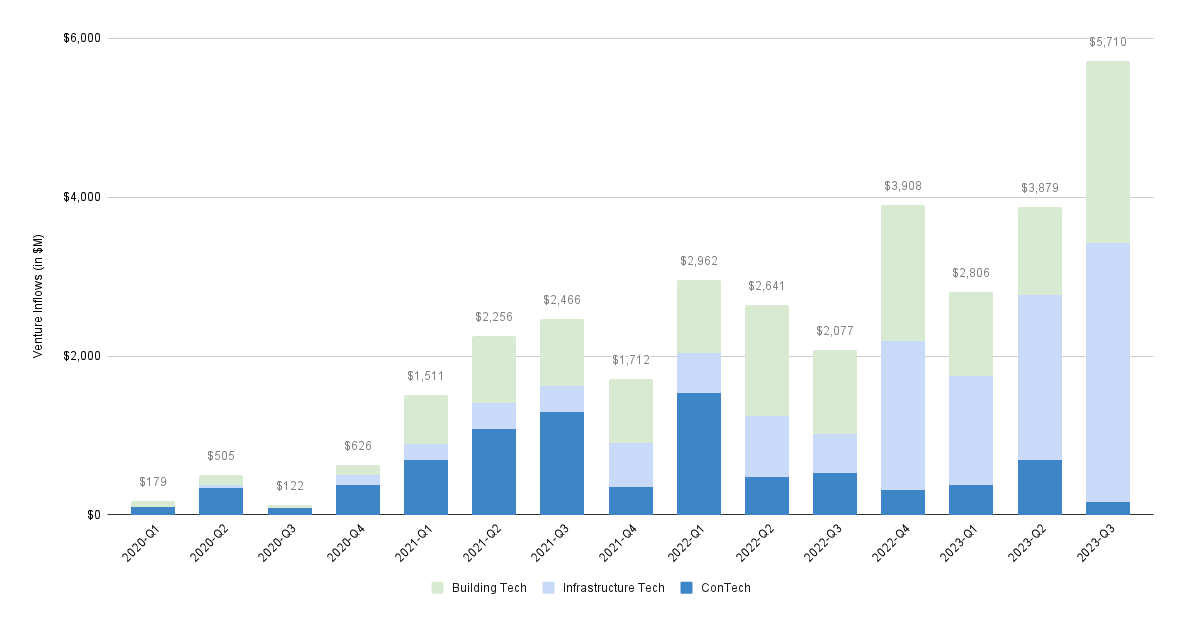

At the same time, VCs are beginning to loosen their purse strings and deploy later-stage (aka, higher dollar value) capital. In the past 4 weeks, innovative ventures in the built environment raised $4.3B across 28 deals (average deal size north of $150M) adding up to more than this VC niche was able to raise in the 5 months prior (see this quarter-to-date boom in built world VC deployment).

The US economy has proven an untenable ability to withstand the most aggressive rate hike cycle in 4 decades. The Federal Reserve has driven its benchmark policy rate (Fed Funds Rate) up over 6,500% in less than a year and a half – the Fed Funds rate went from effectively 0% to 5.33% in 15 months. Contrary to traditional economic models, unemployment has been holding near record lows, and GDP has continued to climb, while inflationary pressures manage to abate - August's CPI report will be released on Wednesday, Sept. 13th.

How has the US economy remained so buoyant in the face of the most aggressive rate hike cycle in 4-decades?

The past 3-years have been some of the most formative years in human history, with the mass adoption of operationally optimizing digital tools (e.g. cloud computing, big data analytics, IoT, real-time asset monitoring, etc.), the rapidly advancing field of artificial intelligence (AI), and an insatiable appetite for the latest technologies.

This digital transformation has provided management teams with a level of real-time operational visibility and insights that allow businesses to foresee potentially adverse scenarios and mitigate risk appropriately. For example, project44, a real-time logistics solution – which raised a $420M Series F at a $2.7B valuation in January 2022 – tracks more than 1 billion global shipments per year, enabling its predictive supply chain analytics platform to provide over 1,200 companies with the tools necessary to reduce unneeded costs associated with procurement delays.

Can the latest technology allow advanced economies to avoid economic downcycles?

Investors' appetite for the earliest-stage innovations continues to grow, with 1,077 unicorns (a private growth company that has attained a valuation of $1B+) being created since 2021 began. The GDP-driving startup communities of the world are maturating quickly, catalyzing increasingly competitive market landscapes where best-in-class innovations are discovered and iterated upon.

The operational improvements that have already been developed will only continue in the years ahead, with those sectors that have lagged the tech adoption curve historically being gifted with the most value-creating opportunities. The paper-trailing built environment is ripe for a digital transformation, and those positioned for this inevitable industry change have sizable upsides ahead.

3 Billion Dollar VC Deals

$1.6B | Growth Capital | 9/7/2023

Country: Sweden

Lead Investors: Altor, GIC, Hy24, and Just Climate,

Participating Investors: Andra AP, AMF, Cristina Stenbeck, Hitachi Energy, IMAS Foundation, Kinnevik, Schaeffler, Vargas and Wallenberg Investments holding company FAM

H2 Green Steel (H2GS AB) was founded in 2020, with the ambition to accelerate the decarbonization of industry using Green Hydrogen. Steel is the company’s first industry vertical due to its technological and commercial maturity when it comes to CO2 reduction possibilities. H2 Green Steel accelerates the decarbonization of the European steel industry, one of the largest carbon dioxide emitters. The founder and largest shareholder is Vargas, who is also a co-founder and one of the larger shareholders in Northvolt. H2 Green Steel is headquartered in Stockholm, Sweden, with its first plant under development in Boden, northern Sweden.

$1B | Series D | 8/29/2023

Country: United States

Lead Investor: Origin Ventures

Participating Investors: Amity Ventures, Tokio Marine Future Fund, S3 Ventures, GTM Fund, Alpha Square Group and FJ Labs

Redwood is building a circular supply chain to power a sustainable world and accelerate the reduction of fossil fuels.

To make batteries sustainable and affordable we need to close the loop at the end of life. We’re localizing a global battery supply chain and producing anode and cathode components in the U.S. for the first time – from as many recycled batteries as possible.

$1.1B | Growth Funding | 9/8/2023

Country: United Kingdom

Lead Investors: KKR ($750M) and M&G Plc's Infracapital ($340M)

Zenobe designs, finances, builds and operates battery solutions. The company's batteries capture renewable energy, balance its supply on the grid, and transport it to electric vehicles. At the end of their lifecycle, Zenobe repurposes them, building a circular economy for batteries. The output from one process can be the input for the next, saving vital materials, carbon, and value.

Want Deeper Insights Into This Venture Investment Niche

Checkout BuiltWorlds Venture East Conference in Miami This Fall

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.