This article was shared as part of BuiltWorlds’ Verified Contributor Program.

The term “construction” often equates to how we build our cities and neighborhoods. However, the economic value chain for a large office tower is very different from that of remodeling a single-family home or building a new light rapid transit line. We are publishing this blog entry as a launching pad to explore the North American construction industry in more detail.

The U.S. Census Bureau splits construction into residential and non-residential. Residential includes all single-family homes, both newly built and remodeling, as well as multifamily dwellings. Non-residential is split into various sub-types of “vertical” work and “horizontal” work. We have found that multifamily residential is most similar to vertical non-residential work, creating the categories “commercial” and “civil” (horizontal) construction. Below are more details on these three types of construction work:

Construction categories

It is worth emphasizing that incentives are not the same for different types of construction. As early-stage investors in construction technology, we seek to understand how technology is solving an industry pain point and enhances (or disrupts) the current industry. We recognize construction is not the easiest industry to navigate and equally appreciate that the most successful technology startups in this sector have a rare combination of product knowledge and industry experience. It’s our hope to share our experience — as a venture fund whose single limited partner includes one of the largest contractors in the world — on how the construction industry functions in generic terms.

Before diving in, we’d like to acknowledge that construction is a service industry. Every project is different, every owner is different. Nothing is absolute. Please do not take our generalizations as an edict — but rather an attempt to build a resource for our community in the built environment technology space.

The Value Chain: Commercial Construction

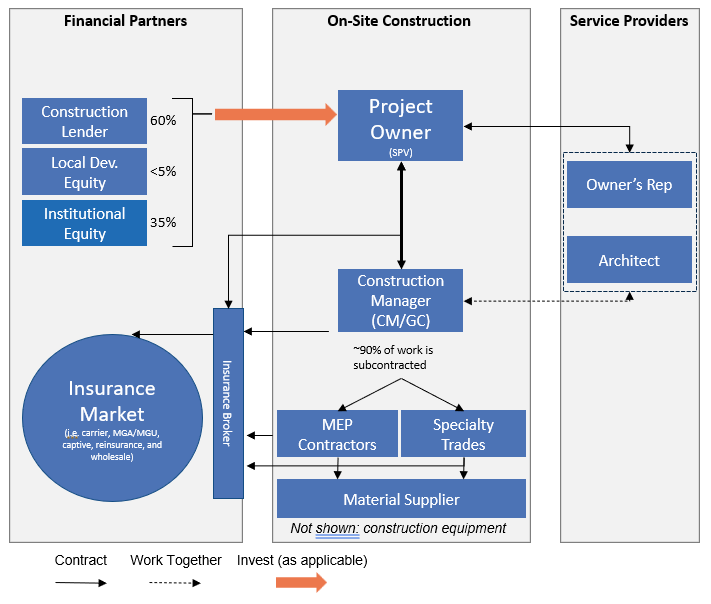

In this post, we will explore the commercial construction value chain, the players in the commercial construction ecosystem (broken down into three groupings: Financial Partners, On-Site Construction, and Service Providers), discuss how commercial construction is contracted, and conclude with an example project cost breakdown. We have chosen commercial construction as the first focal point because we see more technology startups targeting commercial construction vs. other verticals. We often see startups targeting commercial construction because the technology buying decision is closely aligned to a return on investment or risk reduction to the project owner, general contractor, or another party. In addition, commercial construction generally includes more complex and expansive subcontracting vs. other categories of construction, thus tools to manage contracted work are most applicable. For example, StructionSite (progress monitoring), Clearstory (change order management), SmartPM (schedule analytics) and Procore (project management) have a majority of their client base in the commercial construction sector.

Commercial construction stakeholders

Commercial construction — specially, U.S. commercial construction owned by the private sector — is driven by the financial incentive of the Project Owner. In short, this means stakeholders are incentivized to deliver the project on-time and on-budget.

The Stakeholders

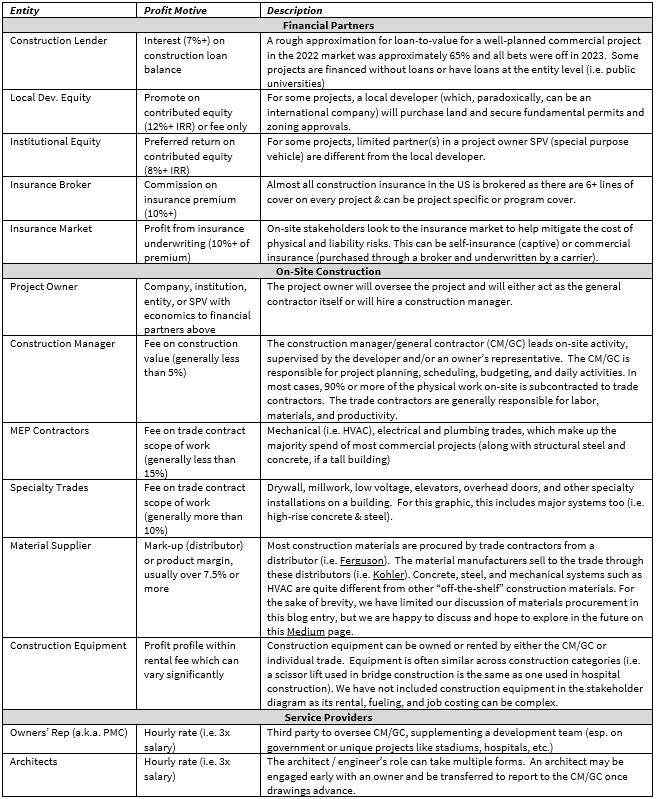

Construction projects are a web of participants with different economic interests and an aligned objective: finish the project on-time, on-budget. As we prepared this paper, we consistently bumped into this complexity — the stakeholders of a single project come together to accomplish that individual project, rarely to repeat exactly a second time. Therefore, please consider this list a summary — other stakeholders exist and could be very meaningful, depending on the project. Below is our summary:

Commercial Construction Stakeholders

Please note: the financial partners can vary, depending on who owns the project. Government buildings (i.e. schools) don’t have developers. Fortune 500 companies & healthcare systems may develop their own buildings with zero project-specific outside financing. Real estate investment trusts can develop without other institutional equity. There are many permutations, but the example above gives a working definition to “commercial construction.”

Contracting and the Flow of Risk

Each stakeholder in commercial construction seeks to transfer a portion of project delivery risk through the contracting process. Or, put another way, every service provider — from the HVAC test & balance provider up to the project owner — agrees to a specific scope of work. This contract can be simple, but more often, is relatively lengthy to articulate the process for when things don’t go to plan.

The scope of a project is often separated into five “risk” buckets:

- Enabling Work: zoning, permitting, and similar

- Design: project architecture, engineering and related specifications

- Construction Services: project construction

- Lease-Up Services: getting tenants into the building. This doesn’t apply in projects where the owner is the only tenant (i.e. Microsoft builds a data center which it owns outright and occupies)

- Property Management & Maintenance Services: running the building once occupied

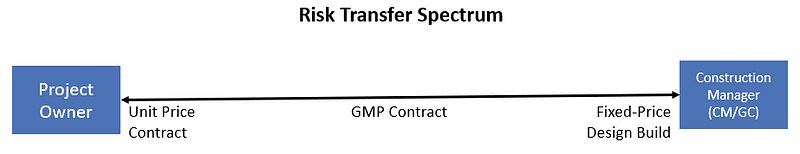

We will focus on construction services and set the others aside for the moment. The key contract for construction services is the construction contract between the project owner and the CM/GC. For much of commercial construction, this is done through a Guaranteed Maximum Price (GMP) contract. A GMP is a fixed construction management fee plus a capped price for all in-scope construction work. Other common construction contracts include unit price (project owner pays an agreed price per installed quantity), fixed-price design build (CM/GC takes quantity risk and design risk to complete project) and other many other iterations.

Relative contractual risk transfer between parties

Typically, a project owner selects a CM/GC at the conceptual design phase based on a combination of qualifications, pricing, and relationship. This conceptual design phase is after a project pro forma is developed but may be before project financing (or even final site selection). The CM/GC then proposes its price and contract terms based on ~50% design documents; later in the construction process, a fixed construction price may be provided (i.e. 90% design documents). In addition, the construction contract requires project completion by a fixed date — with some exceptions, of course. These exceptions include things like natural disaster, discovery of contaminated materials, unknown geotechnical condition, scope expansion, and third-party risks (i.e. utilities). The construction contract can include shared contingency particularly for unknowns and shared decisions. In turn, the CM/GC seeks to transfer production, labor and certain materials purchasing risks down to its trade contractors.

Read the complete article, which covers common subcontracts and project cost breakdown next, on Medium.

Aaron Toppston is Managing Partner of GS Futures.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.