BuiltWorlds’ 2024 Annual Venture & Investments Report revealed a resilient asset class amidst a difficult global venture fundraising environment.

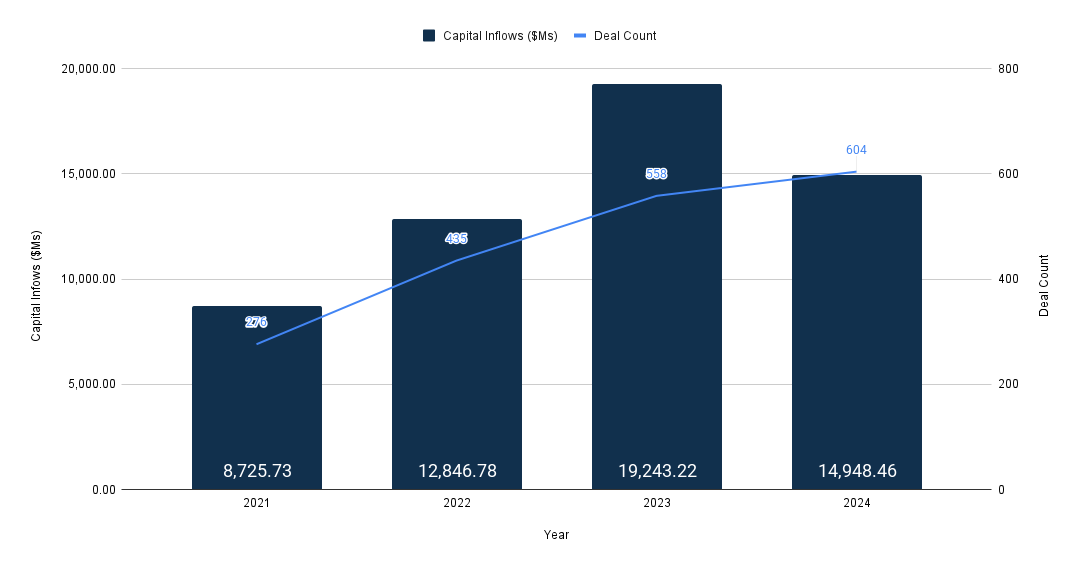

Overall, deal counts increased year over year for built environment venture capital (VC) and technology/startup mergers and acquisitions, while capital inflows experienced a slight pullback—a rebound from 2023’s exceptionally high numbers, driven up by five deals at or exceeding $1 billion in value.

For those following the VC markets closely, the increase in industry venture activity comes as a surprise; high interest rates and suppressed exit activity have hampered global VC activity across all industries since 2022’s record investment levels. To understand how the built environment has experienced year-over-year increases in venture activity, the following key takeaways will unpack the dominant trends in the industry’s innovation economy.

Before delving into the 2024 Annual Venture & Investments Report key takeaways, we will look at how BuiltWorlds classifies industry technology to better understand the key trends.

Construction technology covers software solutions, tools, equipment, and robotics that are used by the back office and the field in project execution. Examples of these solutions include project management software, workforce management software and hardware, accounting and payments solutions, and advanced tools, equipment and robotics used on the jobsite.

Building technology pertains to the hardware and software connected to the asset itself. Examples of this tech include high-performance materials, tenant services/user experience software, energy systems and HVAC, planning and design solutions, and property technology. The property tech solutions that fall under BuiltWorlds purview are residential and commercial software that facilitate property management, renovation management, and transaction management.

Infrastructure technology incorporates all project software, tools, equipment, robotics, energy storage, and utilities management solutions involved in the horizontal construction process or grid-scale energy transition. Examples of these technology areas include community-scale waste management, energy storage, alternative energy, and construction tech solutions used solely on horizontal projects.

Key Takeaways

- The performance of built environment VC is underpinned by macro factors such as U.S. construction spending being at an all-time high (including large increases in U.S. public construction spending in the last four years as a result of the Bipartisan Infrastructure Law and Inflation Reduction Act) and increasing European construction output, according to Eurostat.

- Construction tech VC inflows increased year over year to $2.265 billion in 2024 from $1.705 billion in 2023—representing an increase of $560 million, or 32.9%.

- In 2024, 137 construction tech VC funding rounds were reported, compared to 145 in 2023. Construction tech deal volumes are trending towards 2022’s highs, after a lull throughout 2023 and early 2024.

- Construction tech VC activity was largely driven by investment for startups providing labor productivity solutions—like workforce management software, HR solutions, site monitoring technology, and robotics and labor automation—and ESG compliance software. The increase in funding for these technologies fueled the gains made in the construction tech space.

- Building tech VC inflows decreased to $4.759 billion in 2024 from $5.640 billion in 2023—representing a decrease of $880.8 million, or 15.6%.

- In 2024, 247 building tech VC funding rounds were reported, compared to 196 in 2023. Building tech venture activity accelerated in late 2024 to reach record levels of deal flow.

- Hardware has been primarily responsible for the growth in venture activity for building tech startups. Building energy systems and HVAC, high-performance materials, and modular construction startups accounted for a majority of the capital invested in this sector. This was supplemented by increased investment in property management and architecture and design software tools.

- Infrastructure tech VC inflows decreased to $7.9 billion in 2024 from $11.89 billion in 2023—representing a decrease of $3.985 billion, or 33.5%.

- In 2024, 216 infrastructure tech VC funding rounds were reported, compared to 215 in 2023.

- Infrastructure tech buoyed a majority of the growth in built world VC markets due to interest in energy infrastructure and an influx in government funding.

- Eighty-eight built environment tech M&A transactions were completed in the last year, largely driven by increased competition between private equity-backed rollup plays and strategic tuck-in acquisitions.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.