The 2024 Venture East Conference was an opportunity for the BuiltWorlds network to connect with Boston’s vibrant built world tech community, made possible in part through a partnership with Suffolk Technologies and their BOOST Accelerator Demo Day. We’re happy to say that by virtue of the high quality thought leadership and exchange surrounding innovation and investment from the industry’s most impactful players, the event was deemed a resounding success.

As we ruminate on an inspiring time in Boston, a few points made throughout the Venture East conference and partner events remain potent, even a few weeks removed.

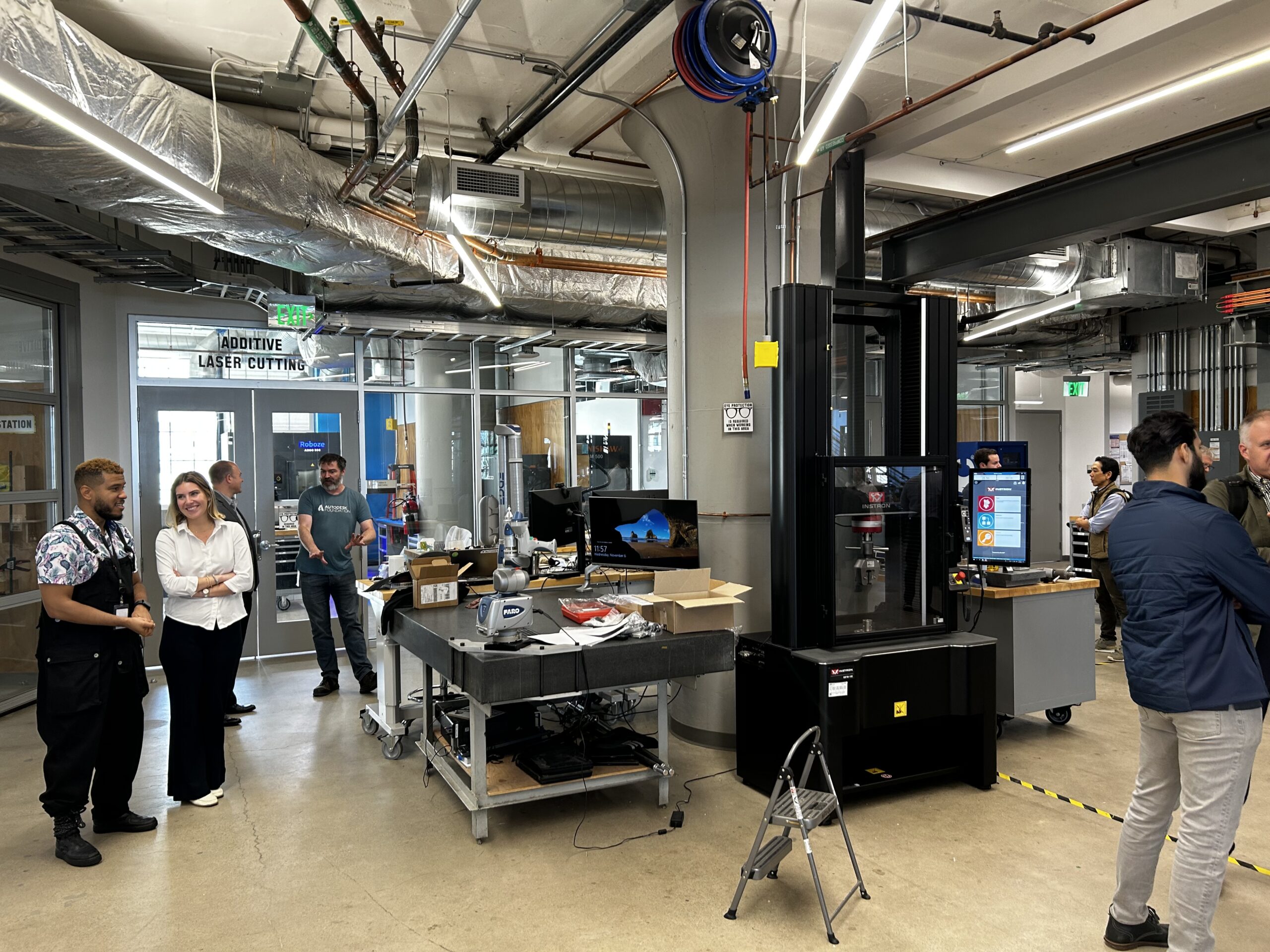

Day One: BuiltWorlds’ Venture and Construction Tech Forum Groups Meet at Autodesk’s Boston Tech Center

- Autodesk is contributing substantially to the advancement of industrialized construction through its internal and external research initiatives with customers, universities and startup companies. Specifically, advancements in automation, like robotic-assisted welding, have led to a more efficient construction process.

- A thing or two can be learned from a VC firm on its fifth fund: Building Ventures partners, Allen Preger and Jesse Devitte (Venture East keynote speaker), explained how they have cultivated a network of the industries’ biggest stakeholders to support the firm’s portfolio companies in capacities beyond limited partner (LP) positions in a fund.

- In the BuiltWorlds’ Venture Forum Meeting, leaders from corporate strategy and M&A arms from across the industry discussed the increased competition in the dealmaking environment from private equity firms. These strategic acquirers expressed the sentiment that they cannot compete with the speed and capital of PE firms; however, an effective corporate strategy can provide a defense mechanism. Corporates must align strategy and M&A to achieve the best targets and deal terms. “M&A isn’t a strategy,” said Erik Swennumson, head of corporate development at Autodesk. “It’s a tool of corporate strategy”

Day One: Suffolk Technologies’ BOOST Demo Day

- John Fish, Chairman and CEO of Suffolk Construction, delivered a welcoming address that set the framework for the challenges that built world innovators are currently facing. Fish stated that “for the first time, the cost to build exceeds the value of the asset being built.” This quote struck a chord with many of the attendees, especially as the impacts of the global housing shortage are squeezing all stakeholders in the built environment.

Day Two: Venture East Conference – Takeaways from the Panelists

- A major theme of early-stage investing in 2024 has been an increase in bridge financing rounds, amidst a decline in the graduation rate from the Seed to Series A stage. On the surface, this seems like a cataclysmic revelation for built environment startups. However, it’s a good thing for industry innovation. Omar Smith, early stage investor at Blackhorn Ventures, explained that it’s better to have startups fail early than to continue funding them just to collapse in the later stages.

- Incorporating artificial intelligence is becoming a standard for new tech startups, putting those without it behind the curve. On the other hand, existing tech solutions need a plan for keeping up with the proliferation of new AI-powered solutions.

- Corporate investors are important to have on the cap table. However, it is important for startups and co-investors to understand the purpose of investment for each participating investors.

- When taking an investment from strategic corporate venture arms, unintentional corporate bad behavior can misalign the incentives of the investor and startup. It is important for startups to mitigate this in the term sheet.

- Growth stage companies in the built world require a different approach from their investors. Primarily, the role of the investor at this stage is to help the company transition from a founder-led strategy to institutional processes that are repeatable to scale.

- Product-market fit is not stagnant, it must be continuously re-evaluated as the company grows. The growth-stage investor plays a significant role in that process.

- In order for a startup to be competitive in the built environment, it must leverage a mix of debt and equity financing. Solutions like venture debt, equipment financing and warehouse financing can be utilized in tandem with venture equity to create a capital structure that funds growth and operations.

- Strategic acquirers are always thinking about their offerings and, in certain circumstances, are willing to place big bets externally rather than develop products internally.

- Strategic acquirers can become more competitive by prioritizing effective relationship building. By having strong relationships with targets and advisors, strategic acquirers make less of a bet on target companies’ leadership teams and can facilitate a more seamless integration.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.