The credit markets are tightening in the wake of the two largest bank fallouts since the financial crisis of 2008, and the implications of Silicon Valley Bank’s dismemberment (currently being sold off in pieces) puts elevated pressure on small businesses that rely on local lines of credit for normal operations.

In the weeks that followed SVB’s collapse, small/regional banks – who are responsible for financially supporting startups & small businesses in the US – saw ~$400B in cash withdrawals from fearful depositors (moving either to money market funds or a larger/“safer” financial institution), which has catalyzed what's beginning to look like a tidal wave of credit line retractions.

This news has significant ramifications for subcontractors, tradesmen, and smaller suppliers who rely on these lines of credit to support normal operations. This will almost certainly lead to some distressed M&A and business failures.

The silver lining I see here is an opportunity for deeper industry digitization. The numerous FinTech startups in the built world are all addressing the undue financial burden put on smaller construction entities (subs, trades, and suppliers) who are largely responsible for holding on to that near-term P&L deficit or accounts receivable (AR) – initial purchase of supplies and equipment – up to 30 days after completion.

According to a study done by Clemson professor, Dennis Bausman, general contractors wait on average 99 days for payment, while subcontractors wait an average of 167 days.

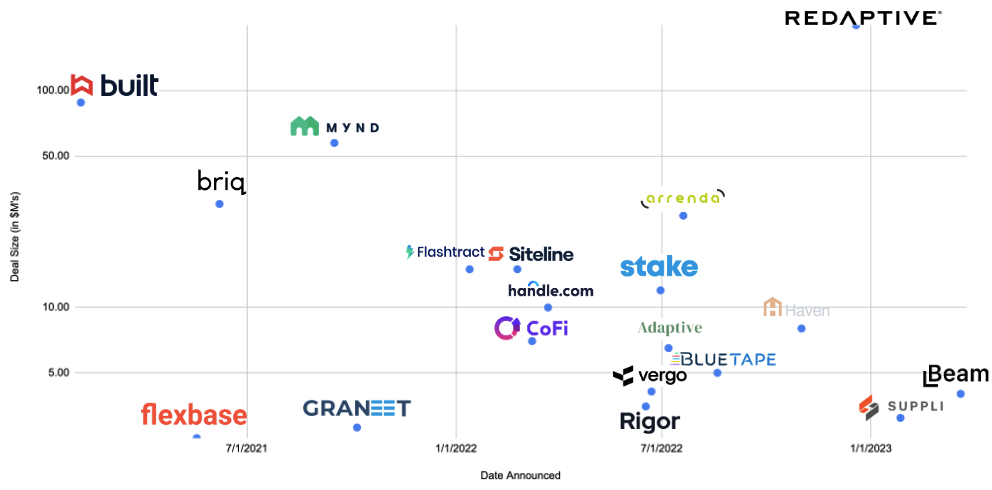

Since 2021, FinTech built-world startups have seen $500M in inflows across 20 deals, all aiming to reduce financial burdens on any one entity. The tightening credit market might be the push this sector needs to adopt the operational efficiency-improving FinTech solutions available. The nascent digital payment solutions in AEC may finally be positioned to penetrate the most digitally resistant part of the construction industry: sub/small contractors.

Check out BuiltWorlds Venture Dashboard for live coverage of deals within this startup niche.

5 Startups To Watch

Latest Round

$3.1M | Seed | 1/27/2023

Investors

Equal Ventures, Audacious Ventures & Dash Fund

Overview

Suppli is a software company whose mission is to empower construction materials suppliers. Suppli offers a single software solution that makes handling everything from credit applications to payments to liens easy. Our value proposition is simple: accelerate cash flow, reduce risk, and increase sales.

Latest Round

$3.5M | Seed | 6/16/2022

Investors

Agya Ventures, Bain Capital Ventures, Digital Currency Group, Flow Ventures, Koji Capital, and Third Prime.

Overview

Rigor Protocol opens up construction finance to the rapidly growing decentralized finance (‘DeFi’) ecosystem. Through DeFi, lenders of all stripes are welcome to help meet historic demand for vital infrastructure; they no longer need to be “specialists” in construction lending, nor are they restricted to lend locally. Loans are collateralized by the world’s oldest asset — land — and improvements to that asset. Returns for lenders are knowable, transparent throughout the building process, reliable, and fixed-term. In addition, lenders are given tokenized representations of their investments, which may allow them to use that investment across the crypto economy.

Rigor allows builders to access capital from the general public (the lenders/investors) to finance infrastructure the public needs to live and thrive, expanding their opportunity to meet historic global demand.

Latest Round

$10M | Series A | 3/23/2022

Investors (Series A + Seed)

Energize Ventures, Ironspring Ventures, Roosh Ventures, Y-Combinator, Zigg Capital, Elefund, Soma Capital, Friale & Liquid 2 Ventures

Overview

Handle is construction software that is purpose-built for material suppliers and contractors to help manage the entire process of protecting payment rights.

Handle's software automation tools help with manual and repetitive tasks associated with late payments such as lien management, owner verification, deadline tracking, RFI, enhanced waiver processes, and much more.

Latest Round

$7M | Seed | 3/9/2022

Investors

Blackhorn Ventures, MetaProp, Tenacity

Overview

CoFi is a digital platform that empowers contractors to get project funding backed by on-demand payments. By engaging multiple partner lenders, CoFi can ensure the best rates and terms for construction loans. Using CoFi allows builders to seamlessly streamline cash to the job site so everyone gets paid fast.

Latest Round

$125M | Series D | 9/30/2021

Investors

Addition, Canapi Ventures, Index Ventures, Goldman Sachs, Nyca Partners, Fifth Wall, Nine Four Ventures, Renegade Partners, Green Point Partners, Witkoff Group, TCV, Brookfield Technology Partners, 9Yards Capital, XYZ Venture Capital & HighSage Ventures

Overview

Built is fixing lending and spending for the entirety of the construction finance ecosystem—and simultaneously providing services that enable all stakeholders in a construction project to get the job done faster and more efficiently than ever before.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.