Are you already a BuiltWorlds Member?

Click here to be taken to the full report

The lagging technological adoption in the AEC space (architecture, engineering, & construction) an aging workforce, and an inability to sufficiently staff the construction bender the economy’s been on for the past 2 years—annual construction spending exploded from $1.452 trillion to $1.745 trillion in the US over the past two years (data collection from April 2020 to April 2022)—has created an unparalleled opportunity for entrepreneurs, industry innovators, & savvy venture investors.

There are few leaders in the AEC innovation space, with the recently IPO'd Bentley Systems (BSY) & Procore (PCOR) leading much of this fragmented pack into the Roaring 20s (where technology and humanity will synergize in a way we never thought was possible). The proliferating need to fill the growing gaps in the skilled labor market offers a significant market share opportunity for future-focused construction robotics newcomers.

The old-school nature of the industry and its previously innovation-hampering culture had kept leading technology from unleashing its productivity-driving innovations on to this now adaptation-fueled industry. Today, AEC industry leaders have never been more excited to embrace the ease and convenience that the latest robot technologies provide.

The now cash-bloated construction sector is racing towards robotic technology to prepare for a more competitive and cost effective future as economic demand cools. The mission-critical setbacks related to the labor shortage, and persistent supply chain disruption has turned this AEC-tech race towards the humanless advantage of robotic automation (reducing fallibility) into a sprint, with over $1 billion in venture capital inflows fueling AEC robotics year-to-date.

The public equity markets have capitulated as instantiated recession fears mount. An impending economic slowdown is all but a forgone conclusion from what’s priced into this forward-looking indicator (US stock market looks between 6-to-18 months ahead), and even Fed Chair Powell’s sanguinity about a “soft-landing” (economic buoyancy in the face of aggressive demand curbing rate hikes) was lost after the Central Bank’s 75-bps hike in the latest FOMC meeting. The cash-fueled venture capital space is finally pulling the trigger on next-generation tech as valuations come down and innovations spring up.

Economic Downturns & Automation

Recessions have worked as automation accelerators in recent decades. The long-term profitable potential of driving more productivity per employee is at the top of AEC company’s capital spending list as we enter the prolific digitization of The Fourth Industrial Revolution.

Economic downturns force businesses to look internally towards the efficiency of their operations, which includes human capital’s ability to manage workflows, and whether skilled labor could be better utilized elsewhere if automated tech could manage monotonous processes. This has led to a phenomenon called job polarization. The National Bureau of Economic Research describes this as the decreasing share of middle-skill, routine occupation workers, the exact demographic that gets replaced by automation during these contractionary periods.

When implemented correctly, more jobs are created than lost as humans can work alongside these automated tasks dealing with more complex, creative, and subjective responsibilities.

The COVID-19 pandemic has pushed automation and digitalization to accelerated speeds never seen before, and the AEC industry is finally embracing it. The economic recession induced by the pandemic forced 10 years of rapid digitalization/automation to take place in 10 months. Companies were in ‘fight-or-flight’ mode and had to adopt these technologies to survive. This trend will continue as the uncertainty of our economy is as prominent as the automation and efficiencies that robotics provide become a competitive necessity.

Tight Labor Market

As fully-remote/hybrid employment becomes the norm for Millennials in our rapidly digitizing economy, the surging hourly wages in this now understaffed industry (over 10% above the average hourly wage in the private sector) have not been enough of a draw to attract younger generations to this dangerous hands-on profession.

The number of construction workers employed in the US has not fully recovered from its peak of over 7.7 million in 2006 (2 years before the housing bubble popped). The number of construction workers in the US has fallen by more than 1% since its 2006 peak, while the general employed population has risen by over 11% (151.68 million employed in the US). At the same time, total construction spending in the US skyrocketed 37%, which is a clear indication of marginal productivity improvements.

Real economic growth is driven by a combination of changes between capital and labor expansions at its most basic level, but many forget about the critical exponential component: technology, which is quickly becoming the most important across sectors.

The construction workforce is aging fast, with the average age for this skilled labor industry growing from 37.2 in 1992 to 42.5 today. Some naysayers would say that the age of digitalization has softened and coddled humanity into something weak. Nothing could be further from the truth. The groundbreaking advancements in technology humanity has made in recent years stimulated a stronger global economy than ever before - this healthy resiliency was illustrated by the economic shift to digitally-driven remote functionality during lockdown.

Automation in construction is becoming an increasingly attractive operational avenue, as the swelling competition in the space brings down costs, and rapidly advancing robotic capabilities.

The construction robotics market is expected to generate an unprecedented 5-year compounded annual growth rate (CAGR) of 24% (according to Allied Market Research), and the best-positioned early-stage ventures in this space have capital return potential many multiples above that already zealous forward-looking CAGR.

Built World Robotic Market Trends

While the publicly traded global equity markets see $10s of trillions in valuation haircuts, the AEC venture investment space burgeons with fresh capital, as investors begin deploying the mountains of sidelined cash they’ve been hoarding since 2022 kicked off.

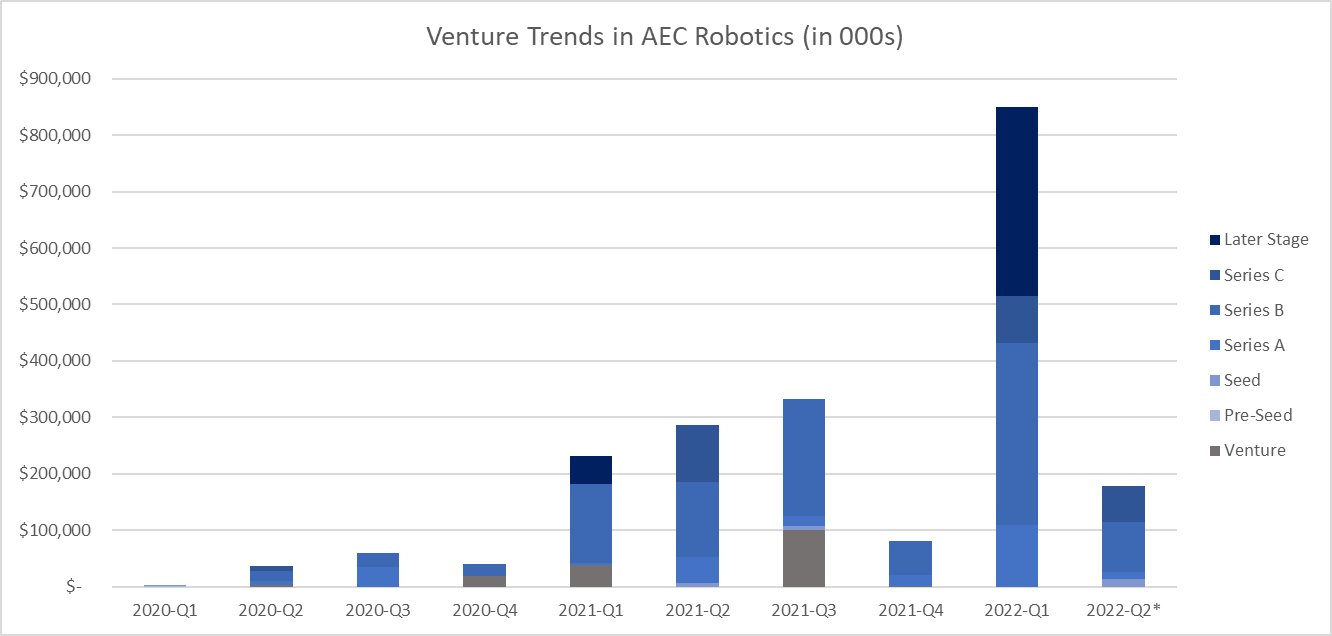

Venture funds have poured more than $1 billion into construction robotic startups since the start of this tumultuous year, accounting for more than half of the total investments this space has seen since the digitally-charged Roaring 20s began.

The valuation multiple compression we’ve seen across equity markets (public & private) has cash-rich VC & CVC (venture capital & corporate venture capital funds) professionals doing more than just looking at the increasingly attractive long duration opportunities in the construction tech space.

Warehouse-focused robotics and 3D construction printing innovations have seen the most significant cash infusions since this tumultuous year began.

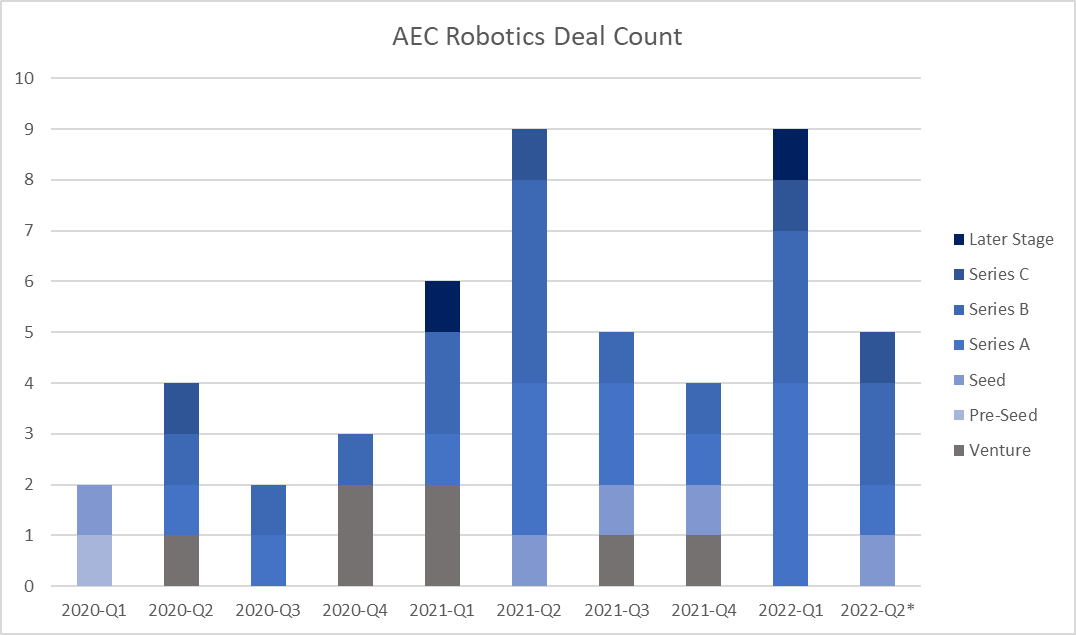

The volume and size of robotics deals in the AEC sector has been steadily increasing since 2020. As our economy begins to cool off after the post pandemic bull market, a growing volume of venture capital deal-flow has been directed towards robotics companies.

Top Venture Deals

Of the hundreds of robotics funding rounds in the BuiltWorlds ecosystem - tracked in real-time by BuiltWorlds Venture Dashboard - there were a number of deals that broke above that $100 million fundraising milestone. Featured below are a couple of the recent notable companies to receive nine-digit investments:

Exotec, a French–based warehouse robotics solutions company, secured $335 million in Series D funding led by investors Goldman Sachs, 83North, and Dell Technologies Capital. Exotec’s most renowned solution, The Skypod System, is a fully integrated, modular warehouse system which uses robots to stock shelves and escort inventory to desired locations around the warehouse. These systems allow customers to add robots, stations, or shelving units to the distribution center and not experience any interruptions in the supply chain process. Exotec’s warehouse systems are used by leading retail and e-commerce companies across 3 continents.

ICON, who built the first 3D-printed homes sold in the United States, raised a total of $392 million in Series B funding over the last calendar year. The initial raise was $207 million in August of 2021, led by Norwest Venture Partners, 8VC, Bjarke Ingels Group, Fifth Wall, Moderne Ventures, and Oakhouse Partners. In February of 2022, the company announced an extension of that Series B funding, receiving an additional $185 million from Tiger Global Management with participation from existing investors. These funds will be used to accelerate the company’s various 3D-printed housing community projects as well as “off-world construction” in partnership with NASA.

Addverb Technologies, is another heavy hitter in the igniting AEC robotics space, and its latest $132 million Series B funding round earlier this year is expected to fuel this AI-charged innovator’s next wave of prolific growth. Addverb sold 10,000 robots in 2021 and has already proven triple-digit topline growth in fiscal-year 2022 (ending March 31st). This strategic raise was solely funded by Reliance Industries, one of India’s largest conglomerate companies. The funds will be used to expand internationally (to North and South America) as well as break ground on robotic manufacturing facilities utilizing Addverb Technologies’ solutions. Addverb robots provide various solutions including warehouse automation, hospital asset tracking, airport baggage handling, and many more.

Top Investors

The cohort of investors within the AEC robotics ecosystem was exceptionally broad with a number of generalist VCs, strategic CVCs, and even more focused funds not putting all their eggs in this still exceptionally nascent basket since 2020 began.

Brick & Mortar Ventures, a leading “pure-play” AEC-focused VC in the market, has been the most active investor in the construction robotics space. Brick & Mortar has invested in 5 AEC robotics initiatives in the past year and a half, accounting for 25% of their total built world deal count. The fund’s most recent venture investment in Rugged Robotics $9.4 million Series A round in March, a leading competitor of Dusty Robotics (who closed a $45 million Series B less than two months later), to develop seemingly simple “Roomba-like” robotics for enhanced construction layout mapping.

Tiger Global, one of the world’s largest crossover funds (private & public) with $27 billion in assets under management (as of Q1 2022), came in right behind Brick & Mortar as the second most active investor in this niche, participating in 3 later-stage built robotic venture rounds (Series B & C) in the past 52-weeks. All of Tiger’s investments in the construction automation space were in companies with proven revenues, triple-digit CAGR, and a clear path towards an IPO. This is only natural for Tiger Global Management who dabbles in next-generation investment in both the private and public realms.

Built Robotic’s Future Market Disruptors

BuiltWorlds is scaling its venture vertical and building out actionable content to provide our community of AEC leaders (you guys) with leading edge insights. Our analytics team has been working with the tidal wave of ConTech/PropTech innovators poised to disrupt this rapidly adapting space.

Our Venture team will be primarily focusing on early-stage AEC-tech startups seeking Pre-Seed to Series A funding in this new member only section, featuring our favorite "Future Market Disruptors" in upcoming reports.

Industry 4.0 (aka the Fourth Industrial Revolution) is kicking off after a digital tailwind like we’ve never seen before. Entrepreneurial enlightenment in the AEC space has savvy venture capitalist and strategic corporate funds from legacy players on the hunt for the next Built World industry disruptor.

BuiltWorld’s startup ecosystem is brimming with an insurgence of 10x+ investment opportunities and our Venture team will be providing actionable insight into some of the best-positioned startups looking for that next capital infusion today.

Upcoming Venture Reports & Top Lists

BuiltWorlds Q2 Venture Report

Preconstruction Report

Project Software Report

Field Solutions Report

Smart Jobsite Report

BuiltWorlds Q3 Venture Report

Global Innovators 50

Do you think your startup has the potential to disrupt the future of the built world? If so, fill out the subsequent questionnaire to be considered. By filling out this form, your startup will also be considered for one of BuiltWorlds' monthly demo days which are featured in front of our Venture Forum - a group of active investors in the space.

Want Your Startup To Be Considered?

Fill out an application to get your startup the early investment exposure it needs to grow.

WANT TO VIEW THE REST OF THIS REPORT? (featuring this week's Market Disruptors) EXPLORE MEMBERSHIP OPTIONS BELOW:

Are you already a BuiltWorlds Member?

Click here to be taken to the full report

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.