The 2023 Top Investors Awards - to be Presented at Venture East

A unique and exciting addition to the Venture East Conference in 2023 is the introduction of our Top Investor Awards Ceremony. Last month we had the opportunity to share the Top 50 Active Investors in the space via our toplist and now we want to take that further.

Below are the categories of awards that we plan to present at this year’s Venture East Conference:

- Most Active Investor - This award goes to the most active investor in the Built ecosystem over the past 12 months. See BuiltWorlds 2023 Venture Investors 50 list for more.

- Largest VC Fund - This award goes to the traditional venture fund (defined as a multiple LP Fund) that announced the largest fund in the past 12 months.

- Most Influential Strategic Fund - This award goes to the Strategic Investor (defined as a single LP Fund) that has done the most to support the ecosystem over the past 12 months through the number of deals done, the size of deals, and other special initiatives undertaken.

- Top Strategic Fund Launch - This award goes to the Strategic Venture Fund (defined as a single LP Fund) that announced the largest fund in the past 12 months.

- Accelerator of the Year - This award goes to the Accelerator Program that has had the most impact on the ecosystem in the past 12 months.

- Most Active Corporate Acquirer - This award goes to the corporate innovator who has made the most value-creating acquisitions in the built ecosystem.

We are incredibly excited to celebrate the achievements of these leading venture companies and give them an opportunity to showcase all of the work they’ve done to help move towards a better built world.

Other Happenings to Look Forward to at Venture East

Aside from the glitz and glamor of the impending awards ceremony, Venture East is shaping up to be a conference that you won’t want to miss. We currently have over 40 thought leaders on the docket to participate in panel discussions and presentations on everything from how to create profitability from sustainability efforts to leading AI solutions within the preconstruction space.

- DealMaker's Alley - Venture East also allows attendees to participate in DealMaker’s Alley. This effort to streamline communication between VCs and startups at Venture Conferences was first introduced last year and proved to be a huge success. Startups who plan to attend can schedule specific time slots with investors and have a designated place (aka “the alley” - which is actually a nice, quiet room) to meet and discuss potentially strategic partnerships.

- LatAm Night - Also, unique to Venture East is the focus on the LatAm region of the world and how this small yet mighty area has impacted the global AEC investing space. Progreso X and BuildTech Ventures in partnership with BuiltWorlds will be hosting our first-ever LatAm Demo Night featuring startups from the region like Mangxo, Envirotech, Construex, Uptime Analytics, and more.

The 2023 Venture East Conference will be an incredible opportunity for investors and startups alike to take a pulse of the venture world as we head towards the end of the year and start to form a clearer picture of expectations for what’s to come in 2024.

Q3 Highlights Overview

Throughout the year BuiltWorlds carefully monitors investments and transactions occurring within the built ecosystem. After all, investments and M&A activity ultimately are what lead startups down the road to piloting and eventually adoption.

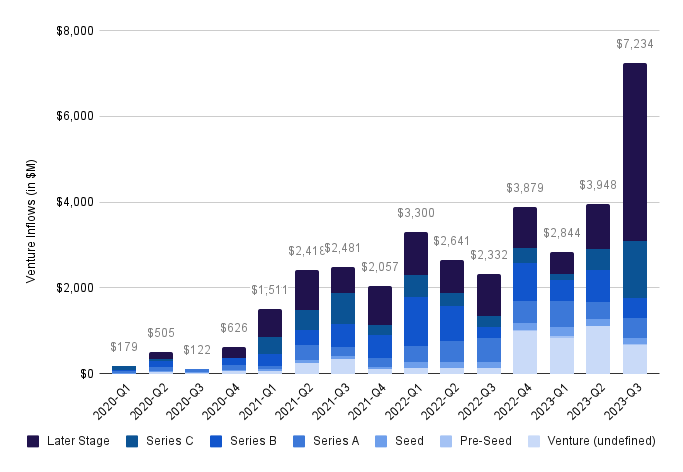

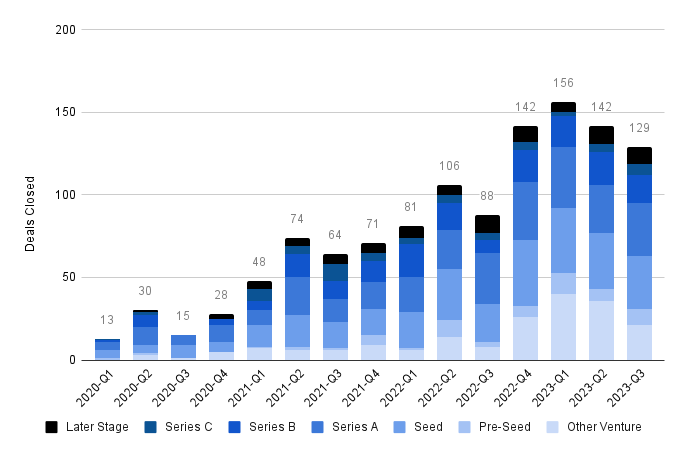

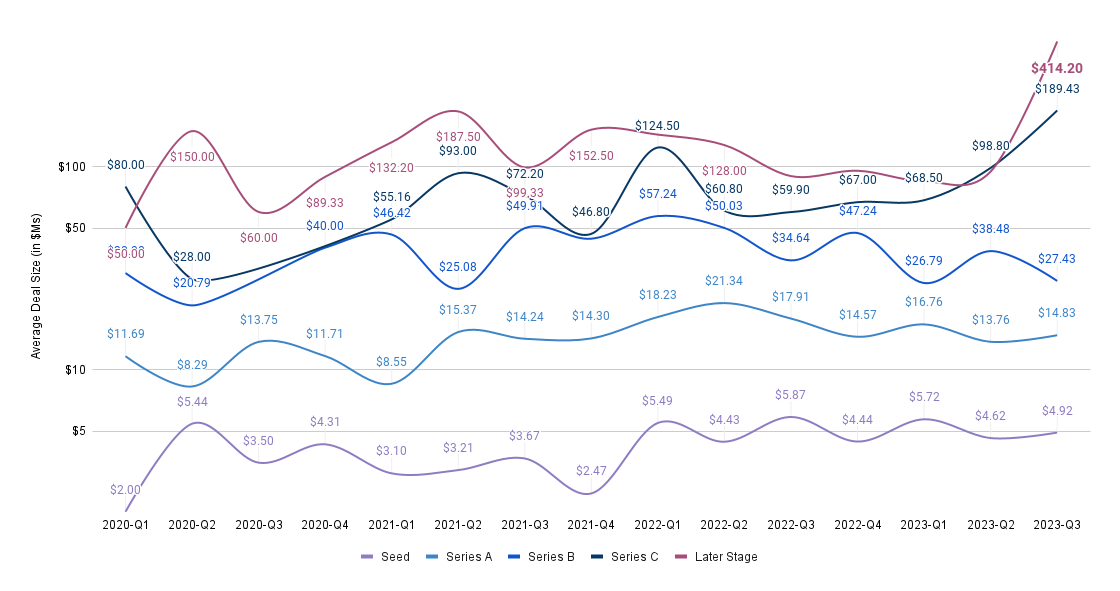

The third quarter of 2023 proved to be an exciting and pivotal moment for venture activity within the AECO space. Q3 saw a record level of deployment into emerging built world-tech solutions, with Series C and later-stage deals driving the action. Post-Series B deals accounted for 83% of quarterly capital invested, but only 16% of completed VC deals, propelling average later-stage check-sizes to incredible levels (see charts below).

Built World Venture Deal Flow (since 2020)

Average Check Size by Stage

Climate Tech-focused venture investors began to open their purse strings to this carbon-intensive industry primed for progress (the built world accounts for ~40% of global carbon emissions), with three $1B+ deals that defined Q3 (shown below).

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.