Yesterday, the Biden administration published a report calling for sweeping action on the lack of affordable housing in America. One of seven points covered in the administration’s 2024 Economic Report of the President, the affordable housing issue appears to be set to be a major campaign topic for the administration on par with the focus on energy transition that was such a prominent part of the Inflation Reduction Act legislation during the president’s first term. While the report primarily focuses on zoning and incentives opportunities for expanding the availability of affordable housing, a look deeper into the report reveals that the agenda could also include a major push to promote, manufactured, modular housing, providing a major boost to a new generation of integrated modular housing startups.

Deep in chapter four of the report, reference is made to the potential of manufactured housing to play a critical role in helping address the crisis. The report asserts (based on a Freddie mac web page that provides no obvious supporting evidence and cites a 1976 standard) that manufactured housing is 45 percent cheaper than traditionally built housing while also being higher quality, safer, and more ecologically sound and more resilient to natural disasters. While that is not a figure commonly heard in the industry, both industry experts and the report seem to agree that the opportunity to achieve the savings from modular would be realized as modular builders achieve economies of scaled in their productions, and that has been something that has been difficult for many volumetric modular builders up to this point. The report specifically suggests that manufactured housing could be a potent solution in rural areas of America, but many of the points made seem that they might also apply in urban and suburban areas as well.

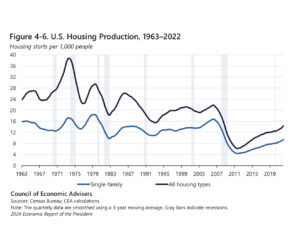

At the base of the economist report is an argument that the country is simply not building homes at a rate consistent with the rate of home building prior to the Great Recession, and this has led the country to have a significant housing deficit which is particular acute in the smaller, more affordable part of the market. If the federal government were to follow through on recommendations in the report, there are clear areas of opportunity to boost modular housing

- Allowing more sites to be available for affordable housing would open more opportunities to identify parcels suited to the specific designs and needs of modular. In a recent meeting with modular housing startup, Aro, we saw how the company uses software to analyze many parcels and identify those suited to their product. Clearly standardizing and loosening zoning rules could potentially open the way for more eligible parcels.

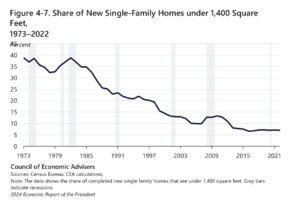

- Greater ability to build smaller homes could be a boon to modular companies like Chicago-based inherent homes which focusss on affordable housing. Additionally, incentivizing zoning that would allow for smaller home sizes would also help companies live inherent that also aim to offer “micro” homes, smaller units which could also be added to lots with existing homes where zoning does not currently allow multiple dwelling units.

- While rules allowing more and smaller single family homes may have applications in some areas for some modular companies, other modular builders such as FullStack Modular and AssemblyOS would benefit from rules allowing more midrise modular housing. Proponents of mid rise modular particularly argue that in densely populated areas where there is significant unhoused population, mid and even high rise modular buildings would ultimately be more efficient and logical.

- Depending on the financial tools the government were to make available, it is possible that the federal government might be able to help modular builders attaining more predictable backlogs, critical for maintaining a consistent workforce in modular factories, for optimizing throughput, and for financing investment in machinery and software that further helps maximize the efficiency of modular construction.

- Another long held impediment to the scaling of modular construction has been varying building codes across regions. In a business which presumably experiences improving economics as it produces more of the same product from a single factory, being able to standardize what is built by working to consistent, regional building codes can be a critical factor in how quickly a grove can achieve scale in its production.

- A perhaps more controversial area of regulation that may also support modular builders is in building systems designed to lower the carbon footprint and improve the resiliency of buildings. It is possible that certain of these types of requirements would promote the competitive of prefabricated homes such as those produced by Aro or European startup, GROPYUS, companies that bill their homes as being net zero, carbon neutral, or otherwise having better environmental profiles.

While there may be other ways the federal government could help promote the industrialization of housing construction through subsidies or through tax credits for adoption of other technologies or equipment that may improve the process or by assisting companies with the complex insurance requirements relating to the manufacture of housing as distinguished from building it on site, for example, it seems that the focus on reducing impediments to get housing factories to scale in serviceable regions in order to achieve economies of scale may be the great are of opportunity, and if, as the report suggests, the industry is still producing millions fewer housing units per year than it did in the first past of the century, than the demand may, indeed be there to support a variety of modularized housing projects across a the country, if people at local levels are willing to accept more uniform and more permissive rules.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.