Last month, Borealis Ventures announced the launch of Building Ventures, an early-stage venture capital fund dedicated to the built world. In the days following the launch, Jesse Devitte, co-founder of both Borealis and Building Ventures, sat down with BuiltWorlds' Journalist Jim Lichtenwalter to talk about the new fund and his goal of building a better world.

First off, this is the toughest question I'll ask you today: who are you and what is your title right now?

My name is Jesse Devitte and I'm one of the co-founders of Building Ventures. And previous to that I was a co-founder of Borealis Ventures.

You obviously just announced Building Ventures. Can you go into a little bit about what Building Ventures is?

It's really an expansion of the work we've been involved in over the last decade from our venture capital business, but one that allows us to increase our resources and enhance our focus on investment opportunities in the built world. I would consider this an important next step, but not the last step we'll make. There's more to come as we go forward. But it's really all about investing in and supporting the startups and entrepreneurs working towards a better built world. That's our mission at the end of the day.

So how did Building Ventures come about? You mentioned that you used to be with Borealis and you all did a lot of great work there. How did Building Ventures kind of spin out of that?

Let me just give some background quickly. In the 1990s, I was part of a company called Softdesk, which was the largest application add-on company for Autocad. We made the application for architects and engineers. We raised venture capital to fuel our growth and that company went public, it was quite a ride. That was one unique lifetime experience. And it happened to be where I grew up professionally, which was cutting my teeth, building and selling personal computer software for architects and engineers in the 90s. After the IPO and operating the company for a couple of years, Autodesk acquired us as they organized the AEC market group. And I became the first executive leading that group for Autodesk and driving their initiatives in AEC. So when I felt like that was in really good hands and I was ready to move forward to the next level, I decided to go out and see if I could create more of those type of companies, not specific to AEC, but just in general. It was a real shocker when all of a sudden after I co-founded a venture capital firm, AEC people start calling me to help them. And honestly, in the beginning, I was just helping them then Brad Schell called me from a company with a product called Sketchup, it was the first investment I made in 2003 as a venture capitalist in AEC software and I've never looked back.

[This fund is] really all about investing in and supporting the startups and entrepreneurs working towards a better built world. That's our mission at the end of the day.

Do you mind if I ask how much that venture was?

It was a company that was funded with less than $5 million including some early angel funding. We did something for the company that, frankly, we feel needs to happen a lot: we did a bit of what we call an "organizing round.” There's a time, if you will, to professionalize the company when the next level of capital comes in and it's a great time to make sure the organization is right, all the documents are right, the right team is on board, and that the company is ready to scale for the longer term. So we led an organizing round of capital for Sketchup and that round was less than $3 million and we did a portion of it.

But I think it's also one of the classic cases though, where capital was used for the right thing, which was to accelerate the business, not to substitute for lack of sales. I've been involved in over 50 investments now in my lifetime, more than 20 in the built world. Overall at Borealis, those 50+ investments have been across many industries. And there are many things that are the same. Capital is the best answer for fuel to grow your business. Sometimes people think of it in a different way. In the case of Sketchup, I don't think we ever used the actual capital that we invested in the company. It just gave the company the confidence to go to market super aggressively and that worked really well for them. That's an ideal situation for venture capital, and that's why the amount is sometimes not as important as the purpose and use of it.

We don't report individual results, but people would collectively accept the fact that it was a very successful outcome for the company, for the team, and for the investors. Something I always look for is a successful outcome supporting the company's mission. The mission of Sketchup was to make 3D available to everyone, to democratize 3D, specifically the conceptual drawing and design. And today that may indeed be the most used 3D design tool in the world. From a financial standpoint, it was a great success. And from the company mission, which is always where we're focused, it was an outrageous success, even if you look at it today.

Moving to Building Ventures, what stage are you all focusing on and why are you choosing that stage?

In general, we're early stage investors, but we have a particular word that's going to sound very New England-ly. And when do you share it with Matt Gray, he's going to chuckle. We are working in something we call the "sapling" stage. This is just after the initial “seed stage” before a company might be ready for a traditional Series A. We think this is when the biggest impact can be made to help a company and to help an investment become a company.

While “sapling” is our preferred entry point, we are also full life cycle investors so we intend to invest in every round of the company going forward and reserve the proper amount of capital to ensure we can do that--different than many of the strategics who can be a great partner for these young companies but generally write one check tied to a business partnership arrangement. It's ok for these different types of investors to be in the same company as long as everyone agrees what the company goals are going forward.

Interested in seeing more BuiltWorlds content centered around venture?

Here are four premium insights:

Investing in the Smart City - Jesse Devitte, Borealis

Increasing investment in the built world - Darren Bechtel, Brick and Mortar Ventures

BuiltWorlds 2018 Venture Investors 50 List

Venture in the Built World Research Report

To view, login to our Member Portal or apply to join the BW Member Network.

Why do you think this “sapling” stage is the area where you can make the biggest impact as opposed to other areas?

Because at that stage there is a product and it's in the hands of early users. There are also decisions that accompany a product to ensure it serves the marketplace and to make sure that those early customers are treated like investors. The other thing is that we believe you need to build a company. It's not just about an investment nor is it just about a product. Products don't stand alone. I think there is a particularly high bar in this industry because the nature of the customers who are designing, building, and operating things, are their businesses at their core. They’re looking to technology to help them achieve their goals, not replace what they're doing. They want to do it better. That requires a certain amount of knowledge, support, and ensuring of their success. In fact, at the end of the day, we don't use the term “built tech” because it's not about the tech, it's about the results.

This is why I like BuiltWorlds because you all are about a better built world. It's about the ultimate product. We're focused on the tech as one component, but also building a company. I use an analogy--it's on my LinkedIn page--it's a surfer on a surfboard, riding a wave. To me, the surfer is the team, the board is the product and the wave is the market - together those are the three basic components and a unique way to look at what we search for in these companies at this stage. Of course, you need to have a product and everyone that approaches us has a product or an advanced idea for a product or service. But really the most important thing to us in so many ways are the team – who these people are, what they're about, what their backgrounds are, what they're committed to, and if they are strong enough to adapt to market dynamics. The wave is the marketplace and key the dimension inside the wave is the customers. How much pain do they have, how badly do they need something, how do they think about it, how will they deploy it, how much will they pay for it? What is the business model? You could have the best team with the best product, but if there's not a market demand for it you could be the surfer standing in the parking lot with a nice board.

At the end of the day, we don't use the term “built tech” because it's not about the tech, it's about the results.

With that in mind, what separates Building Ventures from other VCs?

I would say we're company builders. And by the way, I think this is an industry that's less about traditional competition and is undercapitalized. We don't have a traditional competitive dynamic. Entrepreneurs who come and pitch us always tell us the same thing. Maybe this sounds a little hollow when I say it to you, but the reality is there's room for a lot of capital here and the time is now. Our hope is that as more venture firms are spun up to focus on the space along and more existing mainstream VC firms come into the space, we could maintain the same collaborative dynamic that design and building teams maintain to deliver actual buildings or pieces of infrastructure. So, therefore, less competition and more collaboration.

We know how the customers buy and consume products and technology in this space, whether they're architects, engineers, construction companies, or real estate professionals. We've been around this for a long time. We know how the customers implement technology and how they think about return on investment. The challenges around implementation and adoption of technology in this space are unique given that It's a project-based industry, so you really need to have an appreciation for how projects are designed, financed, scheduled and built. We are able to leverage our industry experience in helping build out companies to serve it.

On the venture side, we've been there. I've walked the walk. When entrepreneurs ask me how they should pick, I say beyond the industry knowledge, network access, and all the obvious things you want in an investor, the other part of this is that at the end of the day you want someone in your corner during your not-so-good weeks. Because when you’re building these businesses at the beginning, there's a lot of great things that are going to happen, but that journey also has a lot of tough days, long days, some not-so-good weeks. And I tell entrepreneurs, if you want us in your corner when that's happening, then you might want to sign us up. When things are going well, everybody's happy, but that's actually not how it goes most of the time. So, company building, industry-knowledgeable investors who are ready for the first call, at all times. That's sort of how I think about it. I think that's our greatest value add. But I would also just say we're collaborative, not just with the teams but with other investors and partners.

One of the things that stuck out to me about the press release for Building Ventures is that it talked about how the company was formed to fund and grow solutions for Earth's exploding population. What does that mean and what do you plan to do at Building Ventures to achieve that goal?

I would say this is one of the big things that's different now than it was 10 years ago. This industry of technology for architecture, engineering, construction, facility management, and real estate has been a little bit of a sleepy industry. Sure, the asset-heavy industries and the physical asset industries have always been a little sleepy, a little quiet, and a bit in their own domain. But there are bigger secular forces at work now that we've never had before, and the biggest set of secular forces at work are the collision course that we're on in our planet. We have one planet and too many humans all piling into cities, most of which are coastal. You can weave any story from that point, but we're focused on where the actual intersection is and we believe there's a point of no return in the next couple of decades and you can feel this, any city you're in in the world. According to one study we have to be on a pace of 13,000 new buildings finished every day somewhere in the world - just think about the scale of that challenge. So, there's a tremendous amount of pressure on our urban lifestyle and infrastructure and that's only going to get worse. Nine out of ten people born today will be born in an urban area. 200,000 people around the world will be moving from the country to cities today alone, somewhere in the world. Mike Bloomberg wrote a book that was very inspiring for us a year ago and it was called "Climate of Hope," that was written in the wake of the US withdrawing from the global climate accord. He had one very crisp conclusion and I'm going to quote him: "It's not as sexy as saving the rainforest and you won't raise any Hollywood or celebrity philanthropic money for it but the single best thing we can do to save the planet is to improve how we design and operate our buildings." That's really the bottom line because that's where we can have an impact.

One of the things about that is it does give you a focal point. Beyond the bad news part of this intersection point of no return, the good news is you're focused on where you could make a difference. And I think the way we design, build, and operate our built world in those environments is the key towards a more sustainable planet--which we're on the path to actually not having. I've watched this industry grow and this is one of the newer driving factors. You can't create that market dynamic - that wave - on your own. You have something driving it. And this is it. I think within that there's some particular investment thesis as they come out of that. We have to change how we design and build. The industrialization of construction and learning from how manufacturing is done is part of job one. We need to think about it that way and think about all the technology that could be put to work to enable that.

When the Empire State Building was completed, it was done in one year and 35 days. The Salesforce tower took over 48 months all these decades later. Should that really be the case? It doesn't seem like it should be. If you look at how they build cruise ships, they can build a cruise ship and put it in the water in 24 months. We can't complete a building of that scale in that period of time. But different parts of the industry are learning how to build better, and so it's just natural that it would come to this.

I think the way we design, build, and operate our built world in those environments is the key towards a more sustainable planet--which we're on the path to actually not having. I've watched this industry grow and this is one of the newer driving factors.

I totally agree with you. And you've been reading the same reports that I've been reading that say the construction industry is so far behind in adopting technology and I think that's just such a key aspect for us moving forward and get to that place where we're building things more efficiently and quickly.

Absolutely. And I don't think that eliminates any design. I mean design is just as important as the implications for the industrialization of construction, spaces, and service are significant. The ramifications are really big. It starts as a drop and then it ripples out from there. The impact is across the entire industry and you'll see this move towards new business models. That's another way when you know how an industry is in transformation: when you see new business models. And obviously, from your standpoint, you can see all the new companies too. Companies don't just come from anywhere. They are a sign, they are an early indicator that there's something really important happening. So the question is whether or not the companies will have the resources in the form of capital or access to the mentors who can help them build those businesses smartly and efficiently. And time will tell.

What sort of ventures do you plan on focusing on?

I would say that the bar for us are things that are considered disruptive, that's what we want to champion. This industry has seen a lot of evolutionary incremental change because the pain is so great when it comes to just trying to design, build, and operate more efficiently. But now the big decisions have to be made. So I don't want to sound soft or lofty the about it, but game changers are what we're interested in. We want to champion the people, technologies, and companies that are ready to disrupt this industry. That's what's really going to move the industry forward versus yet another small solution that does one piece of the solution. At the end of the day, we're looking to make a bigger impact. That's why we're investing more resources and we're really investing in the next decade of our life. We are hoping that our work will help the industry move forward, but at the end of the day, our legacy will be in these companies. Can we really identified build, support, and help advance game-changing companies? That's what the industry needs and that's our mission.

You've obviously had a lot of success at Borealis. How do you plan on replicating success at Building Ventures?

We've been part of a growing ecosystem, so one of the ways we want to continue to build on our success is making sure that we have a bigger impact than even just early investments. We want to contribute to the ecosystem, help grow the ecosystem, support the initiatives that are out there, mentor the next generation of entrepreneurs, and support the industry initiatives around diversity, hiring, and developing next-generation talent. All those things are very important to us. So we participate in accelerators and incubators, for exactly MIT designX. We're very involved here in the Cambridge, Boston area. We're also involved with Urban-X in Brooklyn. We give a lot of time to those and we do that because we're reinvesting in the industry, and we think we could make a bigger impact that way. I think that's one of the ways we'll do it. Ultimately, our companies will do the talking for us, but along the way, the key to making a difference to the industry is to be at an even bigger mission to make a larger impact. And you'll see that we'll announce some things for the future that support that initiative in addition to the work that we do.

This industry has seen a lot of evolutionary incremental change because the pain is so great when it comes to just trying to design, build, and operate more efficiently. But now the big decisions have to be made.

So recently the built industry has seen a lot of big exits and a lot of money raised in the venture sector. Do you think that we're at the top of the investment cycle or do you think we're just now getting started?

I think it's really early, obviously. I think it's really early because, frankly, the secondary drivers are only going to get more intense. There's only going to be more pressure on our world as we get more humans and they all pile into cities. That dynamic is going to continue to be fuel for the fire, and that's going to drive a more and more investment. I think you could see that even by, not just fund like ours, but Brick and Mortar and others, it's also by the many strategic investments in funds you see at becoming active now, and the broader investment community now coming to this industry. The combination of those things is an indication to me that we're really in the early stages of what's going to happen. And unfortunately I wish in some ways I had better news to report like there is something to be solved, but the reality of it is, this is not going to be solved anytime soon. For better or worse, there are decades of investment opportunities.

What is your view on venture right now, especially compared to where it's been in the past?

We're very happy to see the traditional venture world looking at this industry.

Yes. We are too.

That’s the first development. I think the other thing, frankly, is that sometimes we think about venture, we sort of look the other way, which is "let's look at the crop of entrepreneurs, the depth, and game-changing nature of the ideas." That's really encouraging. That's what gives me the confidence that we're going to see more and more knowledgeable venture, and larger funds involved around it, so it develops into essentially its own asset class. At the end of the day, what could be a bigger area for venture capital than the world in which we live, breathe, are born into. Everything we do every day is the built world! Everything we do in every hour of our days involves the built world. But no one has ever really thought about this as an investment area and I believe it's going to become one of these areas that is going to grow very fast and people will look back years down the road and think "why didn’t someone think about that as a sector for investment versus networking, consumer electronics, or whatever?" Those are all interesting things in life, but this is the real thing and that's why it's the next great area. We have a saying at Building Ventures: the next great hardware platform is our physical world. And that's what we're focused on improving, building on, and advancing.

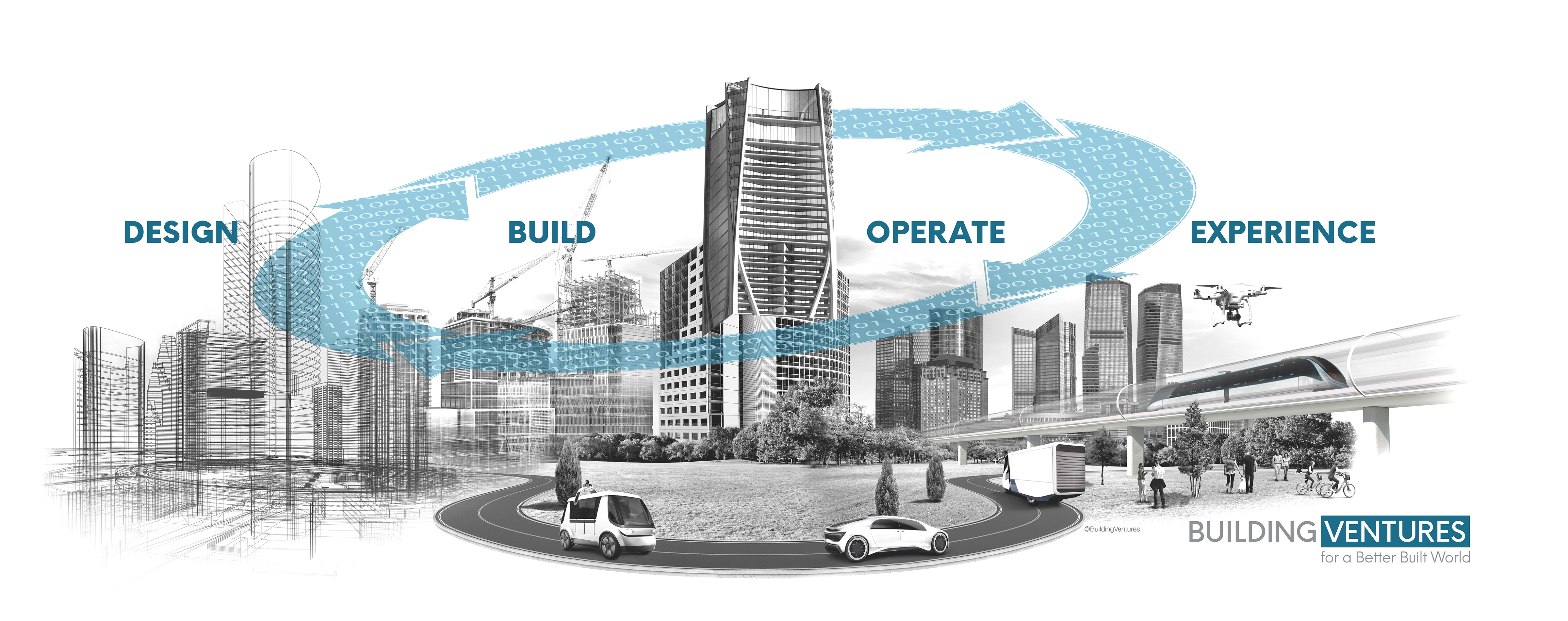

That's another reason why we're not just focused on how we design, build and operate it, but also how people experience it. That's where the humans if you will come into the formula, how the population experiences it. I think all the tools we have--mobile, cloud, sensors, etc.--they enable that vision to become real. And at the end of the day, it's driven by citizens, people, and humans around the world who interact with the built world. That's the ultimate test. And as you know, there's been a disintermediation, given through transparency of technology, that more people can have a say. So, owners now have a bigger say in what's being designed to build for them because they can literally see it. I had an architect friend who once told me trying to understand where a building project is just like driving down the street in the pouring rain with no windshield wipers - it doesn’t have to be that way anymore.

Previously you could not see much into the process. Now you can see a lot more. You can literally see how you design what your progress is like. And that makes for so much better decisions earlier in the process which delivers a better product at the end of that component of the built world. I think that we're really just beginning, and BuiltWorlds, and all of us who were in this together are at the forefront of the next great investment sector because it's the biggest one we have in the world--because it is our world--and it's undercapitalized. The problems that are putting pressure on it are only going to increase, unfortunately. So I think that means opportunity.

A little earlier you said you believe we're going to have decades and decades worth of investment opportunities to come in this industry. With that being said, what are your long term goals for Building Ventures? 10 to 15 years from now when you look back, what do you want Building Ventures to look like?

I hope that we will be viewed as people that help create some great companies that made a major impact and improved our physical world. That's the combination of a business and investment success and actual real-life success. That's the formula we're looking to achieve. We will be graded by the companies we've helped build with the entrepreneurs that we back, and the work that they do and how meaningful it is. That will be the test for us. And we're on that mission. It's been interesting for me because it feels like I've been in training for this, so I'm really excited because it's game time at the next level now and it's a really unique moment in time. My Building Ventures co-founder, Travis Connors and I did our first deal together in 2006 which was a Smart Cities company long before we had the term “Smart Cities”. We’ve been watching and waiting for this market opportunity to reach an inflection point that would support a dedicated venture effort in the built world and we believe it has finally arrived. Again, I keep saying this, but it's because to a certain extent it's because of some unfortunate challenges we have on planet Earth. But improvement in how we design, build and operate is overdue and absolutely necessary. This just provides more impetus, the energy to get people moving and get it done.

I'm a believer in the market, and markets speak. We don't make things up and create markets, we identify them and we leverage them, we work with entrepreneurs to deliver on their promise. The market is speaking. This capital that's being raised, whether it's by the firms in the industry or its outside people coming in, is the market is indeed speaking. When we look at who our investors are, it's very exciting to see many industry people involved in our activities, whether they're in our network or they're more directly collaborating with us. And I think again, that speaks volumes to what's happening in the industry. The industry including many of the leading traditional players in it are leaning all the way in, too. So it's a great market opportunity to be captured from my standpoint.

Jim's TL;DR Corner:

Jesse said a lot of interesting and encouraging things in this interview. At the most high-level, the built industry is--in the opinion of Jesse--at a time of great change. As he said, we are really at the beginning of the investment cycle, which means the built world is fertile ground for innovation and new technologies. Zooming in a little more, Jesse provided us with some details of Building Ventures’ goals moving forward. Up front, the fund is really continuing a lot of Borealis’ previous work, while focusing on opportunities in the built environment. While Building Ventures wants to fund companies in all stages of fundraising, but they are specifically focusing on the “sapling stage” between a company’s seed stage and series A round of funding. This is where Jesse feels like Building Ventures can make the most difference, and help usher forward products and plays that not only benefit consumers, but also “build a better world.” One of the key aspects of this goal is to help push the construction process forward by encouraging more environmentally-friendly practices and products.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.