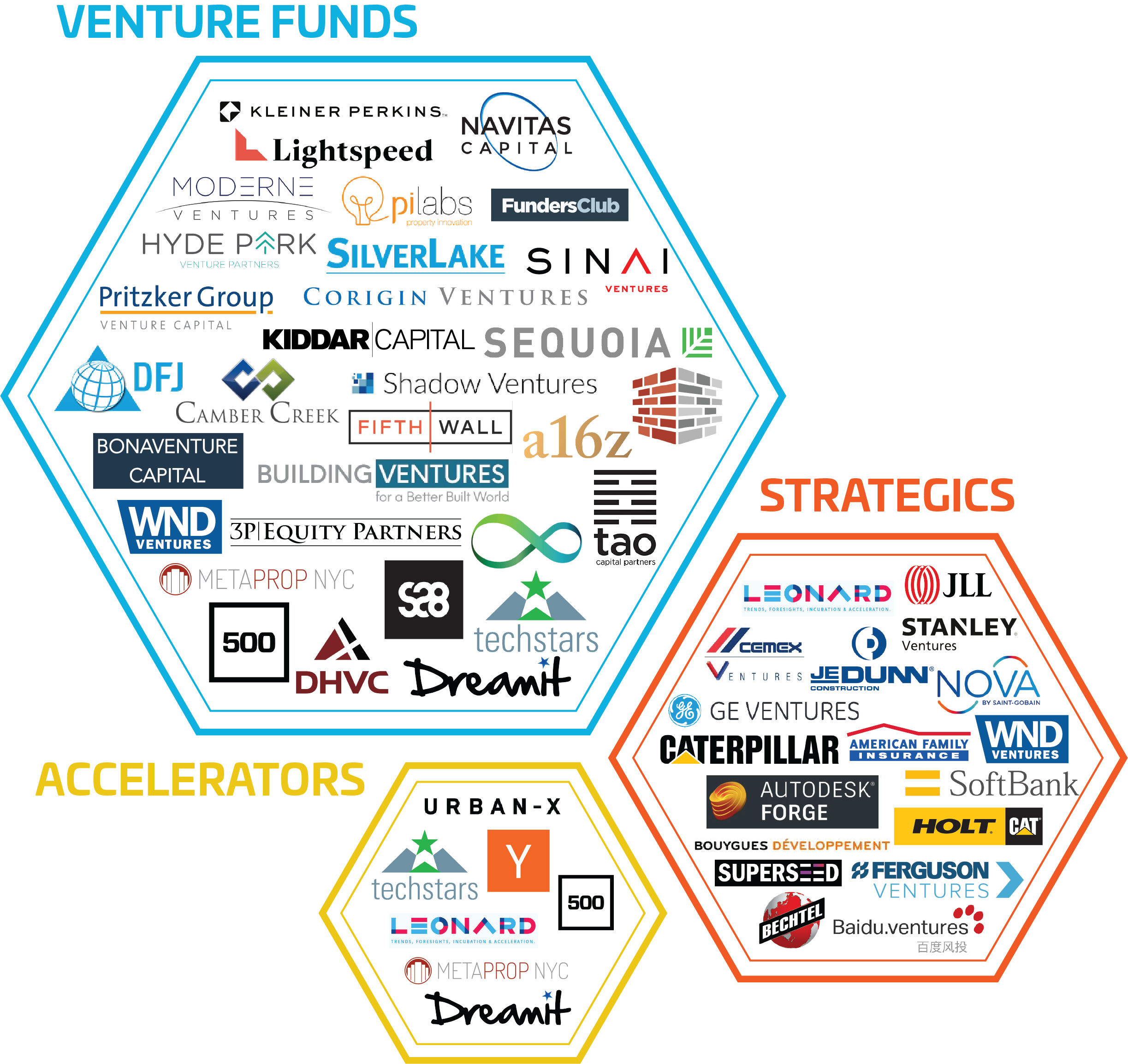

Earlier this year BuiltWorlds released its first ever list highlighting venture investors within the built environment. We saw major names like Brick & Mortar, Tech Stars, and the Autodesk Forge Fund, among other venture funds, accelerators, and strategic investors.

It’s time we expand on that.

We have found it imperative to keep our network informed about who is leading the funding of some of the built industry’s hottest tech startups like Katerra, PlanGrid, and Rhumbix. Read on to explore how some of these household names got their start, and which investors helped to propel them.

Didn’t make the list? Know a company that deserves to be included? We know we can’t find everyone in the space, so please apply to be considered for our future lists on the Insights Release Calendar.

*List appears in alphabetical order by sub-category

Venture Funds

1. 3P Equity Partners

Headquarters: San Jose, CA

Founding Year: 2012

Founder(s): Leonid Perelman

Number of Investments: 3

3P Equity Partners invests mainly in mid-sized companies within the general manufacturing, heavy industrials, e-commerce, consumer retail and technology industries. Investments in the built industry have been focused on the manufacturing sector abroad, largely within eastern European countries.

Notable built environment portfolio companies: JPI Glass, Teknika Strapping Systems, Van-Am Custom Engineering

2. Andreessen Horowitz (a16z)

Headquarters: Menlo Park, CA

Founding Year: 2009

Founder(s): Ben Horowitz, Marc Andreessen

Number of Investments: 710+ (99 leads)

The firm specializes in seed stage funding through later stage and growth stage investments. With a significant volume of heavy-hitter investments like Airbnb and Lyft, it is no surprise that Andreessen Horowitz emphasizes the fastest growing sectors including: media, software, mobile, internet, infrastructure, and technology.

Notable built environment portfolio companies: Airbnb, Lime, Lyft, Oculus VR, Airware

3. Bonaventure Capital

Headquarters: Birmingham, AL

Founding Year: 1998

Founder(s): Steve Dauphin

Number of Investments: 37 (1 exit)

Bonaventure focuses on investing and partnering with companies that will positively impact cost and use of the built environment. Following an investment, Bonaventure partners with management teams and boards of directors to adapt and improve strategy and execution. With investments in companies like Gridsmart and PowerGen, Bonaventure is contributing to the evolution of city infrastructure and the built environment.

Notable built environment portfolio companies: Gridsmart, PowerGen, Enviva

4. Brick & Mortar Ventures

Headquarters: San Francisco, CA

Founding Year: 2014

Founder(s): Darren Bechtel

Number of Investments: 28 (5 leads)

Darren Bechtel and his "built industry tech" focused venture firm, Brick & Mortar, have been entirely focused on the real estate, hospitality, and construction industries since its founding in 2014. In 2018, the team led funding rounds for VEERUM and zlien, after a substantial investment year in 2017 which included notable companies like HoloBuilder, Serious Labs, Rhumbix, and BuildingConnected.

Notable built environment portfolio companies: HoloBuilder, Rhumbix, PlanGrid, Serious Labs, BuildingConnected, zlien, VEERUM, Fieldwire, Getable

5. Building Ventures (fka Borealis Ventures)

Headquarters: Boston, MA

Founding Year: 2001

Founder(s): Jesse Devitte, Travis Connors

Number of Investments: 74 (26 exits)

Building Ventures was built for the built environment. With over 20 investments and 10 successful exits in the built space since they were founded 17 years ago, Jesse Devitte and his partners are uniquely focused on investments at the convergence of design, construction and real estate technologies. In recent years, the Borealis Built Environment Investment team made investments in Smartvid.io, SketchUp, Vico Software, FieldLens, Honest Buildings, Assemble Systems, and many more.

Notable built environment portfolio companies: Blokable, Helix, Honest Buildings, Smartvid.io, Fieldlens (acquired by WeWork), SketchUp (acquired by Google), Vico Software (acquired by Trimble), Assemble Systems (acquired by Autodesk), Envista (acquired by Accela).

6. Camber Creek

Headquarters: Washington, D.C.

Founding Year: 2009

Founder(s): Casey Berman

Number of Investments: 24 (10 exits)

Camber Creek has taken a unique approach to real estate tech investment by offering their portfolio companies an advisory team with expertise that spans the industry from construction to development to property management, leasing, and investing. 2018 marked the closing of the second Camber Creek fund focused on the real estate tech industry, which included investments in companies like Latch and Bowery.

Notable built environment portfolio companies: Bowery; Building Engines; Latch

7. Corigin Ventures

Headquarters: New York, NY

Founding Year: 2013

Founder(s): Ryan Freeman

Number of Investments: 47 (10 leads & 5 Exits)

The relatively young venture firm launched at full speed and now has a solid portfolio of over 50 companies. Providing seed capital to talented founders, Corigin Ventures invests among the built world in IoT and real estate tech, including real estate platform Compass and keyless smart access system company Latch.

Notable built environment portfolio companies: Renoviso, Compass, Transfix, Latch, LoftSmart, Transported, Roam, Bowery

8. DFJ Growth

Headquarters: Menlo Park, CA

Founding Year: 1985

Founder(s): John Fisher, Steve Jurvetson, Tim Draper

Number of Investments: 804 (194 leads & 167 exits)

DFJ has spent three decades discovering and celebrating those billion-dollar tech companies that are pushing the boundaries of innovation. Their niche includes investments in global leaders like Twitter, Baidu, and Tesla, so when their attention is drawn to built industry tech (Katerra, Formlabs, Silver Spring Networks, Helix) we're confident the industry is on the right track.

Notable built environment portfolio companies: Helix, SolarCity, Silver Springs Networks

9. DHVC

Headquarters: San Francisco, CA

Founding Year: 2013

Founder(s): Andrew Gu, Shoucheng Zhang

Number of Investments: 147 (17 leads)

DHVC invests in companies leading the charge within artificial intelligence, AR/VR, big data, blockchain, cloud computing, and IT applications. DHVC participated in the series C round of funding for popular construction drone technology company 3DR back in 2015.

Notable built environment portfolio companies: 3DR, AutoX, Trustlook, Bigstream, Quilt Data

10. Fifth Wall

Headquarters: Venice, California

Founding Year: 2016

Founder(s): Brad Greiwe, Brendan Wallace

Number of Investments: 20 (7 leads)

Fifth Wall is seeking to "reimagine the built world." After making a splash in February 2017 by announcing its $212 million focus fund, the largest venture fund to ever exclusively target built world tech, Fifth Wall has not taken a break. In 2018, the firm sought to raise a targeted $400 million for its second flagship fund to focus on real estate tech, including industry names like Opendoor and Hippo.

Notable built environment portfolio companies: Enertiv, Clutter, Opendoor, VTS, Blueprint Power

11. FundersClub

Headquarters: San Francisco, CA

Founding Year: 2012

Founder(s): Alex Mittal, Boris Silver

Number of Investments: 338 (6 leads & 38 exits)

FundersClub launched the first ever online venture capital platform with the purpose of funding the most innovative startups communications, IT, transportation & logistics, and real estate at the earliest stages. Portfolio companies have gone on to raise over $3 billion in follow-on capital from some of the leading built industry investors including, Andreessen Horowitz, Sequoia, and Kleiner Perkins.

Notable built environment portfolio companies: Bridgit, InstaGIS, Flexport, EasyPost, ShipBob

12. Hyde Park Ventures

Headquarters: Chicago, IL

Founding Year: 2011

Founder(s): Guy Turner, Ira Weiss

Number of Investments: 114 (17 leads)

Hyde Park Ventures has been an active funder of software startups in the midwest for 7 years. In that time, they have made well over 100 investments and numerous exits, while leading upwards of 15 rounds, and reaching the construction and real estate industries along the way with portfolio companies like Bridgit and Truss.

Notable built environment portfolio companies: Bridgit; Gradebeam; cribspot; Truss; ShipBob

13. Invenergy Future Fund

Headquarters: Chicago, IL

Founding Year: 2017

Founder(s): Michael Polsky

Number of Investments: 5 (3 leads)

Understanding that energy efficiency and availability plays one of the largest roles in the built environment, Invenergy Future Fund seeks to invest in those companies doing just that. The fund focuses on the digital application of affordable energy opportunities and despite its youth, has made significant impact by investing alongside larger players like GE Ventures.

Notable built environment portfolio companies: DroneDeploy, Volta Charging, SparkCognition

14. Kiddar Capital

Headquarters: Falls Church, VA

Founding Year: 2007

Founder(s): Todd Hitt

Number of Investments: 13 (1 lead)

Kiddar Capital launched its Built World Fund in 2017 taking a step away from its private capital investments by raising $25 million in outside capital. Leading built industry investments include popular names like Aquicore, BuildingConnected, and Rhumbix. Also notable is Founder and CEO Todd Hitt’s $50 million private capital commitment to nurturing built world technologies, specifically in construction, real estate, logistics, and automation.

Notable built environment portfolio companies: Aquicore, Upside Door, BuildingConnected, Kanler, Rhumbix, CargoSense

15. Kleiner Perkins Caufield & Byers

Headquarters: San Francisco, CA

Founding Year: 1972

Founder(s): Eugene Kleiner, Tom Perkins, Frank Caufield, Brook Byers

Number of Investments: 1045 (266 leads & 207 exits)

KPCB might just be one of the most notable investment firms in the U.S. today as demonstrated by its investments, which include Google, Amazon, Spotify, Airbnb. Despite the recent loss of Mary Meeker, Kleiner remains a top talent organization that continues to dip its toes in AEC/RE technology companies, such as Nest, Airware, and Silver Spring Networks. We expect attraction to the industry to grow once larger exits become more commonplace.

Notable built environment portfolio companies: Nest, Airware, chargepoint, Silver Spring Networks

16. Lightspeed

Headquarters: San Francisco, CA

Founding Year: 2000

Founder(s): Barry Eggers, Christopher Schaepe, Peter Nieh, Ravi Mhatre

Number of Investments: 653 (192 leads & 119 exits)

Of their 300+ portfolio companies, Lightspeed has seed one third either IPO or get acquired. Additionally, one third of them are majority female-owned or female-fronted companies. With fewer, yet some big built industry names (like BuildingConnected) making up its portfolio, we expect growth in these numbers as venture capital flowing into the built industry continues to grow at a rapid pace.

Notable built environment portfolio companies: ALICE, BuildingConnected, SolarEdge

17. MetaProp

Headquarters: New York, NY

Founding Year: 2015

Founder(s): Aaron Block, Clelia Peters, Zachary Aarons

Number of Investments: 39 (4 leads)

Grounded in the Real Estate industry, MetaProp is moving past the smaller investment arena, launching its second fund focused on real estate coming in at $40 million in June of this year. Unique to MetaProp are its investments in accelerator graduates including construction software platform OnSiteIQ and real estate investor software platform Hoozip.

Notable built environment portfolio companies: Blueprint Power, LocateAI, Workframe, Flo Technologies, Ravti, Enertiv, onTarget, Parkifi, Betterview, OnSiteIQ

18. Moderne Ventures

Headquarters: Chicago, IL

Founding Year: 2015

Founder(s): Constance Freedman

Number of Investments: 35 (1 exit)

Moderne Ventures is a Chicago-based venture fund that serves early-stage startups in the real estate sector along with mortgage, finance, insurance, and home services. Constance Freedman's firm takes partnership seriously as they’re tooled with Moderne’s influential corporate network of over 700 corporations and executives who provide business opportunities and guidance. Moderne Ventures recently announced the seven companies selected for its 2018 Passport Program (including smart building technology platform Dwelo), consisting of a seven month industry immersion program packed with strategic consulting and mentorship.

Notable built environment portfolio companies: Fieldlens, LeaseLock, Arcbazar

19. Navitas Capital

Headquarters: Los Angeles, CA

Founding Year: 2009

Founder(s): Jim Pettit, Travis Putnam

Number of Investments: 24 (8 leads)

A $60 million fund focused on real estate and construction technologies, Navitas Capital invests across themes such as AI, workflow, and smart buildings, among others. Among a deep portfolio of other built industry leaders, Navitas has helped grow and scale companies like PlanGrid, Gridium, and Katerra.

Notable built environment portfolio companies: PlanGrid; Gridium; Katerra; Matterport; Honest Buildings; Aquicore; View; Optimum Energy; Truss

20. Pi Labs

Headquarters: London, UK

Founding Year: 2014

Founder(s): Dominic Wilson

Number of Investments: 27 (6 leads)

Europe's first venture capital platform investing exclusively in real estate technology, Pi Labs is not afraid to take a bet on tomorrow's next great idea. Investing largely in seed rounds, Pi Labs puts far more than financial capital behind its portfolio companies, making sure to leverage its vast ecosystem of industry experts. You'll notice some unique names coming out of this European investor as they focus largely on companies within their region.

Notable built environment portfolio companies: Airsorted, Switchee, Rentuu, Property Basecamp

21. Pritzker Group Venture Capital

Headquarters: Chicago, IL

Founding Year: 1996

Founder(s): JB Pritzker

Number of Investments: 184 (26 leads)

The Pritzker Group Venture Capital offers a differentiated approach to investing and as such are appropriately categorized as an 'evergreen fund', meaning that they will incrementally supply capital throughout the business lifecycle. This means that they are in it for the long haul. Specializing in early expansion, Pritzker has emphasized consumer-focused, digital health and emerging technology companies, backing built industry companies like IrisVR, Dronebase, and smartvid.io.

Notable built environment portfolio companies: Dronebase, SpotHero, FleetMatics, IrisVR, smartvid.io

22. s28 Capital

Headquarters: San Francisco, CA

Founding Year: 2015

Founder(s): Kent Ho

Number of Investments: 30 (4 leads)

s28 Capital invests in founders ideas, especially those that have the potential to scale quickly as defensive products, across various consumer and enterprise technology sectors. With massive built industry tech names like Rhumbix, PlanGrid, and Kespry on their roster, we are given confidence in the future of construction technology.

Notable built environment portfolio companies: Rhumbix, PlanGrid, Kespry, Intermix.io

23. Sequoia Capital

Headquarters: Menlo Park, CA

Founding Year: 1972

Founder(s): Don Valentine

Number of Investments: 1166 (368 leads)

Sequoia is a household name in the investment community with companies like Google, Airbnb, Oracle, and Apple entering their list of portfolio companies. But it is important to note an emphasis on many companies disrupting the built industry including PlanGrid, NEXT Trucking, and Houzz.

Notable built environment portfolio companies: Houzz, PlanGrid, Embark Trucks, Mapillary, NEXT Trucking, Ascend.io

24. Silver Lake

Headquarters: San Francisco, CA

Founding Year: 1999

Founder(s): David Roux, Glenn Hutchins, Jim Davidson, Roger McNamee

Number of Investments: 50 (23 leads)

Silver Lake is devoted to the leading philosophy that global technology demand will shape the future. Given the enormous flood of built industry technology companies entering the private markets, we expect to see a larger portion of Silver Lake's consideration shift toward these companies moving forward.

Notable built environment portfolio companies: EDR, Aras

25. Sinai Ventures

Headquarters: Palo Alto, CA

Founding Year: 2017

Founder(s): Jordan Fudge, Eric Reiner

Number of Investments: 42 (8 leads)

Investing at all stages of the venture lifecycle, Sinai Ventures has shown a strong dedication to advancing software and internet startups. With 5 lead investments since the beginning of 2018, companies like Doorport and Blink Identity are helping to innovate in the smart building tech sector in partnership with Sinai.

Notable built environment portfolio companies: Doorport, Compass, Biobot Analytics, Blink Identity, Openland

26. Tao Capital

Headquarters: San Francisco, CA

Founding Year: 2002

Founder(s): Nicholas Pritzker, Joby Pritzer

Number of Investments: 26 (6 leads)

Since 2002, Tao Capital Partners have invested in companies that are making positive, sustainable change in technology, alternative energy, healthcare, and real estate. Portfolio companies Buildium, SolarCity, and Raken in particular showcase Tao's dedication to innovation in the built industry as one of the core investment areas they focus on.

Notable built environment portfolio companies: Buildium, SolarCity, Raken

Strategics

27. American Family Ventures

Headquarters: Madison, WI

Founding Year: 1983

Founder(s): Peter Gunder, Dan Reed

Number of Investments: 25 (7 funds)

American Family Ventures is the venture capital arm of American Family Insurance. Their approach involves investing across the growth cycle from seed rounds to growth stage rounds. Notable exits include ride-sharing company Juno and global home security company Ring (acquired by Amazon in 2018).

Notable built environment portfolio companies: Ingenious.io; Hover; Cozy; Ring

28. Autodesk (Forge Fund)

Headquarters: San Rafael, CA

Founding Year: 1982

Founder(s): John Walker

Number of Investments: 130+ (67 acquisitions)

Autodesk has historically been a major player among strategic investors into the built industry, helping a number of software innovators grow and acquiring several of them. In 2017, the company announced its $100 million Forge Fund targeting investments in collaboration across designers, makers, and engineers with notable investments such as 3DR, Smartvid.io, and most recently, its investment and acquisition of Assemble Systems, utilized to help expand Autodesk's offerings.

Notable built environment portfolio companies: Assemble Systems (acquired in 2018), Rhumbix, eSUB, 3DR, Smartvid.io

29. Baidu Ventures

Headquarters: Beijing, China

Founding Year: 2016

Founder(s): Wei Liu, Daisy Cai

Number of Investments: 58 (2 funds)

Baidu Ventures is the venture arm of Chinese internet service company Baidu. The independent fund is focused on investing in companies pushing the boundaries for cutting-edge technologies like artificial intelligence, virtual reality and data-enabled companies. Baidu Ventures offers a unique resource: their parent company and its deep team of talented engineers as well as its data and systems architecture. With two funds thus far, the venture arm has raised over $500 million.

Notable built environment portfolio companies: OpenSpace, AMP Robotics, Airmap; CiDi

30. Bechtel Future Fund

Headquarters: San Francisco, CA

Founding Year: 2009

Founder(s): Robin Bechtel

Number of Investments: 9 (2 leads)

A strategic internal incubator and capital fund for leading engineering, procurement, construction, and project management company Bechtel, the Bechtel Future Fund finances technologies that can dramatically improve engineering and construction processes, quality, and safety. The fund takes ideas from customers, employees, and suppliers, allowing them to mature from concept to prototype in a sandbox before deploying as them as Bechtel project pilots, encouraging exploration and innovation in the built industry.

Notable built environment portfolio companies: Hover, Dealpath, Citadon, APX, Myhomekey.com

31. Bouygues Développement

Headquarters: Paris, France

Founding Year: 2015

Founder(s): Renaud Trnka

Number of Investments: 18

Venture arm of large French construction company Bouygues Group. With a focus on construction and engineering tech Bouygues Développement is a leader among European built environment investors.

Notable built environment portfolio companies: Colas Group; RB3D

32. Caterpillar Ventures

Headquarters: Menlo Park, CA

Founding Year: 1925

Founder(s): Caterpillar Inc.

Number of Investments: 15 (5 leads)

Caterpillar Ventures is a subsidiary of the world's largest construction equipment manufacturer, Caterpillar Inc. With deep industry experience from generations of customer, dealer, and supplier collaboration, Caterpillar Ventures continues to strategically invest in startups innovating in the fields of robotics, energy, materials, and digital solutions. Strategic investments can take many forms, but an agreement between portfolio company Airwave proved to provide the drone analytics company distribution to Caterpillar's and its dealers' customers.

Notable built environment portfolio companies: Clearpath Robotics; Yard Club (acquired by Caterpillar); TriLumina; busybusy; Fastbrick Robotics; Sarcos

33. CEMEX Ventures

Headquarters: Madrid, Spain

Founding Year: 2017

Founder(s): CEMEX

Number of Investments: 5 (3 leads)

CEMEX Ventures is the corporate venture arm of global building materials giant CEMEX. With an emphasis on urban development, new construction trends, and technologies that improve the connectivity within the construction value chain, the firm is looking to invest alongside those companies pushing the boundaries of the construction industry. CEMEX launched its 2018 Construction Startup Competition following the success of the previous year which awarded the winning spot to construction productivity platform Ipsum. The competition is based on the objective of finding exactly these tech startups inspiring to disrupt the construction industry.

Notable built environment portfolio companies: Concrete Sensors, StructionSite, Prysmex, Saalg Geomechanics, jelp, Ipsum

34. Ferguson Ventures

Headquarters: Newport News, VA

Founding Year: 2018

Founder(s): Ferguson

Number of Investments: None at this time

Plumbing supplies and HVAC equipment distributor, Ferguson, is committed to driving the built industry forward and as such, established Ferguson Ventures (in 2018) as its venture arm tasked with partnering with technology companies, providing industry expertise, and scaling assistance. Given its youth, we have limited information on potential portfolio companies, but hold high hopes for this new business unit.

35. GE Ventures

Headquarters: Menlo Park, CA

Founding Year: 2013

Founder(s): General Electric

Number of Investments: 158 (38 leads & 22 exits)

GE's venture arm has made it a priority to invest in the digital revolution with a unique ability to leverage its parent company to help portfolio companies scale and accelerate their growth. With both lead and supporting investments from Series A through Growth, GE Ventures is driving digitization and the adoption of emerging smart technology. In 2018, they led a Series D round for African renewable energy innovator Zola Electric, and continue to invest in industrial IoT applications.

Notable built environment portfolio companies: Upskill, Volta Charging, Rethink Robotics, Advanced Microgrid Solutions, Zola Electric

36. HOLT Ventures

Headquarters: San Antonio, TX

Founding Year: 2016

Founder(s): Charlie Strickland

Number of Investments: 4 (2 leads)

San Antonio-based heavy equipment dealership HOLT CAT, the largest CAT dealer in the U.S. has made partnerships for the purpose of innovation a cornerstone of their business since the early 20th century. Despite its youth in the formal venture space, HOLT Ventures brings a wealth of mentorship and guidance to new technology companies solving challenges in the industrial and manufacturing industries. This was well exemplified by their partnerships with fellow venture firms Caterpillar Ventures and Brick & Mortar Ventures to fund three industrial startups at SXSW in 2017: PermitZone, Yan Engines, and 5D Robotics.

Notable built environment portfolio companies: PermitZone, Airwave, Smart Picture, Used Equipment Guide, 5D Robotics

37. JE Dunn

Headquarters: Kansas City, MO

Founding Year: 1924

President and CEO: Terry Dunn

Number of Investments: 3 (3 leads)

The construction services giant JE Dunn opened a strategic venture arm in 2016. Their first investment went to Site 1001, a spinout from the construction Giant who led their Series A which closed at $11 million in 2017.

Notable built environment portfolio companies: Site 1001; Homebase

38. JLL Spark Fund

Headquarters: San Francisco, CA

Founding Year: 2017

Founder(s): JLL

Number of Investments: 3 (1 lead)

Stimulating a surge in real estate technology investment, JLL Spark launched its $100 million Global Venture Fund dedicated to real estate tech. JLL Spark was launched by parent company JLL in 2017 in order to identify, incubate, and strategically invest in real estate tech startups.

Notable built environment portfolio companies: Skyline AI, Dealpath

39. Saint-Gobain NOVA

Headquarters: Courbevoie, France

Founding Year: 2006

Founder(s): Saint-Gobain

Number of Investments: 80

NOVA is the venture arm of building materials company and manufacturer, Saint-Gobain. NOVA works to leverage Saint-Gobain's internal resources to support its partnerships with leading startups focused on sustainable innovation, meaning companies like Building Envelope Materials (BEM) who develops energy retrofit systems for commercial and residential buildings. By leveraging relationships with established venture partners, like Navitas Capital, NOVA connects its startup companies to the financing they need to grow and scale.

Notable built environment portfolio companies: Unity Homes, Hover, Building Envelope Materials (BEM)

40. Superseed

Headquarters: Collingwood, Australia

Founding Year: 2017

Founder(s): Phil Sondhu, Clayton Newell

Number of Investments: 1

As it stands today, Superseed Ventures is in its formation year and proud to be supported and funded by The Reece Group, Australia's largest plumbing, HVAC, and waterworks supplier. As Reece is acquiring clients in the U.S. through the acquisition of Morsco, Superseed is set to scale fast. Superseed has positioned itself with the one goal of "advancing ideas that shape the built environment." With one successful investment under their belt with tradespeople network, goodwork, we see a bright future for this venture firm.

Notable built environment portfolio companies: goodwork

41. SoftBank Vision Fund

Headquarters: Tokyo, Japan

Founding Year: 1996

Founder(s): SoftBank

Number of Investments: 266 (101 leads)

SoftBank's Vision Fund has led the charge on some of the worlds largest built industry tech funding rounds in history. This has included leading investments in WeWork ($4.4 billion), Katerra ($865 million), and Compass ($450 million). There is no debate that SoftBank is a leading investor in the built industry.

Notable built environment portfolio companies: WeWork, Katerra, Compass

42. Stanley Ventures

Headquarters: Atlanta, GA

Founding Year: 2016

Founder(s): Stanley Black & Decker

Number of Investments: 10 (3 leads)

The epitome of strategic investing, Stanley Ventures is the venture arm of Stanley Black & Decker. With an emphasis on bringing Stanley Black & Decker resources to the startups they invest in while integrating their innovation into their parent organization, the built industry is a distinct focus, especially as it relates to tools and equipment as exemplified by indoor location positioning startup Redpoint Positioning.

Notable built environment portfolio companies: FreeWire Technologies, Redpoint Positioning, Veloxint

43. WND Ventures

Headquarters: Redwood City, CA

Founding Year: 2016

Management Team: Eric Lamb, Atul Khanzode

Number of Investments: 10

WND Ventures is solely focused on moving the AEC industry forward by working alongside entrepreneurs to incubate new solutions like Digital Building Components and ourPlan. In addition, the firm recognizes great products when it sees them and invests in existing startups looking for funding, namely construction software company Rhumbix and construction SaaS company ManufactOn.

Notable built environment portfolio companies: Rhumbix, ALICE, StructionSite, ManufactOn, Digital Building Components, VueOps, vConstruct, ourPlan

Accelerators

44. 500 Start Ups

Headquarters: San Jose, CA

Founding Year: 2010

Founder(s): Christine Tsai, Dave McClure

Number of Investments: 1700+ (192 leads)

500 Startups runs a 4-month seed program in San Francisco and Mexico City emphasizing internet marketing and customer acquisition, design and user experience, and lean startup practices. Their Series A Program provides growth marketing and investment across multiple locations, globally. With diversity at its core, 500 Startups is a champion of female and minority founders.

Notable built environment portfolio companies: PlanGrid, Buildcon, Lagoa, StructionSite

45. BuiltTech Labs

Headquarters: Atlanta, GA

Founding Year: 2018

Founder(s): KP Reddy

Number of Investments: 35

Launched in early 2018 out of Shadow Ventures, BuiltTech Labs is a closed ecosystem for innovators, entrepreneurs, and investors looking to disrupt the built environment. Companies involved include Eyrus, Parafin, and QuickMEP.

Notable built environment portfolio companies: Eyrus, Parafin, QuickMEP,

46. Dreamit UrbanTech

Headquarters: Philadelphia, PA

Founding Year: 2007

Founder(s): David Bookspan, Michael Levinson; Steve Welch

Number of Investments: 251 (2 leads)

Dreamit UrbanTech is the real estate, construction, and smart city arm of Dreamit Ventures focused on scaling its underlying businesses. UrbanTech seeks those startups who are striving to build the "cities of tomorrow" and connects them with enterprise customers and institutional investors. With over 300 technology companies having graduated from its accelerator program going on to raise over $500 million, Dreamit has established itself as a mainstay of the built industry technology boom.

Notable built environment portfolio companies: Cityzenith, Knowify, Lotikm Flower Turbines, Ecomedes, Raxar, TRAXyl, myComply, Ipsum, PassiveLogic, iDevelop.City, Amenify

47. Leonard

Headquarters: Paris, France

Founding Year: 2017

Founder(s): VINCI

Number of Investments: Launching soon

To support startups creating solutions to cities and infrastructure problems, VINCI Construction launched Leonard in 2017, an intrapreneur program developed to guide businesses and foster a network of collaboration. The first batch of intrapreneurs is nearly launched with solutions including 3D printing for the construction industry, Concreative and infrastructure and housing renovation AR app, Rehalib.

48. Tech Stars

Headquarters: Denver, CO

Founding Year: 2006

Founder(s): Brad Feld, David Brown, David Cohen, Jared Polis

Number of Investments: 210 (21 leads & 42 exits)

In just over one decade, Tech Stars has evolved into a worldwide network of accelerator programs, multiple venture arms summing to $265 million, and one of the world’s most powerful communities of tech innovators. For the built world, they have introduced such companies as GritVirtual, Pillar Technologies, and IrisVR.

Notable built environment portfolio companies: GritVirtual, BuildSim, PermitZone, Pillar Technologies, IrisVR, Latch

49. Urban-X

Headquarters: Brooklyn, NY

Founding Year: 2016

Founder(s): Mark Paris

Number of Investments: 28

The early investment and 20-week accelerator program that Urban-X provides involves an initial investment of $100,000 in up to 10 startups focused on reimagining city life. As such, industries include real estate, construction, infrastructure, mobility, food, water, and energy. With over 2,000 mentors in the Urban-X network, they have pumped out names like RoadBotics, Avvir, and Blueprint Power.

Notable built environment portfolio companies: WearWorks, REVMAX.io, VNatures, Qucit, Blueprint Power, RoadBotics, Rentlogic, Avvir

50. Y Combinator

Headquarters: Mountainview, CA

Founding Year: 2005

Founder(s): Andrew Levy, Jessica Livingston, Paul Graham, Robert Morris, Trevor Blackwell

Number of Investments: 1900+ (340 leads & 197 exits)

Y Combinator upped their investment in the built industry significantly in 2017 when startups like Fibo App, Contract Simply, and UpCodes were invited into the accelerators prestigious 12-week seed program. We have seen limited interest in built industry-specific startups throughout the accelerators 2018 programs.

Notable built environment portfolio companies: PlanGrid (w2012), ShipBob (s2014), EquipmentShare (w2015), BulldozAIR (s2016), Contract Simply (s2017), UpCodes (s2017)

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.