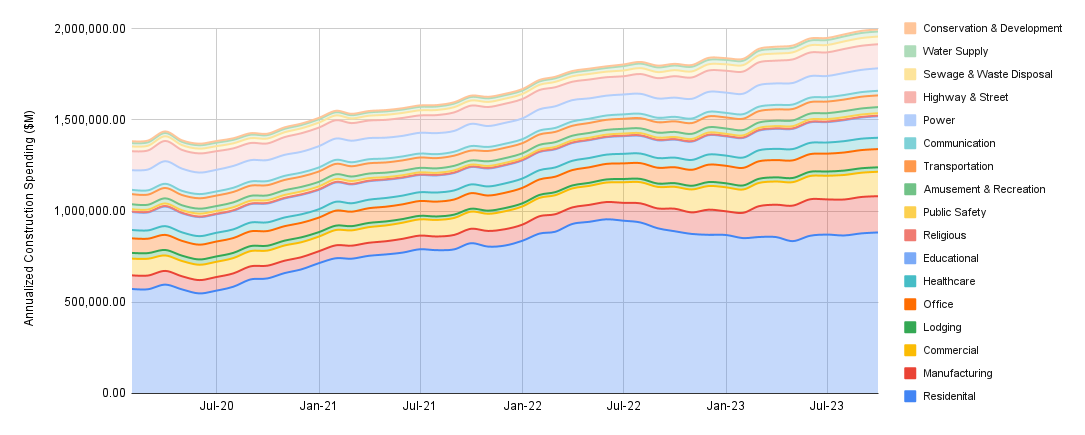

Despite the endless US construction tear (shown below), the ConTech space is feeling some growing pains as investors & innovators alike tighten their purse strings for what could be a long winter.

Annualized US Construction Spending ($M)

The US's economic buoyancy in the face of the most aggressive rate hike cycle in more than 4-decades has furnished the Federal Reserve with an unexpected degree of monetary flexibility.

The US Central Bank has signaled to the market that it would like to keep interest rates higher for longer (maybe even forever), driving down already hurting terminal valuations which account for the the lion's share of any startup's valuation.

The strength in construction has continued to fuel excitement around the secular growth qualities this industry is experiencing compared to the operational trainwreck of many commercial real estate firms. Nonetheless, ambiguity surrounding the next leg of technology adoption in this space coupled with uncertainty about the ability to raise additional capital in the next 12 to 18 months has even the best-positioned AEC startups uneasy.

This past week a couple of major construction tech players announced the start of some long-awaited layoff cycles.

The swelling level of capital strength in industrial US construction projects has created an environment where adoption should thrive, but old habits don’t die easily. Aggressive monetary tightening has catalyzed economic tension, which has pushed corporate America (agnostic of sector health) into a budget-cutting mindset.

OpenSpace, a leading reality capture company that has secured over $200M in VC funding over the past 4 years ($182 of which was raised in the past 2 years), announced it has begun reducing its 330-person employee base. Despite Jeevan Kalanithi's (CEO of OpenSpace) LinkedIn post meant to soothe investor/customer concerns with verbiage about the "extremely well capitalized" position this leading reality capture company possesses, this employment reduction would appear to be little more than a natural part of this innovation's development.

In reality, capital-hemorrhaging ventures across sectors are concerned about continued market penetration and the ability to raise additional VC dollars in the next 12 to 18 months (at least at the valuation attained in the 0% rate economy 18 to 36 months ago).

Ingenious, a building lifecycle management platform that raised a $21.5M Series A in April of 2021 (30 months ago) also announced it would begin laying off some of its ~130-person workforce.

That being said, these cutbacks don't feel as forced as they feel cautionary, with the majority of tech layoffs occurring in the 1st quarter of 2023, which saw about 160,000 tech workers let go. This number continues to fall each month, as the wealth of knowledge once controlled by Mega-Cap tech stocks gets spread across every sector of the economy (including construction tech).

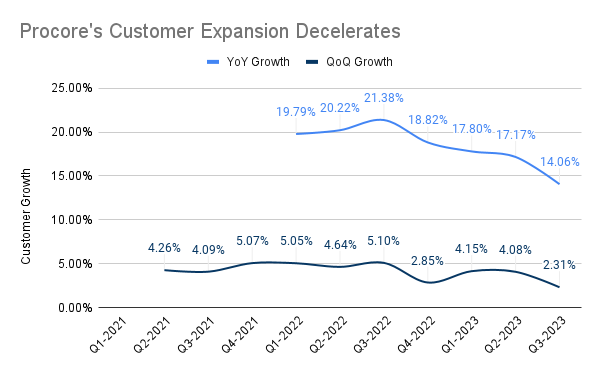

Implication of Procore’s Earnings on Construction SaaS

Procore (PCOR) released its Q3 earnings report last week with seemingly positive results, materially beating analysts' top & bottom-line estimates. Revenues expanded by 33% year-over-year (YoY), while non-GAAP profit margins flipped positive for the first time since the company IPO’ed in 2021. Nevertheless, management’s apprehensive verbiage on last Wednesday evening’s earnings call (11/1) related to a possible growth slowdown citing a challenging demand environment ahead and “deal slippage” in the final couple weeks of Q3.

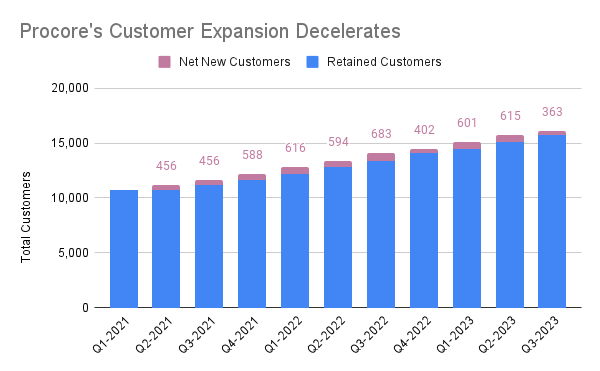

This uncertain sentiment from Procore’s leadership team brought PCOR shares down more than (17%) overnight. Public investors are worried that this leading ConTech giant has started to run into an adoption hurdle. This customer acquisition hurdle will force Procore to rely more heavily on deepening its product mix to attain growth (further pressuring Procore’s nonexistent profit margins) instead of new customer acquisition.

Procore’s decelerating growth after breaching 16,000 customers this past quarter (86% of which are US-based) could be a signal to the AEC venture market that a serviceable addressable market (SAM) for construction SaaS may soon be quantifiable – the total number of real potential customers for construction SaaS.

There were nearly 920,000 US construction companies employing ~8 million workers as of Q1 2023 (up 7% from pre-pandemic levels), according to the US Bureau of Labor Statistics (data releases are 6 months delayed), suggesting Procore’s market penetration remains below 2%.

If we assume that just 75% of the ENR 400 uses Procore, the rate of its adoption outside of the largest 400 US construction companies sits at around 1.46%.

Don't be surprised if this AEC customer deceleration is even more pronounced in Autodesk's (ADSK) Q3 earnings report in 2 weeks (Nov. 21).

Despite a near-term adoption slowdown, construction tech is very well-positioned for the future, as one of the final frontiers of digitalization in one of the healthiest economic growth drivers.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.