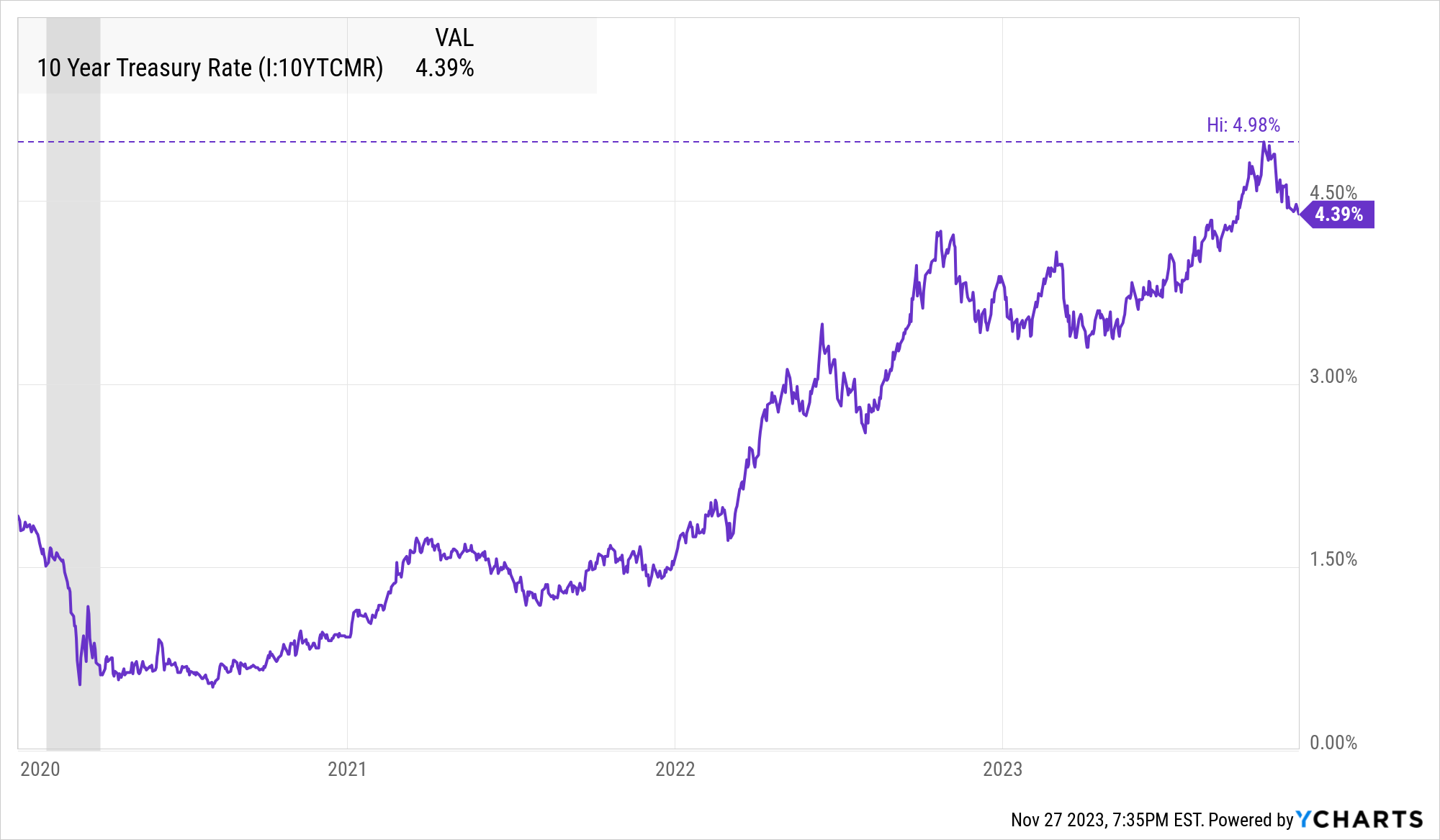

Founders & VCs have been holding their breath over the past 18 months as the US Federal Reserve drove the US 10-Yr Treasury rate, the primary input in investors' valuation discount rates, up over 200% (see graphic below) in an attempt to control unprecedented inflationary pressures.

US 10-Yr Treasury Yield

Since this rate-hiking cycle kicked off at the beginning of 2022, built-world VCs have been forced to consider 11th-hour fundraising strategies to ensure that their best-positioned portfolio companies continue to be supported amid this fundraising dearth.

Many AEC founders have been pushed to raise bridge rounds and inside rounds (no new investors) to stay afloat while other less fortunate startups have been forced to close their doors or sell their business at a significant discount. However, the built world startup ecosystem is early in its maturation relative to nearly every other sector. The lack of material valuations (most valuations remaining below $50M), agnostic sector growth, and capitally conservative founders have allowed many AEC ventures to side-step much of the valuation compressing down rounds that have plagued later-stage VCs in the past 18 months.

With loosening monetary policies in sight, VCs and other growth-oriented investors are now able to quantify the Fed's imminent rate-cutting cycle (expected to begin mid-2024), allowing them to finally consider their next wave of capital deployment.

The public markets, which generally lead private market valuations by 3 to 9 months, called a bottom for valuation compression among profitable businesses at the end of October 2022, when inflationary pressures finally showed material signs of deceleration.

Since the unexpected dip in consumer spending last month, public investors' appetites started shifting toward risk-on investments, providing a bid for less-profitable high-growth tech opportunities (a better benchmark for VC markets).

Below you can see publicly traded AEC-tech has begun to find buyers at below the 10x price-to-sales multiple in the past few months - although adoption deceleration remains a concern among investors (read Is Construction Tech Reaching An Adoption Ceiling? for more), which is reflected in the price-to-sales multiple at the bottom of the chart. The chart below depicts the market-weighted average of Autodesk (ADSK), Procore (PCOR), Trimble (TRMB), and Bentley Systems (BSY).

Publicly Traded Built World Tech (ADSK, PCOR, TRMB, BSY)

Private valuations in the VC market rely on much longer and slower bid-to-offer matching cycles (fundraising cycle). However, the best-positioned investment opportunities are beginning to reveal themselves as the studs separate themselves from the duds in the high-risk, high-reward world of venture investing.

The relative nascency of the built-world startup ecosystem coupled with the still pervasive value gaps in this sector, positions AEC-tech ventures attractively for that next wave of VC deployment.

The built environment is ripening for a digital transformation, but first legacy players need to right-size their evergrowing tech stacks as point solutions become a pain point.

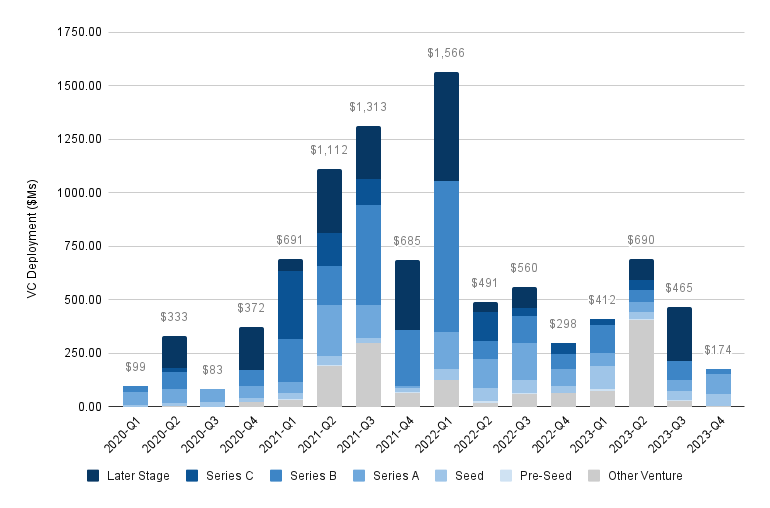

VC Inflows Into Construction Tech ($Ms)

VC deployment into Construction Tech (solutions that are taken off the job site at the end of a project) has slowed considerably in recent quarters, as later-stage generalist investors that this market relied on to support later-stage deals fell off the map as a result of deflating prop-tech valuations frequently incorrectly correlated with AEC tech. Now, corporate venture investors are beginning to fill the gap as foundational industry players realize the competitive necessity of taking a stake in the future built world.

Market Rationale

The Federal Reserve's aggressive monetary tightening (the most hawkish in over 4-decades) sent high-growth company valuations into a tailspin. AEC-tech Investors have been struggling to reconcile the dichotomy between surging discount rates, which went from the lowest in history to an over 15-year high, with the relentless strength in US construction & infrastructure spending.

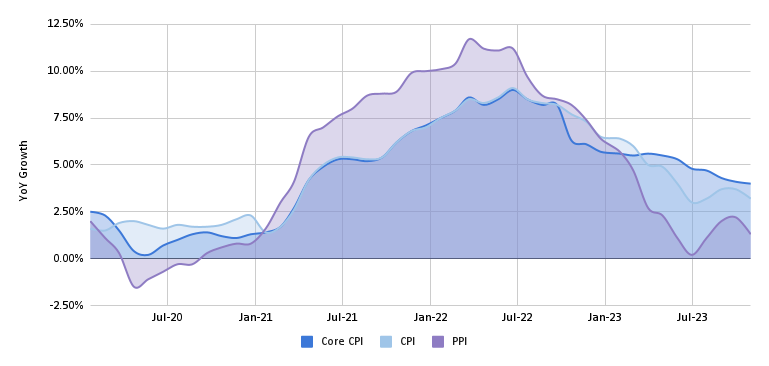

By all accounts, it looked like the FOMC’s interest rate hikes were doing a great job of tempering upward pricing pressures, as shown by the decelerating inflation chart below. However, the decelerating pricing pressures in 2022 were larger as a result of easing supply chain constraints, and only in recent months has demand moderated (FOMC policy changes generally take ~6 months to ripple through the economy).

US Inflationary Pressures (YoY Change)

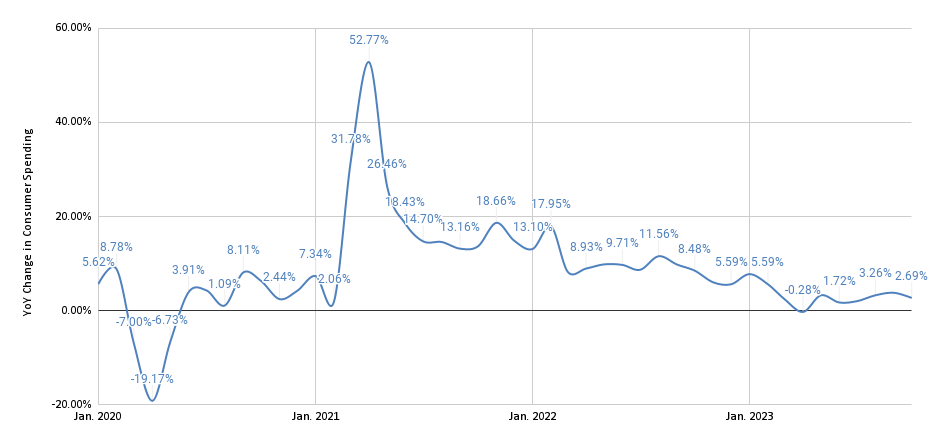

The FOMC’s monetary policies (interest rate controls) only impact the demand side of the equation. As you can see from the US retail sales graphic below, consumer spending (which accounts for 68% of US GDP) tracked well above the 3% 50-year average throughout most of the past 2 years and only came back down to earth in the past 9 months or so.

Recent economic releases provided investors with a deployment catalyst. October’s inflation figure came in below economist estimates (YoY CPI fell to 3.2%), the reaffirming negative month-over-month (MoM) October consumer spending release (US retail sales falling 0.1% MoM), falling new home sales, and rising unemployment rate, are all signals for the FOMC to begin easing its monetary policies.

US Consumer Spending (YoY Change)

What Does This Mean For Built World Valuations

Investors are now able to more reasonably quantify the beginning of the FOMC's monetary easing cycle, which is expected to begin in mid-2024. By the end of 2024, the market is projecting a Fed Funds decline of between 75 and 100 bps from where this benchmark rate sits today.

The built world's innovative ecosystem may be experiencing a transitory slowdown due to economic pressures and overrun tech stacks, but the long-term opportunities for value creation in this sector are undeniable. Based on the recent bid for young AEC-Tech players in the public markets, data suggests we will see this reflected in VCs' next wave of capital deployment into built-world startups in the quarters ahead.

Discussion

Be the first to leave a comment.

You must be a member of the BuiltWorlds community to join the discussion.